As a parent, navigating the complex world of taxes can be daunting, especially when it comes to claiming dependents. One common question that arises is whether or not you can claim your 19-year-old college student as a dependent on your tax return. The answer to this question depends on several factors, which we will explore in detail below.

Eligibility Criteria

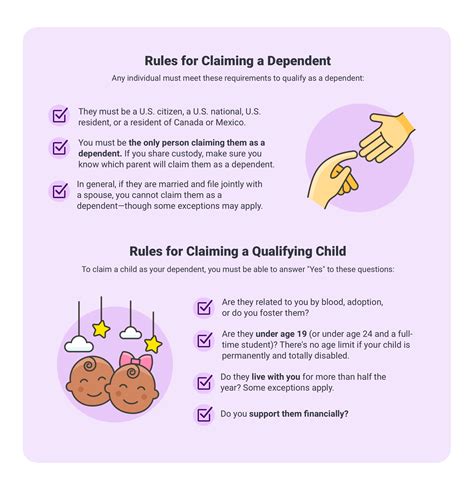

In order to claim your 19-year-old college student as a dependent, they must meet the following criteria:

- Age and Residency: Your child must be under the age of 24 and reside with you for more than half the year. This includes periods of temporary absence for educational purposes.

- Income: Your child’s gross income for the year must be less than $4,400 (as of 2023). This includes income from wages, self-employment, and scholarships.

- Support: You must provide more than half of your child’s financial support for the year. This includes expenses such as tuition, housing, food, and clothing.

- Student Status: Your child must be enrolled as a full-time student at a qualified educational institution, such as a college or university.

Scholarships and Grants

Scholarships and grants received by your child may affect their eligibility as a dependent. These funds are typically not considered income for tax purposes and do not count towards the $4,400 income limit. However, any portion of a scholarship or grant that covers living expenses, such as housing or food, may reduce the amount of support you provide.

Exceptions

There are a few exceptions to the general eligibility criteria that may allow you to claim your 19-year-old college student as a dependent even if they do not meet all the above requirements:

- Physical or Mental Disability: If your child is unable to earn their own income due to a physical or mental disability, you may be able to claim them as a dependent regardless of their age or income.

- Married Students: Married students who meet the other eligibility criteria can be claimed as dependents by either parent or their spouse.

- Students Receiving VA Benefits: Students who receive educational assistance from the Department of Veterans Affairs may be eligible to be claimed as dependents by their parents, regardless of their income or support level.

Tax Benefits of Claiming a Dependent

Claiming your 19-year-old college student as a dependent can provide significant tax benefits, including:

- Increased Personal Exemption: You can deduct a personal exemption of $4,400 for each dependent you claim. This reduces your taxable income and can lower your tax bill.

- Child Tax Credit: Parents with dependents under the age of 19 may be eligible for the Child Tax Credit, which provides a tax credit of up to $2,000 per child.

- Education Tax Credits: You may be eligible for education tax credits if you pay for your child’s college expenses. These credits include the American Opportunity Tax Credit and the Lifetime Learning Credit.

Conclusion

Whether or not you can claim your 19-year-old college student as a dependent depends on several factors, including their age, income, support level, and student status. By understanding the eligibility criteria and exceptions, you can determine if you are able to claim your child and take advantage of the associated tax benefits. If you have any questions or concerns, it is always best to consult with a tax professional for guidance.