Introduction

Continuing legal education (CLE) is an essential aspect of maintaining the competence and knowledge of attorneys. In the state of New York, attorneys are required to complete 24 CLE credits every two years, including 4 credits in ethics and professionalism. This article provides a comprehensive guide to the NY CLE requirement, addressing its importance, requirements, exemptions, and strategies for compliance.

Importance of CLE

The NY CLE requirement is designed to ensure that attorneys remain up-to-date on the latest legal developments and ethical standards. By participating in CLE programs, attorneys can enhance their skills, improve their knowledge, and stay informed about emerging issues in the legal profession.

Key Statistics:

- According to the American Bar Association, over 90% of state bar associations require attorneys to complete CLE credits.

- A study by the National Center for Continuing Legal Education found that attorneys who participate in CLE programs have higher client satisfaction and lower malpractice rates.

CLE Requirements in New York

Number of Credits:

Attorneys in New York are required to complete 24 CLE credits every two years, including 4 credits in ethics and professionalism.

Reporting Deadlines:

Attorneys must report their CLE credits to the New York State Bar Association (NYSBA) by December 31 of every even-numbered year.

Exemptions:

Certain attorneys are exempt from the NY CLE requirement, including:

- Attorneys who have been admitted to the New York State Bar for less than one year

- Attorneys who are retired or inactive

- Attorneys who are serving in the military or on active duty

- Attorneys who are employed by a law school or government agency

Strategies for Meeting the CLE Requirement

1. Attend Traditional CLE Programs:

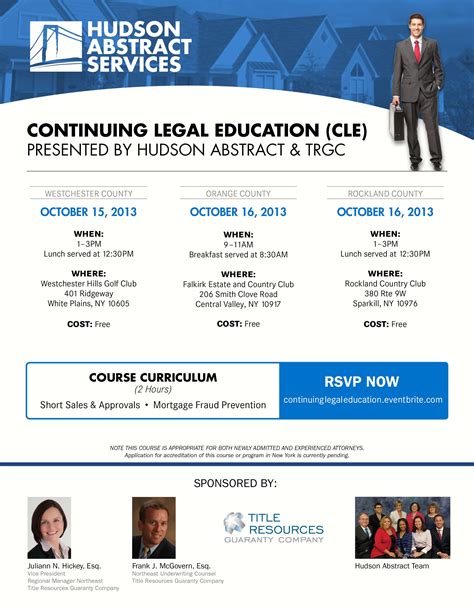

Attorneys can earn CLE credits by attending in-person or online seminars, conferences, and other educational events offered by professional organizations and law schools.

2. Take Self-Study Courses:

Self-study courses allow attorneys to earn CLE credits at their own pace by reading materials, watching videos, or listening to audio recordings.

3. Participate in Pro Bono Activities:

Attorneys can earn CLE credits for providing pro bono legal services to low-income or underserved clients.

4. Write Articles or Books:

Attorneys can earn CLE credits for publishing articles or books on legal topics.

Tips and Tricks for Compliance

- Plan Ahead: Start planning your CLE activities early to avoid last-minute stress.

- Track Your Credits: Use a spreadsheet or other method to keep track of your completed CLE credits.

- Utilize Technology: Take advantage of online CLE programs and self-study courses to earn credits conveniently.

- Consider Group Discounts: Enroll in CLE programs with colleagues or join bar associations that offer discounts on CLE courses.

- Seek Mentorship: Consult with experienced attorneys or CLE providers for guidance on selecting appropriate CLE programs.

Applications of CLE in the Legal Profession

The NY CLE requirement has far-reaching applications in the legal profession. By staying up-to-date on the latest legal developments, attorneys can:

1. Enhance Client Service:

- Provide more informed and effective legal counsel to clients.

- Stay abreast of changes in the law that may impact client matters.

2. Improve Professional Competence:

- Develop new skills and knowledge to handle complex legal issues.

- Maintain a high level of professionalism and ethical conduct.

3. Advance Career:

- Qualify for leadership positions within law firms and professional organizations.

- Enhance their reputation and credibility among colleagues.

Conclusion

The NY CLE requirement plays a crucial role in ensuring that attorneys in New York are competent, knowledgeable, and ethical. By understanding the requirements, utilizing effective strategies, and embracing the opportunities provided by CLE, attorneys can fulfill their obligations and reap the benefits of continued professional development.

Table 1: CLE Credit Distribution

| Category | Credits |

|---|---|

| General Law | 20 |

| Ethics and Professionalism | 4 |

Table 2: CLE Reporting Deadlines

| Year | Reporting Deadline |

|---|---|

| 2024 | December 31, 2024 |

| 2026 | December 31, 2026 |

| 2028 | December 31, 2028 |

Table 3: Exemptions from NY CLE Requirement

| Category | Exemption |

|---|---|

| Admission to NY Bar | Less than one year |

| Status | Retired or inactive |

| Military Service | Active duty |

| Government Employment | Law school or government agency |

Table 4: Strategies for Meeting CLE Requirement

| Strategy | Description |

|---|---|

| Traditional CLE Programs | Attend in-person or online conferences, seminars, and courses |

| Self-Study Courses | Earn credits through readings, videos, or audio recordings |

| Pro Bono Activities | Provide legal services to low-income or underserved clients |

| Written Publications | Publish articles or books on legal topics |

| Group Discounts | Enroll in CLE programs with colleagues or join bar associations for discounts |