Benedictine University, a private Catholic institution located in Lisle, Illinois, offers undergraduate, graduate, and professional programs. While pursuing higher education, students are often concerned about the financial implications, which include tuition fees and other expenses. This article aims to provide an in-depth analysis of Benedictine University’s tuition costs and the available financial aid options to help prospective students plan their education expenses effectively.

Understanding the Components of Tuition Fees

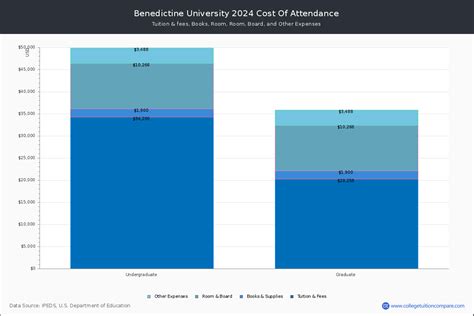

Benedictine University’s tuition fees vary depending on several factors, including the program, level of study, and residency status. For undergraduate programs, the tuition fees for the 2023-2024 academic year are as follows:

| Class Level | In-State Tuition | Out-of-State Tuition |

|---|---|---|

| Freshman | $36,540 | $41,610 |

| Sophomore | $36,540 | $41,610 |

| Junior | $37,200 | $42,270 |

| Senior | $37,200 | $42,270 |

For graduate programs, the tuition fees vary depending on the specific program. For example, the tuition fees for the Master of Business Administration (MBA) program for the 2023-2024 academic year are:

| Program | Tuition |

|---|---|

| MBA | $1,350 per credit hour |

Non-credit courses and part-time enrollment also have different tuition fee structures. It is essential to consult the university’s official website or contact the admissions office for the most up-to-date and detailed information on tuition fees.

Additional Expenses Beyond Tuition

Apart from tuition, students need to consider other expenses associated with attending Benedictine University. These may include:

Room and Board: On-campus housing options range from traditional residence halls to apartment-style living for upper-class students, with varying costs depending on the type of accommodation chosen. The university’s website provides detailed information on room and board rates.

Books and Supplies: Course materials, textbooks, and other academic supplies can add to the expenses. The cost of books and supplies varies depending on the program and course requirements.

Transportation: Students who commute to campus may incur transportation expenses, such as car insurance, gas, or public transportation fares.

Health Insurance: Benedictine University requires all full-time students to have health insurance. Students can either opt for the university’s student health insurance plan or provide proof of coverage from an alternative source.

Personal Expenses: Personal expenses, such as laundry, groceries, entertainment, and other miscellaneous costs, should be included in the budget.

Scholarships and Financial Aid Options

Benedictine University offers various financial aid options to help students cover the cost of tuition and other expenses. These include:

Scholarships: The university awards merit-based scholarships to incoming and current students who demonstrate academic excellence, leadership qualities, or other achievements. The scholarship amounts and criteria vary depending on the specific scholarship program.

Grants: Grants are need-based financial aid that does not require repayment. Pell Grants, Federal Supplemental Educational Opportunity Grants (FSEOG), and Illinois Monetary Award Program (MAP) Grants are some of the federal and state grants available to eligible students.

Loans: Student loans are another option to finance higher education. Benedictine University participates in the federal student loan programs, including Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans. Students must complete the Free Application for Federal Student Aid (FAFSA) to determine their eligibility for federal loans.

Work-Study Programs: The Federal Work-Study Program (FWS) provides part-time employment opportunities for eligible students to earn money while attending school. Students can work on campus or off campus at non-profit organizations.

External Funding: Students can also explore external funding sources, such as scholarships from private organizations, foundations, or community groups.

Steps to Apply for Financial Aid

To apply for financial aid at Benedictine University, prospective and current students should follow these steps:

-

Complete the Free Application for Federal Student Aid (FAFSA): The FAFSA is required to determine eligibility for federal and state financial aid. Students can submit the FAFSA online at the Federal Student Aid website. Benedictine University’s FAFSA code is 001601.

-

Provide Required Documentation: After submitting the FAFSA, students may be required to provide additional documentation, such as proof of income or tax returns, to verify their financial information.

-

Review Award Letter: Once the financial aid office processes the FAFSA, students will receive an award letter that outlines the types and amounts of financial aid they are eligible for.

-

Accept or Decline Financial Aid: Students have the option to accept or decline all or a portion of the financial aid offered. They should carefully consider their financial situation and make decisions that best meet their needs.

Alternatives to Traditional Financing

In addition to the traditional financing options discussed above, students may also consider alternative ways to fund their education:

Income Share Agreements (ISAs): ISAs are a relatively new type of financing that allows students to pay for college without taking on traditional loans. With an ISA, students agree to repay a percentage of their future income over a set period after graduation.

Employer Assistance: Some employers offer tuition reimbursement or assistance programs for employees pursuing higher education. Students should inquire with their employers about any available programs.

Military Education Benefits: Veterans and active-duty military personnel may be eligible for education benefits, such as the GI Bill, that can help cover tuition and other expenses.

Additional Considerations

When planning for higher education expenses, students should consider the following additional factors:

Budgeting: Creating a realistic budget that includes all potential expenses is essential. Students should account for tuition, fees, living expenses, and other miscellaneous costs.

Timeline: Financial planning should begin early to allow ample time to research financial aid options and make informed decisions.

Flexibility: Students may need to adjust their financial plan over time as circumstances change. It is important to stay organized and communicate regularly with the financial aid office.

Seeking Professional Advice: Students with complex financial situations or who need additional guidance may benefit from seeking professional advice from a financial advisor or counselor.

Conclusion

Understanding the tuition costs and financial aid options available at Benedictine University is crucial for prospective students and families planning for higher education expenses. By carefully considering the various financing options and exploring alternative funding methods, students can navigate the financial aspects of their education journey and pursue their academic goals without the burden of overwhelming debt.