Ashland University is a private, comprehensive university located in Ashland, Ohio. Founded in 1878, Ashland University offers a wide range of undergraduate and graduate programs, including online degrees and continuing education courses.

Tuition Costs

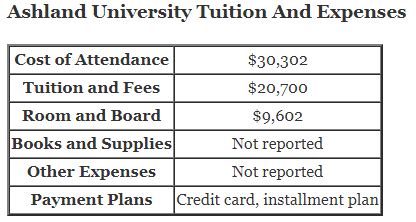

Ashland University’s tuition rates vary depending on the level of study, residency status, and enrollment type. For the 2023-2024 academic year, the following tuition rates apply:

| Level of Study | Residency | Tuition |

|---|---|---|

| Undergraduate | Ohio Resident | $27,790 |

| Undergraduate | Non-Ohio Resident | $34,230 |

| Graduate | All Residents | $1,070 per credit hour |

Additional fees may apply, including student activity fees, technology fees, and health insurance premiums.

Financial Aid and Scholarships

Ashland University offers a variety of financial aid options to help students pay for college, including scholarships, grants, loans, and work-study programs. For the 2022-2023 academic year, Ashland University awarded over $80 million in financial aid to students.

The average financial aid package for first-year students is $25,000, and over 95% of Ashland University students receive some form of financial aid.

Payment Options

Ashland University offers a variety of payment options for students and families, including:

- Monthly payment plans

- Semester payments

- Credit card payments

- Electronic check payments

Students can also use their financial aid to cover tuition costs.

Common Mistakes to Avoid

When planning for college expenses, it is important to avoid common mistakes, such as:

- Underestimating the cost of attendance. Tuition is only one part of the cost of attending college. Students should also budget for living expenses, books, supplies, and transportation.

- Borrowing too much money. Students should only borrow as much money as they need to cover their educational expenses. Federal student loans typically have lower interest rates than private loans, so students should exhaust all federal loan options before considering private loans.

- Not applying for financial aid. Many students who qualify for financial aid do not apply. Students should submit the Free Application for Federal Student Aid (FAFSA) each year to determine their eligibility for federal and state aid.

Why Ashland University Tuition Matters

The cost of college is a significant investment, but it is also an investment in your future. A college degree can open doors to new career opportunities and higher earning potential.

According to the U.S. Bureau of Labor Statistics, college graduates earn, on average, 84% more than workers with only a high school diploma. In addition, college graduates are more likely to have jobs that require critical thinking, problem-solving, and communication skills.

Benefits of Attending Ashland University

Ashland University offers a number of benefits that make it a great investment for your future, including:

- Small class sizes. Ashland University’s average class size is 20 students, which allows for more personalized instruction and interaction with professors.

- Dedicated faculty. Ashland University’s faculty are dedicated to teaching and research. They are experts in their fields and are committed to helping students succeed.

- Career services. Ashland University’s Career Services department provides students with a range of services to help them prepare for and find their dream job.

- Nationally recognized programs. Ashland University’s programs are consistently ranked among the best in the nation by U.S. News & World Report and other organizations.

How to Make College More Affordable

There are a number of things you can do to make college more affordable, including:

- Earn college credit in high school. By taking college courses in high school, you can get ahead on your degree and save money on tuition.

- Apply for scholarships. There are a number of scholarships available to Ashland University students. You can search for scholarships on the university’s website or through online scholarship search engines.

- Work part-time. Working part-time can help you offset the cost of college. However, it is important to balance work and school so that your grades do not suffer.

- Live in a dormitory or off-campus. Living in a dormitory can be more expensive than living off-campus, but it can also help you save money on transportation and other living expenses.

- Cook your own meals. Eating out can be expensive. By cooking your own meals, you can save money and eat healthier.