Introduction

The Maine Education Opportunity Tax Credit (MEOTC) is a groundbreaking tax credit program that empowers Maine taxpayers to make a tangible difference in the lives of students throughout the state. This innovative program provides a tax break for individuals and businesses that contribute to eligible educational organizations. By harnessing the power of tax incentives, the MEOTC fosters increased support for Maine’s educational system and creates opportunities for students to reach their full potential.

Tax Credit Details

Eligibility:

- Individuals and businesses with Maine state tax liability

- Contributions must be made to qualified Educational Scholarship Organizations (ESOs)

Contribution Limits:

- Individuals:

- Up to $1,000 per year

- Married couples filing jointly: up to $2,000 per year

- Businesses:

- Up to 75% of state tax liability (capped at $500,000 for large corporations)

Tax Credit:

- Individuals receive a 100% tax credit for their contributions

- Businesses receive a 75% tax credit for their contributions

How it Works

-

Contribute to a Qualified ESO:

Identify and donate to an ESO that supports educational scholarships or programs. -

Receive Tax Credit:

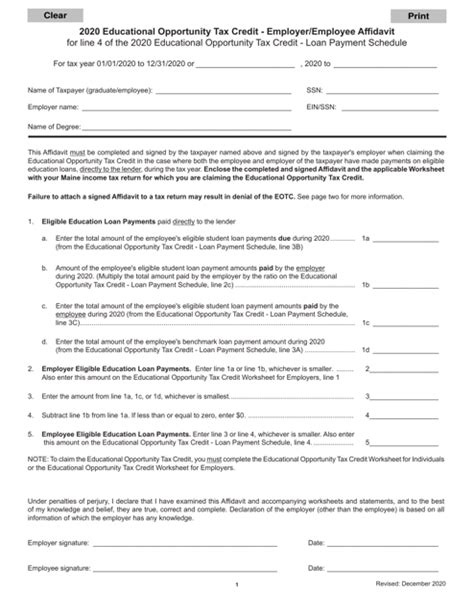

Claim the tax credit on your Maine state income tax return using the appropriate form:

* Individuals: Form 1040-ME Schedule M

* Businesses: Form 1120-ME Schedule J -

Reduce Tax Liability:

Apply the credit to reduce your state income tax liability dollar for dollar.

Educational Impact

The MEOTC has a transformative impact on Maine’s educational landscape by:

- Expanding Scholarship Opportunities: Increases funding for scholarships and educational programs, making them more accessible to students from all backgrounds.

- Enhancing Educational Programs: Funds innovative educational programs and initiatives, such as career and technical training, STEM education, and college readiness.

- Strengthening Educational Institutions: Supports educational organizations that provide essential services to students, including tutoring, mentoring, and enrichment programs.

Economic Benefits

In addition to its educational benefits, the MEOTC also drives economic development in Maine:

- Job Creation: The expansion of scholarship programs and educational initiatives leads to increased demand for teachers, school staff, and program administrators.

- Increased Business Investment: Tax credits create financial incentives for businesses to invest in Maine’s workforce, supporting economic growth and vitality.

- Brain Gain: By providing financial support for Maine students, the MEOTC helps retain and attract talented individuals to the state’s workforce.

Common Mistakes to Avoid

- Not Contributing to a Qualified ESO: Ensure that your contributions are directed to a Maine-approved ESO.

- Exceeding Contribution Limits: Be mindful of the established contribution limits to avoid reducing the potential tax credit.

- Incorrect Tax Form: Use the correct state tax form (Form 1040-ME Schedule M for individuals and Form 1120-ME Schedule J for businesses) when claiming the tax credit.

- Ignoring Deadlines: File your tax return with the claimed tax credit by the Maine state tax deadline.

Why the MEOTC Matters

The MEOTC is a vital tool for improving the quality of education and economic well-being in Maine. By investing in education, we invest in the future of our state. The MEOTC empowers Maine taxpayers to make a meaningful contribution to the lives of students and shape a brighter future for all.

Testimonials

“The MEOTC is a game-changer for education in Maine. It allows individuals and businesses to make a tangible difference in the lives of students.” – Maine Governor Janet Mills

“The MEOTC has enabled us to expand our scholarship program, providing more opportunities for Maine students to pursue higher education.” – Executive Director of Maine Educational Opportunity Fund

How to Benefit from the MEOTC

- Get Informed: Familiarize yourself with the program guidelines and eligibility requirements by visiting the Maine Revenue Services website.

- Identify a Qualified ESO: Research and select an ESO that aligns with your educational interests.

- Make a Donation: Contribute within the established limits to a qualified ESO.

- Claim Your Tax Credit: File your Maine state income tax return and claim the tax credit using the appropriate form.

FAQs

1. What is the purpose of the MEOTC?

The MEOTC provides Maine taxpayers with a tax credit for contributions to educational scholarship organizations, supporting educational opportunities for Maine students.

2. Who is eligible for the MEOTC?

Individuals and businesses with Maine state tax liability are eligible to claim the tax credit.

3. How much tax credit can I receive?

Individuals can receive a 100% tax credit (up to $1,000 per year), while businesses can receive a 75% tax credit (up to 75% of their state tax liability).

4. What are the deadlines for claiming the MEOTC?

The MEOTC must be claimed by the Maine state income tax deadline, which typically falls in April.

5. How do I find a qualified ESO?

A list of qualified ESOs in Maine can be found on the Maine Revenue Services website.

6. What if my contribution exceeds the limit?

Contributions beyond the established limits will not qualify for the MEOTC.

7. Can I transfer my tax credit to someone else?

The MEOTC tax credit is non-transferable.

8. What are some educational programs that benefit from the MEOTC?

MEOTC funds support various educational programs, including scholarships, tutoring, mentoring, STEM education, and career and technical training.

Table 1: MEOTC Contribution Limits

| Entity | Contribution Limit |

|—|—|—|

| Individual | Up to $1,000 per year |

| Married Couples Filing Jointly | Up to $2,000 per year |

| Businesses | Up to 75% of state tax liability (capped at $500,000 for large corporations) |

Table 2: MEOTC Tax Credit Rates

| Entity | Tax Credit Rate |

|—|—|—|

| Individuals | 100% of contribution |

| Businesses | 75% of contribution |

Table 3: Educational Impact of the MEOTC

| Aspect | Impact |

|—|—|—|

| Scholarship Expansion | Increased access to scholarships and educational programs |

| Educational Program Enhancement | Funding for innovative educational initiatives |

| Institutional Strengthening | Support for educational organizations providing essential services |

Table 4: Economic Benefits of the MEOTC

| Aspect | Impact |

|—|—|—|

| Job Creation | Increased demand for education professionals |

| Business Investment | Incentives for businesses to invest in Maine’s workforce |

| Brain Gain | Retention and attraction of talented individuals |