Filing taxes can be a daunting task. With all the forms and deadlines, it’s easy to feel overwhelmed. But what if you could do your taxes with just your last pay stub?

Is It Possible?

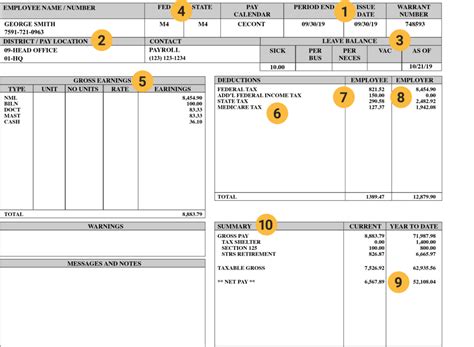

Yes, it is possible to do your taxes with just your last pay stub. Your last pay stub contains all the information you need to file a basic tax return. This includes your income, deductions, and withholding.

What You Need

To file your taxes with your last pay stub, you will need the following information:

- Your Social Security number

- Your date of birth

- Your filing status

- Your income

- Your deductions

- Your withholding

You can find all of this information on your last pay stub.

How to File

Once you have all the necessary information, you can file your taxes online, by mail, or through a tax preparer.

- Online: There are a number of free and low-cost online tax filing services available. These services will guide you through the process of filing your taxes and help you avoid mistakes.

- By mail: You can also file your taxes by mail. To do this, you will need to download and fill out the appropriate tax forms. You can find these forms on the IRS website.

- Through a tax preparer: If you are not comfortable filing your taxes yourself, you can hire a tax preparer to do it for you. Tax preparers can help you with all aspects of filing your taxes, including gathering your information, completing the forms, and filing your return.

Benefits of Filing With Your Last Pay Stub

There are a number of benefits to filing your taxes with your last pay stub.

- It’s quick and easy. Filing your taxes with your last pay stub is the quickest and easiest way to file. You don’t have to gather a lot of information or fill out a lot of forms.

- It’s accurate. Your last pay stub contains all the information the IRS needs to process your return. This means that you are less likely to make a mistake on your return.

- It’s free. There are a number of free online tax filing services available. This means that you can file your taxes for free without having to pay a tax preparer.

Conclusion

Filing your taxes with your last pay stub is a quick, easy, and accurate way to file your taxes. If you are looking for a way to file your taxes without a lot of hassle, this is the option for you.

FAQs

- Can I file my taxes with my last pay stub if I have more than one job?

Yes, you can file your taxes with your last pay stub even if you have more than one job. You will need to combine your income from all of your jobs when you file your return.

- What if I don’t have my last pay stub?

If you don’t have your last pay stub, you can still file your taxes. You will need to gather your income and deduction information from other sources, such as your W-2 forms.

- Can I file my taxes with my last pay stub if I am self-employed?

No, you cannot file your taxes with your last pay stub if you are self-employed. Self-employed individuals must file their taxes using a different form, Schedule C.

- What if I make a mistake on my tax return?

If you make a mistake on your tax return, you can file an amended return. An amended return is a form that you can use to correct any mistakes on your original return.

- What if I owe taxes?

If you owe taxes, you will need to pay the IRS by the filing deadline. You can pay your taxes online, by mail, or through a tax preparer.

- What if I am getting a refund?

If you are getting a refund, the IRS will send you a check or direct deposit the money into your bank account.