Quantitative analysts (quants) are in high demand in the financial industry, and Citibank is one of the leading employers of these highly skilled professionals. Citibank quants play a vital role in the bank’s risk management, trading, and investment strategies.

What Does a Citibank Quantitative Analyst Do?

As a quantitative analyst at Citibank, you will use mathematical and statistical models to analyze financial data. You will help the bank make informed decisions about risk, trading, and investment. Your work will help Citibank manage its risk exposure, optimize its trading strategies, and generate alpha for its clients.

Citibank quants typically have a strong background in mathematics, statistics, and computer science. They are also proficient in programming languages such as Python, R, and MATLAB.

Benefits of Being a Citibank Quantitative Analyst

There are many benefits to being a quantitative analyst at Citibank, including:

- High salary and bonus potential: Quants are among the highest-paid professionals in the financial industry. According to the Bureau of Labor Statistics, the median annual salary for quants is over $100,000.

- Excellent benefits package: Citibank offers a comprehensive benefits package that includes health insurance, dental insurance, vision insurance, retirement savings plans, and paid time off.

- Challenging and rewarding work: As a quant, you will be challenged to solve complex problems and make decisions that have a real impact on the bank’s bottom line.

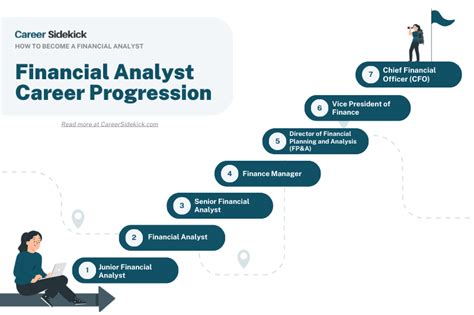

- Opportunities for career advancement: Citibank offers a clear path for career advancement for quants. With hard work and dedication, you can quickly move up the ranks and take on increasingly senior roles.

How to Become a Citibank Quantitative Analyst

If you are interested in becoming a quantitative analyst at Citibank, you should start by getting a strong education in mathematics, statistics, and computer science. You should also develop strong programming skills in Python, R, and MATLAB.

Once you have the necessary education and skills, you can apply for a quantitative analyst position at Citibank. The bank typically hires quants with a master’s degree or PhD in a quantitative field.

Conclusion

If you are a highly skilled mathematician, statistician, or computer scientist, a career as a quantitative analyst at Citibank could be a great fit for you. Quants at Citibank play a vital role in the bank’s success, and they are well-compensated for their work.

FAQs

1. What is the average salary for a quantitative analyst at Citibank?

The average salary for a quantitative analyst at Citibank is over $100,000.

2. What are the benefits of working as a quantitative analyst at Citibank?

The benefits of working as a quantitative analyst at Citibank include a high salary, excellent benefits package, challenging and rewarding work, and opportunities for career advancement.

3. What are the requirements for becoming a quantitative analyst at Citibank?

The requirements for becoming a quantitative analyst at Citibank include a master’s degree or PhD in a quantitative field, strong programming skills in Python, R, and MATLAB, and a strong understanding of mathematics, statistics, and computer science.

4. How can I apply for a quantitative analyst position at Citibank?

You can apply for a quantitative analyst position at Citibank by visiting the bank’s website and searching for open positions.