Yes, it is possible to file your taxes with only your last paycheck stub. What is the process? Here is what you need to do.

Gather Your Documents

The first step is to gather all of the necessary documents you will need to file your taxes.

These documents include:

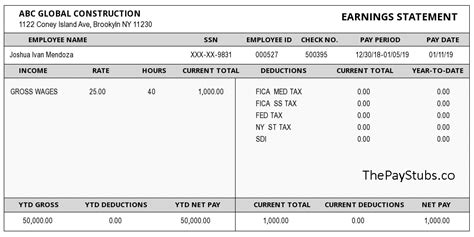

- Your last paycheck stub

- Your Social Security number

- Your bank account information

- Any other tax forms you received

Calculate Your Income

Once you have gathered all of your documents, you need to calculate your income for the year. This includes all of the income you earned from all sources, including wages, tips, self-employment income, and investments.

You can find your income information on your last paycheck stub. Your income will be listed in box 1 of your W-2 form.

Claim Your Deductions

After you have calculated your income, you need to claim your deductions. Deductions are expenses that you can subtract from your income to reduce your taxable income.

Some common deductions include:

- The standard deduction

- Itemized deductions, such as mortgage interest, property taxes, and charitable contributions

- Retirement contributions

- Health insurance premiums

Calculate Your Tax Liability

Once you have claimed your deductions, you need to calculate your tax liability. This is the amount of tax you owe to the government.

You can use a tax calculator to help you calculate your tax liability. The IRS also provides a number of online resources that can help you with this process.

File Your Tax Return

Once you have calculated your tax liability, you need to file your tax return. You can file your tax return online, by mail, or through a tax preparer.

If you file your tax return online, you can use the IRS Free File program. This program allows you to file your tax return for free using software provided by the IRS.

If you file your tax return by mail, you can get the necessary forms from the IRS website or by calling the IRS at 1-800-829-1040.

If you use a tax preparer, they will help you gather your documents, calculate your income, claim your deductions, and file your tax return.

What if I don’t have my last paycheck stub?

If you don’t have your last paycheck stub, you can still file your taxes. However, you will need to use other documentation to prove your income.

Some other documentation you can use includes:

- Your W-2 form

- Your 1099 forms

- Bank statements

- Investment statements

Tips for Filing Your Taxes

- File your taxes early. The sooner you file, the sooner you will get your refund.

- Be accurate. Make sure you enter all of your information correctly on your tax return.

- Keep a copy of your tax return. You will need this for your records.

- If you need help, ask for it. There are many resources available to help you file your taxes.

Conclusion

Filing your taxes can be a daunting task, but it doesn’t have to be. By following these steps, you can file your taxes with confidence.