Introduction

Navigating the financial intricacies of higher education can be daunting, but Clayton State University is committed to making your dream of a college degree a reality. The university offers a robust financial aid program designed to help students from all backgrounds access the resources they need to succeed academically. This comprehensive guide will walk you through the steps involved in applying for and receiving financial aid from Clayton State.

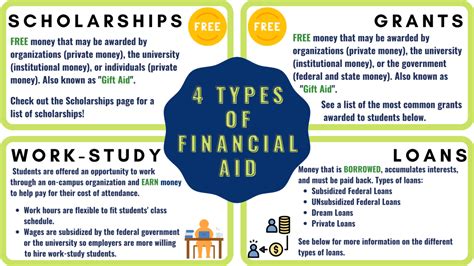

Types of Financial Aid Available

Clayton State offers a wide range of financial aid options to meet the diverse needs of its student body. These options include:

- Grants: Free money that does not need to be repaid, such as Pell Grants and Georgia HOPE Scholarships

- Scholarships: Merit-based awards based on academic achievement, athletic prowess, or other talents

- Loans: Funds that must be repaid, such as federal student loans and private loans

- Work-Study: Part-time employment opportunities that allow students to earn money to help pay for college

- Other Assistance: Tuition waivers, veteran benefits, and aid for students with disabilities

Applying for Financial Aid

The first step towards receiving financial aid is to complete the Free Application for Federal Student Aid (FAFSA). The FAFSA is the primary document used by the U.S. Department of Education to determine your eligibility for federal and state aid. You can complete the FAFSA online at studentaid.gov.

When completing the FAFSA, be sure to use Clayton State’s school code (001551). This will ensure that your application is sent directly to the university.

Deadlines

The priority deadline for submitting the FAFSA is March 1st. However, you are encouraged to submit your application as early as possible. The earlier you submit your FAFSA, the greater your chances are of receiving the maximum amount of financial aid available.

Award Process

Once Clayton State receives your FAFSA, the university will review your application and determine your eligibility for financial aid. You will receive a financial aid award letter that outlines the types and amounts of aid you have been awarded.

Accepting Your Award

If you accept your financial aid award, the funds will be applied to your student account. You will then be responsible for paying any remaining balance.

Common Mistakes to Avoid

- Not submitting the FAFSA on time: Missing the priority deadline can reduce your chances of receiving the maximum amount of financial aid available.

- Not providing accurate information on the FAFSA: Providing incorrect or incomplete information can delay the processing of your application or result in you being denied aid.

- Not accepting your financial aid award: If you do not accept your award, you will forfeit the funds that you have been offered.

- Taking out more loans than you need: Student loans must be repaid, so it is important to borrow only what you need.

- Not managing your finances wisely: Once you receive financial aid, it is important to manage your funds wisely to avoid running out of money before the end of the semester.

Why Financial Aid Matters

Financial aid makes it possible for students from all backgrounds to access the educational opportunities they need to succeed. Without financial aid, many students would not be able to afford to attend college.

Benefits of Financial Aid

- Makes college more affordable: Financial aid can significantly reduce the cost of college, making it more affordable for students and families.

- Helps students focus on their studies: When students are not burdened by financial worries, they can focus on their studies and achieve academic success.

- Enhances career prospects: A college education can lead to better career prospects and higher earning potential.

- Promotes diversity: Financial aid helps to promote diversity on college campuses by making it possible for students from all socioeconomic backgrounds to attend college.

Conclusion

Clayton State University’s financial aid program is designed to help students from all backgrounds achieve their academic goals. By following the steps outlined in this guide, you can apply for and receive financial aid to help pay for your college education.