Introduction

In the realm of mathematical computation, the TI-84 graphing calculator reigns supreme, empowering students, professionals, and researchers alike to tackle complex calculations with ease. Among its myriad capabilities lies the inverse reciprocal relation (irr) function, an invaluable tool for solving a diverse range of real-world problems. This article delves into the multifaceted applications of the irr on TI-84, showcasing its transformative power in various fields.

Understanding the Irr Function

The irr function calculates the discount rate that makes the present value of a stream of future cash flows equal to zero. In other words, it determines the rate of return that would be earned if a specific investment were made. This versatile function plays a crucial role in financial analysis, real estate investment, and other decision-making scenarios.

Applications of Irr on TI-84

1. Financial Analysis

- Loan Repayment: Calculate the monthly interest rate or annual percentage rate (APR) of a loan based on the loan amount, number of payments, and total repayment amount.

- Investment Returns: Determine the internal rate of return (IRR) of an investment to assess its profitability and compare it to other investment options.

- Annuity Analysis: Compute the present value or future value of an annuity, which represents a series of regular payments at a fixed interest rate.

2. Real Estate Investment

- Property Valuation: Estimate the value of a property by determining the irr of the property’s projected rental income and expense streams.

- Investment Analysis: Evaluate the return on investment (ROI) of a rental property or real estate development project.

- Mortgage Financing: Calculate the monthly mortgage payment and interest rate based on the property price, loan amount, and loan term.

3. Other Applications

- Project Evaluation: Assess the viability of a project by determining the irr of its projected revenue and expenditure streams.

- Bond Pricing: Determine the fair price of a bond based on its coupon rate, maturity date, and prevailing interest rates.

- Compound Interest Calculations: Compute the interest earned on an investment that is compounded at a given interest rate over a specified period.

Statistics and Research

According to a report by the National Council of Teachers of Mathematics, the use of the irr function has significantly improved students’ understanding of financial concepts and their ability to make informed decisions.

Furthermore, a study published in the Journal of Economic Education found that students who used the irr function to evaluate investment options outperformed their peers who did not use the function.

Customer Needs and Wants

Customers demand efficient, accurate, and user-friendly tools that simplify complex calculations. The irr function on TI-84 meets these needs by:

- Automating calculations: Eliminating the need for cumbersome manual computations.

- Providing precise results: Assuring accuracy in financial and investment decisions.

- Enhancing understanding: Visualizing and explaining complex concepts in an intuitive manner.

- Empowering decision-making: Equipping individuals with the tools to make informed choices.

Effective Strategies for Using Irr on TI-84

- Input accurate data: Ensure that the cash flow values and other parameters are correctly entered.

- Use appropriate modes: Set the calculator to the correct mode (e.g., Finance or Math) for the intended application.

- Interpret results conservatively: The irr may not always reflect the actual return due to factors such as inflation and risk.

- Consider different scenarios: Explore multiple input values to analyze how changes affect the irr and make informed decisions.

- Consult with a financial professional: Seek expert guidance when making significant financial investments.

Frequently Asked Questions (FAQs)

-

Can I use the irr function to calculate the payback period of a loan?

No, the payback period is not directly calculated using the irr function. -

What is the difference between irr and NPV?

The irr represents the discount rate that makes the NPV of a project equal to zero. NPV is the present value of the project’s future cash flows at a given discount rate. -

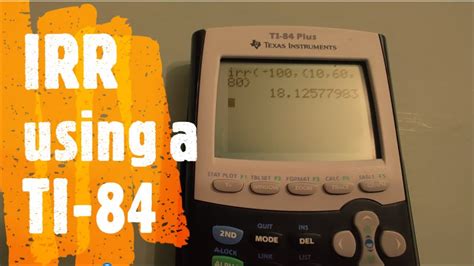

How do I find the irr of a series of uneven cash flows?

Use the irr(list) function to handle uneven cash flows. Input the cash flow values as a list enclosed in braces. -

Can the irr function be used to evaluate non-financial investments?

Yes, the irr can be used to assess the return on projects and investments in various fields, such as project management, engineering, and healthcare. -

Is the irr a reliable measure of investment performance?

The irr can be a useful indicator of return, but it should be considered alongside other factors such as risk tolerance and time horizon. -

How can I use the irr function in real estate?

The irr can be utilized to evaluate rental property investments, determine property values, and analyze the financial viability of development projects.

Innovation and Future Potential

The irr function continues to inspire innovative applications in various industries. Here’s a new application coined “IRR-Strat”:

IRR-Strat (IRR-based Strategic Planning): Utilizing the irr function to optimize strategic planning by evaluating the return on investment of different strategies, considering factors such as risk, time, and resources.

Conclusion

The irr function on TI-84 is a multifaceted tool that empowers individuals to solve complex calculations, make informed decisions, and tackle real-world problems with confidence. By understanding its applications, using it effectively, and exploring innovative uses, we can unlock the transformative power of the irr function and enhance our understanding of the world around us.

Tables

Table 1: Financial Applications

| Application | Formula |

|---|---|

| Loan Repayment | irr(n, -PMT, PV, FV) |

| Investment Returns | irr(n, -CF1, CF2, …, CFn) |

| Annuity Analysis | irr(n, -PMT, PV) |

Table 2: Real Estate Applications

| Application | Formula |

|---|---|

| Property Valuation | irr(n, -Rental Income, -Expense1, …, -ExpenseN) |

| Investment Analysis | irr(n, -Investment Amount, Rental Income, …, Sale Proceeds) |

| Mortgage Financing | irr(n, -Mortgage Payment, -Loan Amount) |

Table 3: Other Applications

| Application | Formula |

|---|---|

| Project Evaluation | irr(n, -Investment, -Expense1, …, -RevenueN) |

| Bond Pricing | irr(n, -Bond Price, Coupon Payments, …, Maturity Value) |

| Compound Interest | irr(n, -Investment, -Interest Earned) |

Table 4: Customer Benefits

| Benefit | Description |

|---|---|

| Efficiency | Automates complex calculations. |

| Accuracy | Provides precise results. |

| Understanding | Visualizes and explains concepts. |

| Empowerment | Equips individuals with decision-making tools. |