Introduction

Navigating the complexities of higher education can be daunting for students, especially when it comes to financing. Two prominent players in the student finance industry, Chegg and Sallie Mae, have joined forces to provide comprehensive solutions that address the unique challenges faced by students and graduates.

Chegg: The Education Superstore

Chegg is a leading provider of online education services, offering a vast array of resources to enhance student learning. Its services include:

- Textbooks: Chegg provides access to affordable textbooks, both physical and digital, allowing students to save money on course materials.

- Study Tools: Chegg’s study tools, such as flashcards, practice questions, and expert tutors, help students master course content and achieve academic success.

- Writing Assistance: Chegg offers writing assistance services, including grammar checking, plagiarism detection, and feedback from writing experts.

Sallie Mae: The Student Loan Giant

Sallie Mae is the largest private provider of student loans in the United States. They offer a wide range of loan products tailored to the needs of students and borrowers:

- Undergraduate Loans: Sallie Mae provides undergraduate loans to help cover tuition, fees, and living expenses for undergraduates.

- Graduate Loans: Sallie Mae offers graduate loans for students pursuing advanced degrees, such as master’s and doctoral programs.

- Parent Loans: Sallie Mae provides parent loans to help parents finance their children’s education.

The Chegg Sallie Mae Alliance

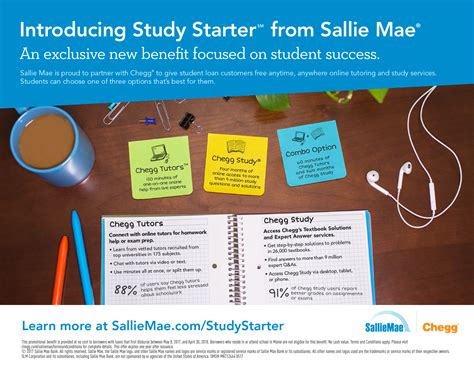

In 2022, Chegg and Sallie Mae announced a strategic partnership that combines their respective strengths to offer students and graduates a seamless and comprehensive financial support system. This alliance provides:

- Integrated Student Services: Chegg and Sallie Mae have integrated their platforms to allow students to access both educational and financial services in one convenient location.

- Personalized Financial Guidance: Students can receive personalized financial guidance and support from both Chegg and Sallie Mae, helping them make informed decisions about their finances.

- Exclusive Benefits: Students who use both Chegg and Sallie Mae services benefit from exclusive discounts and rewards that save them money and enhance their educational experience.

Addressing the Needs of Today’s Students

The Chegg Sallie Mae partnership recognizes and addresses the evolving needs of today’s students. According to the National Center for Education Statistics, the average cost of tuition and fees at a four-year public college or university has increased by over 25% in the past decade. Additionally, the Institute for College Access & Success reports that over 40% of college students rely on student loans to finance their education.

The Chegg Sallie Mae alliance aims to alleviate the financial burden on students and graduates by providing:

- Affordable Access to Education: Chegg’s textbooks and study tools reduce the cost of education for students, while Sallie Mae’s loan products help cover necessary expenses.

- Personalized Support: Students receive tailored guidance and assistance from both Chegg and Sallie Mae, ensuring they make well-informed decisions about their finances.

- Financial Literacy: Chegg Sallie Mae resources empower students with financial knowledge and skills that benefit them throughout their lives.

Benefits of the Chegg Sallie Mae Alliance

The Chegg Sallie Mae alliance offers numerous benefits for students and graduates:

- Reduced Financial Burden: Students save money on education costs and loan payments through Chegg’s affordable services and Sallie Mae’s competitive loan rates.

- Improved Academic Performance: Chegg’s study tools and writing assistance enhance student learning and improve grades.

- Financial Confidence: Sallie Mae’s financial guidance and loan products provide students with the confidence to pursue their educational goals without excessive debt burden.

- Career Success: The financial literacy and personalized support provided by Chegg Sallie Mae prepare students for financial success in their careers.

Conclusion

The Chegg Sallie Mae partnership is a game-changer in the student finance industry. By combining their expertise in education and financial services, Chegg and Sallie Mae provide students and graduates with a holistic and tailored support system that addresses their unique challenges and empowers them to achieve their academic and financial aspirations. This alliance is a testament to the commitment of these two industry leaders to empowering the next generation of professionals and leaders.