USAA and Aflac have joined forces to provide comprehensive insurance and financial protection to service members, veterans, and their families. This strategic partnership combines USAA’s deep understanding of the military community with Aflac’s expertise in supplemental insurance, offering tailored solutions that meet the unique needs of this population.

Understanding the Pain Points of Service Members and Families

Service members and their families face a myriad of challenges, including:

- Frequent deployments and relocations

- Potential for combat-related injuries and illnesses

- Limited access to healthcare and other benefits

- Financial burdens associated with military service

The Motivation Behind the USAA-Aflac Partnership

Recognizing these pain points, USAA and Aflac have collaborated to address the specific insurance and financial needs of service members and families. By leveraging their respective strengths, the partnership aims to:

- Provide reliable supplemental insurance coverage

- Reduce financial stress during deployments or medical emergencies

- Offer peace of mind and financial security

How the USAA-Aflac Partnership Works

The partnership offers a range of insurance products, including:

- Accident Insurance: Provides coverage for accidental injuries and death

- Cancer Insurance: Protects against the financial burden of cancer treatment

- Dental Insurance: Covers preventive and restorative dental care

- Hospital Indemnity Insurance: Supports hospital expenses during hospital stays

These products are designed to complement USAA’s existing insurance offerings, providing additional layers of protection and financial support.

Step-by-Step Approach to Utilizing the Partnership

To benefit from the USAA-Aflac partnership, members can:

- Contact USAA: Reach out to USAA through its website, mobile app, or by calling 800-328-3301

- Assess Insurance Needs: Discuss insurance needs with a USAA representative and determine which Aflac products are most suitable

- Apply for Coverage: Complete the application process and provide necessary information

- Manage Coverage: Manage policies and make changes as needed through USAA’s online portal or by calling Aflac’s customer service line

Pros and Cons of the Partnership

Pros:

- Comprehensive range of supplemental insurance products

- Tailored coverage for the unique needs of service members and families

- Convenient access through USAA’s established network

- Competitive rates and discounts for military members and veterans

Cons:

- Additional premiums for supplemental coverage

- May not cover all potential risks or provide sufficient coverage for some individuals

- Limited flexibility in customizing policies

USAA-Aflac Partnership: A Valuable Resource for Service Members and Families

The USAA-Aflac partnership provides a valuable resource for service members and families, offering comprehensive insurance coverage that addresses their specific challenges. By combining their expertise, USAA and Aflac are making a positive impact on the lives of those who serve our country.

Supplemental insurance products, such as those offered by Aflac, play a crucial role in supplementing the benefits provided by the military. They offer additional financial protection and peace of mind in the event of unexpected events.

Key Figures on Military Insurance Needs

According to the Military Family Research Institute, over 60% of service members have supplemental insurance coverage. This underscores the growing need for additional protection beyond what is provided by the Department of Veterans Affairs (VA) and other military healthcare systems.

Pain Points Addressed by Supplemental Insurance

Supplemental insurance helps address several pain points faced by service members and families, including:

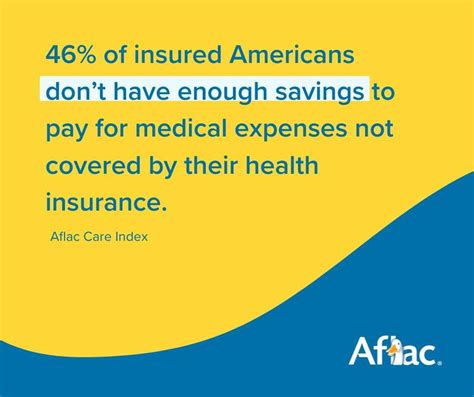

- Insufficient coverage: Military healthcare plans may not cover all necessary expenses, leaving service members with significant out-of-pocket costs

- Lack of financial support: During deployments or medical emergencies, families may face financial hardship due to lost income or unexpected medical expenses

- Limited disability benefits: Military disability benefits may not provide adequate compensation for injuries or illnesses sustained during service

Motivations for Purchasing Supplemental Insurance

Service members and families purchase supplemental insurance for several reasons:

