College is a major investment, and the cost is only increasing. The Expected Family Contribution (EFC) is a measure of how much your family is expected to contribute towards the cost of your education. This number is used to determine your eligibility for financial aid.

If your EFC is high, you may not qualify for as much financial aid as you need. This can make it difficult to afford college. Fortunately, there are a number of things you can do to lower your EFC.

Complete the FAFSA

The Free Application for Federal Student Aid (FAFSA) is the form that you use to apply for financial aid. It is important to complete the FAFSA accurately and on time. The information you provide on the FAFSA will be used to calculate your EFC.

Report all of your income and assets

When you complete the FAFSA, you will need to report all of your income and assets. This includes your wages, salaries, investments, and savings. The more income and assets you have, the higher your EFC will be.

Claim deductions and credits

There are a number of deductions and credits that you can claim on the FAFSA. These deductions and credits can reduce your EFC. Some of the most common deductions and credits include:

- The student loan interest deduction

- The American Opportunity Tax Credit

- The Lifetime Learning Credit

File an appeal

If you believe that your EFC is too high, you can file an appeal. You will need to provide documentation to support your appeal. The documentation may include:

- Proof of unusual expenses

- Proof of a change in income

- Proof of a change in assets

Get help from a financial aid counselor

If you need help with the FAFSA or with filing an appeal, you can get help from a financial aid counselor. Financial aid counselors are available at most colleges and universities. They can help you to understand the financial aid process and to make sure that you are getting all of the financial aid that you are eligible for.

According to the College Board, the average cost of tuition and fees at a four-year public college has increased by 26% over the past decade. For a four-year private college, the average cost of tuition and fees has increased by 25%.

This increase in the cost of college has made it more important than ever to lower your EFC. By lowering your EFC, you can increase your eligibility for financial aid. This can make college more affordable.

There are a number of benefits to lowering your EFC. These benefits include:

- Increased eligibility for financial aid

- Lower monthly loan payments

- Shorter repayment period

- More money available for other expenses

If you are looking for ways to lower your EFC, there are a number of resources available to you. You can talk to a financial aid counselor, visit the website of the Federal Student Aid office, or read books and articles about financial aid.

You can also use your creativity to come up with new ideas for lowering your EFC. For example, you could:

- Start a part-time job

- Get a summer job

- Sell some of your belongings

- Rent out a room in your house or apartment

- Ask your parents for help with college expenses

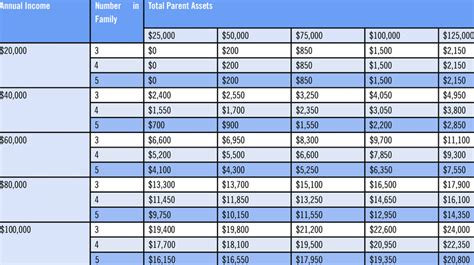

The following tables provide additional information about lowering your EFC.

| Deduction or Credit | Description | Amount |

|---|---|---|

| Student loan interest deduction | You can deduct up to $2,500 of interest paid on student loans. | Up to $2,500 |

| American Opportunity Tax Credit | You can claim a tax credit of up to $2,500 for qualified education expenses. | Up to $2,500 |

| Lifetime Learning Credit | You can claim a tax credit of up to $2,000 for qualified education expenses. | Up to $2,000 |

| Reason for Filing an Appeal | Documentation Required |

|---|---|

| Unusual expenses | Proof of the expenses, such as medical bills or child care costs. |

| Change in income | Proof of the change in income, such as a pay stub or tax return. |

| Change in assets | Proof of the change in assets, such as a bank statement or investment statement. |

| Benefit of Lowering Your EFC | Description |

|---|---|

| Increased eligibility for financial aid | You may be eligible for more grants, scholarships, and loans. |

| Lower monthly loan payments | Your monthly loan payments will be lower if you have a lower EFC. |

| Shorter repayment period | You will have to repay your loans over a shorter period of time if you have a lower EFC. |

| More money available for other expenses | You will have more money available for other expenses, such as rent, food, and transportation. |

How do I know what my EFC is?

You can find your EFC on your Student Aid Report (SAR). Your SAR will be sent to you after you complete the FAFSA.

What is the difference between the FAFSA and the CSS Profile?

The FAFSA is the federal financial aid form. The CSS Profile is a financial aid form that is used by some colleges and universities. The CSS Profile collects more information than the FAFSA, and it can be used to calculate your EFC.

Can I file the FAFSA more than once?

Yes, you can file the FAFSA more than once. However, you must file a new FAFSA each year that you are applying for financial aid.

What should I do if I have unusual expenses?

If you have unusual expenses, you can file an appeal with the financial aid office. You will need to provide documentation to support your appeal.

How can I get help with the FAFSA?

You can get help with the FAFSA from a financial aid counselor. Financial aid counselors are available at most colleges and universities. They can help you to understand the financial aid process and to make sure that you are getting all of the financial aid that you are eligible for.