The cost of higher education continues to rise, making it more important than ever for students and families to understand the financial implications of attending college. Edinboro University of Pennsylvania is committed to providing an affordable education, offering a variety of financial aid options to help students make college a reality.

Below, you will find a detailed overview of Edinboro University’s tuition and fees, along with information about financial aid.

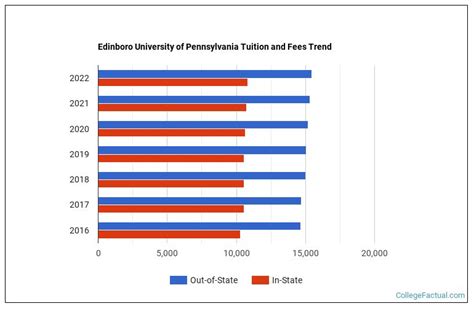

Tuition and Fees

| Year | Tuition | Fees | Total |

|---|---|---|---|

| 2023-2024 | $13,380 | $1,992 | $15,372 |

Note: Tuition and fees are subject to change each year. Please consult the University’s website for the most up-to-date information.

Financial Aid

Edinboro University offers a variety of financial aid options to help students pay for college. These options include:

- Federal Pell Grants: Grants for low-income students who demonstrate financial need.

- Federal Supplemental Educational Opportunity Grants (FSEOG): Grants for students with exceptional financial need.

- Federal Work-Study Program: Provides part-time jobs to help students earn money to pay for college.

- Federal Direct Loans: Low-interest loans for students and parents.

- State Grants: Grants for Pennsylvania residents who meet certain criteria.

- University Scholarships: Scholarships awarded to students based on academic merit, financial need, or other criteria.

Tips and Tricks for Saving Money on College

There are a number of things you can do to save money on college, including:

- Apply for financial aid. The first step to saving money on college is to apply for financial aid. The federal government, states, and colleges all offer financial aid to students who qualify.

- Shop around for scholarships. There are thousands of scholarships available to students, both from colleges and universities and from private organizations.

- Take advantage of tax breaks. The federal government offers a number of tax breaks to help families pay for college.

- Consider a part-time job. Working a part-time job can help you earn money to pay for college and reduce the amount of student loans you need to borrow.

- Live off-campus. Living on-campus can be expensive. If you can, try to live off-campus in a more affordable housing option.

Effective Budgeting Strategies

Once you have a good understanding of your financial aid options, it’s important to create a budget. A budget will help you track your income and expenses and make sure you’re not spending more than you earn.

Here are some effective budgeting strategies:

- Use a budgeting app. There are a number of budgeting apps available that can help you track your income and expenses.

- Set financial goals. Once you have a budget, set some financial goals for yourself. This could include saving for a down payment on a house, paying off student loans, or retiring early.

- Automate your savings. One of the best ways to save money is to automate your savings. This means setting up a system where a certain amount of money is automatically transferred from your checking account to your savings account each month.

- Cut back on unnecessary expenses. Once you have a budget, you can start to identify areas where you can cut back on your spending. This could include things like dining out, entertainment, or shopping.

Conclusion

Attending college is a significant investment, but it’s an investment that can pay off in the long run. By understanding your financial aid options, creating a budget, and following these tips, you can make college more affordable.

Frequently Asked Questions

Q: How much does it cost to attend Edinboro University of Pennsylvania?

A: Tuition and fees for the 2023-2024 academic year are $15,372.

Q: What types of financial aid are available to students?

A: Edinboro University offers a variety of financial aid options, including grants, scholarships, loans, and work-study programs.

Q: How can I save money on college?

A: There are a number of ways to save money on college, including applying for financial aid, shopping around for scholarships, taking advantage of tax breaks, and considering a part-time job.

Q: What is the best way to budget for college?

A: The best way to budget for college is to use a budgeting app, set financial goals, automate your savings, and cut back on unnecessary expenses.

Q: Is it worth it to attend college?

A: Attending college is a significant investment, but it’s an investment that can pay off in the long run. College graduates earn more money than those with only a high school diploma, and they are more likely to be employed in high-paying jobs.