- Peace of mind: Knowing that they have additional coverage provides a sense of security

- Financial protection: Insurance helps cover unexpected expenses and reduce financial stress

- Support during emergencies: Supplemental insurance can provide immediate financial assistance during medical emergencies or deployments

Table 1: Types of Supplemental Insurance for Service Members

| Type of Insurance | Coverage | Benefits |

|---|---|---|

| Accident Insurance | Accidental injuries and death | Lump-sum payment for covered expenses |

| Cancer Insurance | Cancer diagnosis and treatment | Coverage for expenses not covered by military benefits |

| Dental Insurance | Preventive and restorative dental care | Reduces out-of-pocket expenses for dental procedures |

| Hospital Indemnity Insurance | Hospital stays | Daily cash benefit to cover hospital expenses |

Choosing the right supplemental insurance products can be overwhelming. Here are some tips to navigate the complexity:

- Assess Needs: Determine specific insurance needs based on factors such as health history, family status, and financial situation

- Research Options: Explore different supplemental insurance products and compare coverage, benefits, and premiums

- Consult Professionals: Seek guidance from financial advisors or insurance agents who specialize in military insurance

- Consider Discounts: Take advantage of discounts offered by insurance companies for military members and veterans

Developing a comprehensive insurance plan is essential for service members and families. By considering the following factors, they can create a plan that meets their unique needs:

- Military Benefits: Understand the coverage and limitations of military healthcare and disability benefits

- Supplemental Insurance: Determine which supplemental insurance products are necessary to supplement military benefits

- Life Insurance: Ensure adequate coverage for life insurance to protect against loss of income in the event of death

- Retirement Planning: Plan for retirement by considering annuities, IRAs, and other financial products

| Option | Coverage | Benefits | Considerations |

|---|---|---|---|

| Military Healthcare | Basic healthcare coverage, including preventive care, hospital stays, and medication | No premiums | Limited coverage, may require co-payments |

| Supplemental Insurance | Accident, cancer, dental, hospital indemnity | Provides additional coverage not included in military healthcare | Premiums required |

| Life Insurance | Death benefit for beneficiaries | Financial protection against loss of income | Premiums required |

Insurance companies are constantly innovating to meet the evolving needs of service members. Some cutting-edge developments include:

- Usage-Based Insurance: Premiums based on actual usage of healthcare services, promoting healthy behaviors and reducing costs

- Telehealth Integration: Access to virtual healthcare services, including telemedicine consultations and remote monitoring

- Artificial Intelligence (AI): AI algorithms used to streamline claims processing, improve underwriting accuracy, and provide personalized recommendations

| Product | Features | Benefits |

|---|---|---|

| Usage-Based Accident Insurance | Premium discounts for safe driving habits | Reduced premiums for responsible behavior |

| Telehealth-Enabled Cancer Insurance | Virtual consultations with cancer specialists | Access to expert medical guidance from home |

| AI-Personalized Dental Insurance | Custom dental plans based on individual risk profile | Tailored coverage to meet specific dental needs |

USAA and Aflac are committed to empowering service members and families with financial knowledge. They offer a range of educational resources, including:

- Financial Planning Webinars: Online workshops on topics such as budgeting, debt management, and retirement planning

- Military Money Matters Podcast: Interviews with financial experts and discussions on military-specific financial issues

- Virtual Financial Counseling: One-on-one support and guidance from qualified financial counselors

| Resource | Topic | Format |

|---|---|---|

| Financial Planning Webinars | Budgeting, debt management, retirement planning | Online workshops |

| Military Money Matters Podcast | Military-specific financial issues | Audio podcast |

| Virtual Financial Counseling | One-on-one financial guidance | Online sessions |

The USAA-Aflac partnership provides a comprehensive solution to the unique insurance and financial needs of service members and families. By offering a range of supplemental insurance products tailored to their specific challenges, the partnership enhances their financial security and peace of mind. Through ongoing innovation and educational initiatives, USAA and Aflac continue to support the well-being of those who serve our country.