Bridgewater State University (BSU) is a public university in Massachusetts that offers a wide range of undergraduate and graduate programs. The university has a long history of providing affordable education, and its tuition rates are competitive with other public universities in the state.

Tuition Costs

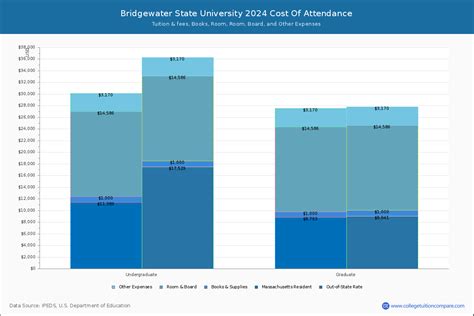

The cost of tuition at BSU varies depending on the student’s residency status and the program of study. For the 2022-2023 academic year, the following tuition rates apply:

Undergraduate Tuition

| Residency Status | Tuition |

|---|---|

| In-state | $13,464 |

| Out-of-state | $25,230 |

Graduate Tuition

| Residency Status | Tuition |

|---|---|

| In-state | $12,216 |

| Out-of-state | $23,082 |

Fees

In addition to tuition, students are also required to pay a number of fees, including:

- Application fee: $50

- Student activities fee: $260

- Athletic fee: $110

- Technology fee: $130

- Health service fee: $230

Financial Aid

BSU offers a variety of financial aid programs to help students pay for their education. These programs include:

- Scholarships: BSU awards over $20 million in scholarships each year to incoming and continuing students.

- Grants: BSU offers a number of grants to students who demonstrate financial need, including the Federal Pell Grant and the Massachusetts State Grant.

- Loans: BSU offers a variety of loans to students who need to borrow money to pay for their education, including the Federal Direct Stafford Loan and the Federal Direct PLUS Loan.

Common Mistakes to Avoid

When applying for financial aid, it is important to avoid making the following common mistakes:

- Missing deadlines: It is important to submit your financial aid application by the deadline in order to be considered for all forms of aid.

- Not completing the FAFSA: The Free Application for Federal Student Aid (FAFSA) is the key to unlocking all forms of federal financial aid. Be sure to complete the FAFSA each year that you are enrolled in college.

- Not applying for scholarships: Scholarships are a great way to reduce the cost of your education. Be sure to apply for as many scholarships as you are eligible for.

- Borrowing too much money: It is important to only borrow the amount of money that you need to pay for your education. Remember that you will have to repay your loans with interest after you graduate.

Why Financial Aid Matters

Financial aid can make a big difference in your ability to afford college. If you are eligible for financial aid, it is important to apply for it. Financial aid can help you pay for tuition, fees, books, and other educational expenses. It can also help you reduce the amount of money that you have to borrow for your education.

Benefits of Financial Aid

There are many benefits to receiving financial aid, including:

- Reducing the cost of your education: Financial aid can help you pay for tuition, fees, books, and other educational expenses. This can save you a significant amount of money over the course of your college career.

- Making college more affordable: Financial aid can make college more affordable for you and your family. This can allow you to focus on your studies and make the most of your college experience.

- Reducing the amount of money that you have to borrow: Financial aid can help you reduce the amount of money that you have to borrow for your education. This can save you money in the long run and help you avoid debt.

Conclusion

Financial aid can make a big difference in your ability to afford college. If you are eligible for financial aid, it is important to apply for it. Financial aid can help you pay for tuition, fees, books, and other educational expenses. It can also help you reduce the amount of money that you have to borrow for your education.