Introduction

Financial aid is a crucial aspect of higher education, enabling students to pursue their academic goals without overwhelming financial burdens. Your Grade Point Average (GPA) plays a significant role in determining your eligibility for various types of financial aid. This article will explore the intricate relationship between financial aid and GPA, providing valuable insights to help you optimize your financial resources and academic journey.

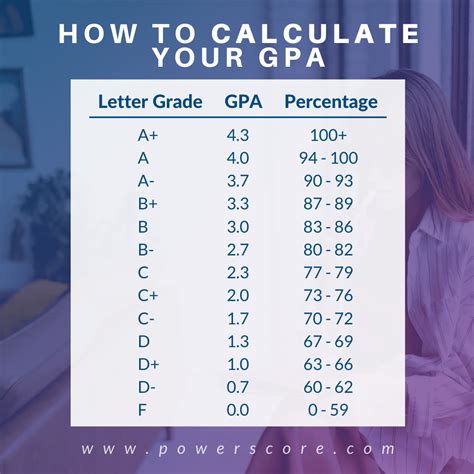

GPA and Eligibility for Financial Aid

Federal Student Loans

The federal student loan programs, including Direct Subsidized Loans, Direct Unsubsidized Loans, and Parent PLUS Loans, do not have specific GPA requirements. However, maintaining a satisfactory academic progress (SAP) is necessary to retain eligibility. SAP typically involves meeting minimum GPA requirements set by your educational institution.

Federal Grants

Federal grants, such as the Pell Grant and Federal Supplemental Educational Opportunity Grant (FSEOG), are awarded based on financial need. While GPA is not a direct determinant of grant eligibility, it can indirectly affect your financial need calculation. A higher GPA may indicate a lower need for financial assistance, potentially reducing your grant award.

Scholarships

Scholarships are merit-based awards that recognize academic excellence. Many scholarships have GPA requirements, with higher GPAs often yielding larger scholarship amounts. The specific GPA requirements vary widely depending on the scholarship provider and the criteria used for selection.

GPA and Financial Aid Packages

Your GPA can impact the overall financial aid package you receive. Educational institutions often consider your GPA when awarding institutional aid, such as university scholarships, grants, and need-based awards. A higher GPA can increase your chances of receiving more generous financial aid packages, reducing your out-of-pocket expenses.

Case Study: Impact of GPA on Financial Aid Packages

According to Sallie Mae’s “How America Pays for College 2023” report:

- Students with GPAs of 3.0 or higher received an average of $12,935 in total financial aid, while those with GPAs below 3.0 received an average of $9,390.

- Of the students who received financial aid, 68% had GPAs of 3.0 or higher.

Common Mistakes to Avoid

Neglecting GPA

Assuming that financial aid is not affected by GPA is a grave mistake. Maintaining a high GPA is essential to maximize your eligibility for financial aid and secure the most favorable financial aid packages.

Ignoring Renewal Requirements

Financial aid awards are often contingent on meeting specific renewal requirements, including maintaining a satisfactory GPA. Failure to meet these requirements can lead to the loss or reduction of financial aid, placing students in a difficult financial situation.

Not Researching All Financial Aid Options

Relying solely on federal financial aid programs can limit your financial resources. Explore other financial aid sources, such as state grants, private scholarships, and employer-sponsored tuition assistance programs, to supplement your financial aid package.

Tips for Optimizing Financial Aid and GPA

Set Academic Goals

Establish clear academic goals and develop a study plan to achieve them. A structured approach to studying can help you improve your GPA and increase your chances of receiving financial aid.

Seek Academic Support

Do not hesitate to seek academic support if you encounter challenges in your coursework. Tutoring, supplemental instruction, and office hours can provide valuable assistance that can boost your GPA.

Apply for Scholarships

Research and apply for scholarships that align with your academic achievements and career aspirations. Many scholarship providers consider GPA as a key criterion for selection.

Manage Your Time

Time management is crucial for academic success. Create a realistic schedule that allows for sufficient study time, while also making room for other important activities. Prioritizing your responsibilities can help you stay on track with your academic goals.

Seek Financial Aid Counseling

Financial aid counselors can provide personalized guidance on navigating the complex world of financial aid. They can help you understand your eligibility, explore different funding options, and optimize your financial aid packages.

Conclusion

Financial aid is an invaluable resource for students pursuing higher education. By understanding the relationship between financial aid and GPA, you can strategically manage your academic journey to maximize your financial resources. By maintaining a high GPA, exploring multiple financial aid options, and seeking professional guidance when needed, you can mitigate financial burdens and achieve your educational aspirations with greater confidence. Remember, investing in your GPA is not only an investment in your academic success but also an investment in your financial future.