Calculating payroll accurately is crucial for businesses to comply with state and federal regulations and ensure employees receive their rightful compensation. For Massachusetts employers, using a comprehensive payroll calculator is imperative for efficient and compliant payroll processing.

Significance of Payroll Calculations in Massachusetts

According to the Massachusetts Department of Revenue (DOR), employers must meet specific payroll obligations, including:

- Withholding state and federal income taxes

- Collecting and remitting Social Security and Medicare taxes

- Determining employee contributions to unemployment insurance and workers’ compensation

Failing to calculate payroll accurately can result in costly penalties and legal consequences. A reliable payroll calculator simplifies this process, ensuring accurate calculations and compliance with complex payroll regulations.

Features and Benefits of Payroll Calculator MA

Payroll calculators offer a range of features and benefits tailored to Massachusetts businesses, including:

- Automated calculations of gross pay, net pay, and withholding amounts

- Support for various pay frequencies (weekly, bi-weekly, monthly)

- Updated with the latest tax rates and withholding regulations

- Compliance with specific Massachusetts payroll requirements

- Generation of detailed payroll reports for record-keeping and employee verification

By utilizing a payroll calculator MA, businesses can:

- Streamline payroll processing and save valuable time

- Minimize the risk of errors and ensure accuracy

- Maintain compliance with state and federal payroll regulations

- Enhance employee trust through transparent and accurate payroll communications

Types of Payroll Calculators Available

Various types of payroll calculators are available for Massachusetts employers, each with its advantages and limitations:

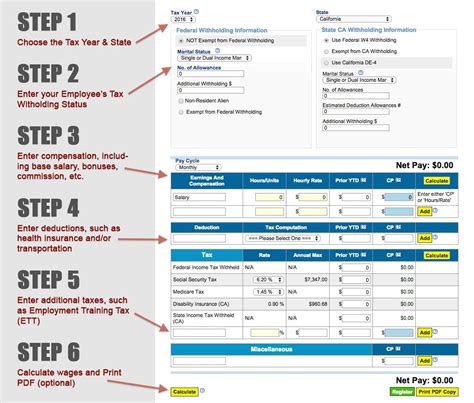

Online Payroll Calculators

- Convenient and accessible from any device with internet access

- Provide basic payroll calculations and may include additional features (e.g., withholding estimates)

- May lack customization options and integration capabilities

Software-Based Payroll Calculators

- Installed on a computer or server within the business

- Offer more advanced features, such as multi-state payroll processing and employee self-service

- Require a software license and ongoing maintenance costs

Third-Party Payroll Services

- Outsourced payroll processing to a specialized provider

- Include full-service payroll management, including calculations, tax filing, and employee administration

- Typically incur a monthly fee for services rendered

Choosing the Right Payroll Calculator MA

When selecting a payroll calculator MA, consider the following factors:

- Business size and complexity

- Number of employees and payroll frequency

- Desired level of automation and customization

- Budgetary constraints

- Compatibility with existing software and systems

- Customer support and availability

Additional Applications for Payroll Calculators

Beyond the core functionality of payroll calculations, payroll calculators can also be leveraged for various other applications, including:

- Payroll Budgeting: Estimating payroll expenses for financial planning and forecasting

- Wage Garnishment Calculations: Determining the appropriate amount to garnish from an employee’s wages for court-ordered obligations

- Overtime Pay Analysis: Calculating overtime payments based on employee time records and applicable overtime rules

- Retroactive Pay Adjustments: Recalculating payroll after salary changes or retroactive adjustments have been made

Tables for Payroll Calculator MA

1. Massachusetts State Income Tax Withholding Rates (2023)

| Taxable Income Range | Withholding Rate |

|---|---|

| $0 – $8,500 | 5.00% |

| $8,501 – $42,500 | 5.65% |

| $42,501 – $85,000 | 6.25% |

| Over $85,000 | 6.95% |

2. Massachusetts Unemployment Insurance (UI) Contribution Rates (2023)

| Experience Rating | Standard Contribution Rate |

|---|---|

| New Employer | 5.40% – 8.90% |

| 0.00 – 1.00% | 1.50% |

| 1.01 – 2.00% | 2.20% |

| 2.01 – 3.00% | 2.90% |

| 3.01 – 4.00% | 3.60% |

| 4.01 – 5.00% | 4.30% |

| 5.01 – 6.00% | 5.00% |

| 6.01 and above | 5.40% |

3. Massachusetts Sales Tax Rates

| Location | Sales Tax Rate |

|---|---|

| Statewide | 6.25% |

| Boston | 6.25% + 0.75% City Tax |

| Nantucket | 6.25% + 4.00% Town Tax |

| Provincetown | 6.25% + 2.00% Town Tax |

4. Massachusetts Local Income Tax Surcharges (2023)

| City/Town | Surcharge Rate |

|---|---|

| Brookline | 1.50% |

| Cambridge | 2.50% |

| Chicopee | 1.00% |

| Fall River | 2.00% |

| Fitchburg | 1.00% |

| Lynn | 0.75% |

| Malden | 1.00% |

| New Bedford | 2.00% |

| Newton | 1.00% |

| Pittsfield | 1.00% |

| Quincy | 1.50% |

| Somerville | 2.00% |

| Springfield | 1.50% |

| Worcester | 1.00% |

FAQs About Payroll Calculator MA

1. What is the minimum wage in Massachusetts?

The Massachusetts minimum wage is currently $15.00 per hour.

2. Are there any tax deductions or credits available to Massachusetts employees?

Yes, Massachusetts offers various tax deductions and credits, including:

- Massachusetts Earned Income Tax Credit (EITC)

- Senior Circuit Breaker Tax Credit

- Property Tax Credit

- Rental Tax Credit

3. How often must Massachusetts employers file payroll taxes?

Quarterly payroll tax returns are due on the last day of April, July, October, and January.

4. What penalties can Massachusetts employers face for payroll tax errors?

Penalties for payroll tax errors can include:

- Interest on late or unpaid taxes

- Penalties for late or incomplete filings

- Audit fees and assessments

5. How can businesses ensure compliance with Massachusetts payroll regulations?

Businesses can ensure compliance by:

- Using an accurate payroll calculator MA

- Staying updated on payroll-related laws and regulations

- Seeking professional assistance from an accountant or payroll specialist

6. Are there any resources available to help businesses with payroll matters?

Yes, the Massachusetts Department of Revenue (DOR) provides resources such as:

- Payroll tax forms and instructions

- Online payroll tax services

- Payroll tax workshops and webinars

7. What are the benefits of outsourcing payroll services to a third party?

Outsourcing payroll services can provide businesses with:

- Reduced administrative burden

- Increased accuracy and compliance

- Access to specialized expertise and support

- Enhanced employee satisfaction and retention

8. How can payroll calculators be used to improve employee communication?

Payroll calculators can be used to generate detailed payroll reports that provide employees with transparent information about their earnings, deductions, and net pay.