Are you looking for a dependable financial institution in Marion, Indiana? Beacon Credit Union is here to offer you a comprehensive range of financial services tailored to your unique needs. With a rich history of serving the community, Beacon Credit Union has been providing exceptional banking experiences for over 80 years.

Understanding Beacon Credit Union

Beacon Credit Union is a member-owned, not-for-profit financial cooperative dedicated to empowering the Marion community through accessible and affordable financial solutions. Unlike traditional banks driven by profit motives, Beacon Credit Union prioritizes the well-being of its members, offering competitive rates, personalized service, and a commitment to financial education.

Comprehensive Financial Services in Marion, Indiana

Beacon Credit Union offers a wide array of financial services to cater to your diverse banking needs. These services include:

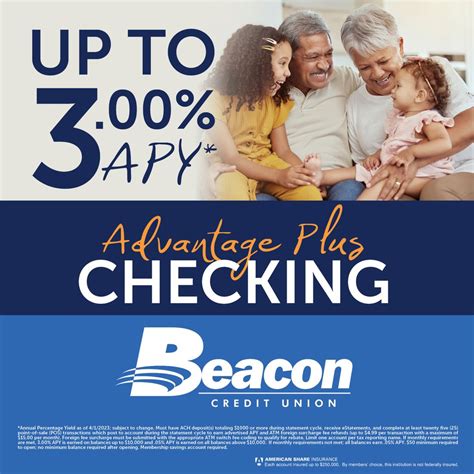

1. Savings and Checking Accounts

Beacon Credit Union provides a variety of savings and checking accounts to help you manage your finances effectively. Their High-Yield Savings Account earns you competitive interest rates, while their Performance Checking Account allows you to access your funds conveniently with no monthly maintenance fees.

2. Loans and Mortgages

Beacon Credit Union offers competitive rates on personal loans, auto loans, and mortgages. Whether you’re looking to consolidate debt, purchase a new vehicle, or finance your dream home, Beacon Credit Union has flexible loan options to suit your needs.

3. Investment Services

Beacon Credit Union’s investment services can help you grow your wealth and plan for the future. They offer a range of investment products, including certificates of deposit (CDs), money market accounts (MMAs), and individual retirement accounts (IRAs).

4. Business Banking

Beacon Credit Union understands the unique financial needs of businesses. They offer a suite of business banking services, including business checking accounts, business loans, and merchant services, to help your business thrive.

Beacon Credit Union Marion Indiana: Financial Empowerment for the Community

Beacon Credit Union believes in empowering its members financially. They offer a variety of financial literacy programs and resources to help you understand your finances, make informed decisions, and achieve your financial goals. These programs include:

1. Financial Education Workshops

Beacon Credit Union hosts free financial education workshops throughout the year. These workshops cover topics such as budgeting, credit management, and investing, providing valuable insights to help you improve your financial well-being.

2. One-on-One Financial Counseling

Beacon Credit Union offers confidential one-on-one financial counseling sessions with their experienced financial counselors. These sessions can assist you in creating a personalized financial plan, managing debt, and achieving your financial aspirations.

3. Youth Financial Literacy Programs

Beacon Credit Union is committed to instilling financial literacy in the youth of Marion. They offer educational programs for students of all ages, teaching them the importance of saving, budgeting, and responsible financial habits.

Why Choose Beacon Credit Union Marion Indiana?

- Member-Owned and Not-for-Profit: As a member-owned financial institution, Beacon Credit Union prioritizes the well-being of its members over profit motives.

- Competitive Rates: Beacon Credit Union offers competitive rates on savings accounts, loans, and mortgages, helping you save money and achieve your financial goals.

- Personalized Service: Beacon Credit Union’s dedicated team is committed to providing exceptional customer service, tailoring their services to your specific financial needs.

- Financial Education: Beacon Credit Union believes in empowering its members financially and offers a range of financial education programs to help you make informed decisions and achieve financial success.

- Community Involvement: Beacon Credit Union is deeply rooted in the Marion community, supporting local businesses, organizations, and individuals through financial services and community initiatives.

Take Control of Your Finances Today

If you’re looking for a financial institution that prioritizes your financial well-being, Beacon Credit Union Marion Indiana is the right choice for you. With a comprehensive range of financial services, personalized guidance, and a commitment to financial education, Beacon Credit Union empowers you to achieve your financial goals and build a brighter future.

Contact Beacon Credit Union Today

Visit Beacon Credit Union’s website at www.beaconcu.org or call (765) 668-8515 to learn more about their financial services and how they can help you take control of your finances.