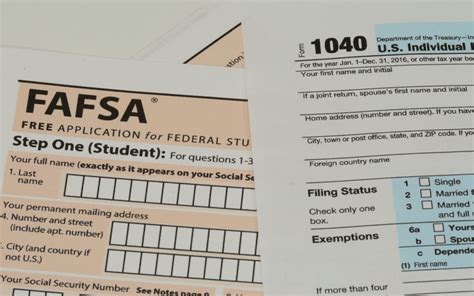

The Free Application for Federal Student Aid (FAFSA) is the gateway to federal student financial aid. It is a daunting process, but it is essential for many students to pay for college. One of the most common questions about the FAFSA is whether or not you can file it without a tax return.

The FAFSA is a form that collects information about your family’s income and assets. This information is used to determine your eligibility for federal student aid, including grants, loans, and work-study programs. The FAFSA is available online at the Federal Student Aid website.

The FAFSA uses your tax return to verify your income and assets. This information is essential for determining your eligibility for federal student aid. Without a tax return, you will not be able to provide the necessary information to complete the FAFSA.

What if You Don’t Have a Tax Return?

If you do not have a tax return, you may still be able to file the FAFSA. You can use the IRS Data Retrieval Tool to transfer your tax information directly from the IRS to the FAFSA. You can also use the FAFSA Alternative Documentation Process to provide documentation of your income and assets.

IRS Data Retrieval Tool

The IRS Data Retrieval Tool is a secure online tool that allows you to transfer your tax information directly from the IRS to the FAFSA. To use the tool, you will need your Social Security number, date of birth, and tax filing status. You can access the tool at the Federal Student Aid website.

FAFSA Alternative Documentation Process

The FAFSA Alternative Documentation Process is a process that allows you to provide documentation of your income and assets if you do not have a tax return. To use this process, you will need to provide the following documentation:

- A signed statement from your tax preparer

- A copy of your W-2s

- A copy of your 1099s

- A copy of your bank statements

- A copy of your investment statements

You can submit your documentation to the Federal Student Aid office by mail or fax.

If you do not have a tax return, you can file the FAFSA using the IRS Data Retrieval Tool or the FAFSA Alternative Documentation Process. Here are the steps on how to file the FAFSA without a tax return:

- Gather your documentation. You will need to gather the necessary documentation to prove your income and assets.

- Create a FSA ID. You will need to create a FSA ID to access the FAFSA online.

- Complete the FAFSA. You can complete the FAFSA online or by mail.

- Submit your documentation. You will need to submit your documentation to the Federal Student Aid office by mail or fax.

Filing the FAFSA without a tax return is possible, but it is more difficult than filing with a tax return. If you do not have a tax return, you should use the IRS Data Retrieval Tool or the FAFSA Alternative Documentation Process to provide documentation of your income and assets.