Financial assistance is a crucial element in pursuing higher education. The Free Application for Federal Student Aid (FAFSA) serves as a gateway to accessing various forms of financial aid, including grants, scholarships, and loans. To determine your eligibility and financial need, the FAFSA requires you to report your total current balance of cash savings and checking accounts.

Why It Matters

Your FAFSA balance directly impacts your Expected Family Contribution (EFC), which is an estimate of how much your family is expected to contribute towards your college expenses. A higher EFC may reduce your eligibility for certain need-based financial aid programs.

How to Calculate Your Total Current Balance

To calculate your total current balance, add up the following amounts:

- Cash savings: This includes money held in savings accounts, money market accounts, and certificates of deposit.

- Checking accounts: This includes all funds available in your checking accounts.

Exclusions

The following accounts are not included in the FAFSA balance calculation:

- Retirement accounts (e.g., 401(k)s, IRAs)

- 529 plans (college savings plans)

- Coverdell ESAs (education savings accounts)

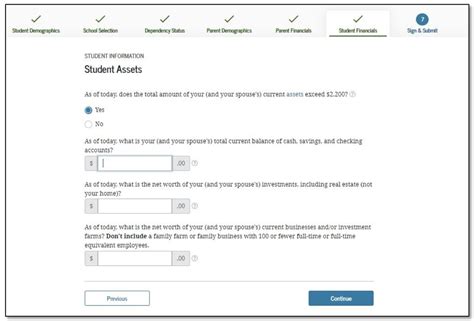

Reporting Your Balance on the FAFSA

When completing the FAFSA, you will be asked to report your total current balance of cash savings and checking accounts as of the date of application. It is important to be accurate in your reporting, as any discrepancies may delay or impact your financial aid eligibility.

FAFSA Thresholds for 2023-2024

The FAFSA considers your income and assets, including your cash savings and checking accounts, to determine your eligibility for need-based financial aid. For the 2023-2024 school year, the following income and asset thresholds apply:

| Income Category | Asset Threshold |

|---|---|

| Dependent student | Less than $27,000 |

| Independent student | Less than $55,000 |

If your EFC exceeds these thresholds, you may still be eligible for certain need-based aid programs, such as Pell Grants.

Strategies for Minimizing Your Balance

If you have a significant amount of money in your cash savings and checking accounts, consider exploring strategies to reduce your balance before applying for financial aid. This may include:

- Transferring funds into excluded accounts, such as retirement accounts or 529 plans.

- Investing in long-term assets, such as stocks or bonds.

- Using your savings to cover current expenses, such as tuition, fees, or housing costs.

Impact of Cash Savings and Checking Accounts on Financial Aid

The table below outlines the potential impact of your cash savings and checking accounts on your financial aid eligibility:

| Balance | EFC | Financial Aid Eligibility |

|---|---|---|

| Low | Lower | Increased eligibility for need-based aid |

| High | Higher | Reduced eligibility for need-based aid |

Conclusion

Your FAFSA total current balance of cash savings and checking accounts plays a critical role in determining your financial aid eligibility. By understanding the thresholds, exclusions, and strategies for minimizing your balance, you can maximize your access to financial assistance and pursue your education goals more affordably.