For students seeking higher education outside their home state, understanding the cost of attendance is crucial. Purdue University, a renowned institution in Indiana, provides various academic programs to non-resident students. This article provides a comprehensive overview of the expenses associated with attending Purdue University as a non-resident for the 2009 academic year.

Tuition and Fees

Non-resident students at Purdue University are subject to higher tuition and fees compared to in-state residents. The cost of tuition for the 2009-2010 academic year was as follows:

- Undergraduate Tuition: $28,050 per year

- Graduate Tuition: $29,700 per year

In addition to tuition, students must also pay various fees, including:

- Student Services Fee: $1,358 per year

- Technology Fee: $294 per year

- Athletic Fee: $216 per year

- Health Fee: $216 per year

Room and Board

On-campus housing and meal plans are available to non-resident students at Purdue University. The cost of room and board varies depending on the type of accommodation and meal plan selected. For the 2009-2010 academic year, the estimated costs were as follows:

- Traditional Residence Hall (Single Room): $9,382 per year

- Traditional Residence Hall (Double Room): $8,578 per year

- Meal Plan (15 meals per week): $4,426 per year

Students may also opt for off-campus housing, which typically involves renting an apartment or house. Off-campus housing costs can vary significantly depending on location and amenities.

Other Expenses

Beyond tuition, fees, and room and board, students should also budget for additional expenses, such as:

- Books and Supplies: $1,200 per year

- Transportation: $1,000 per year

- Personal Expenses: $2,000 per year

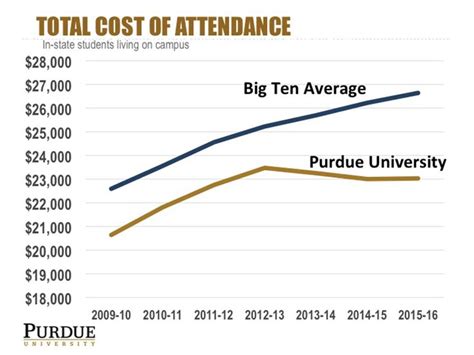

Total Cost of Attendance

The total cost of attendance for non-resident students at Purdue University for the 2009-2010 academic year, including tuition, fees, room and board, and other expenses, was estimated to be:

| Undergraduate | Graduate |

|---|---|

| $46,166 | $47,590 |

This cost estimate does not include expenses for health insurance, travel, or other unforeseen expenses. Students should carefully consider these additional costs when planning their budget.

Financial Aid Options

Purdue University offers various financial aid options to assist non-resident students with the cost of attendance. These options include:

- Scholarships: Merit-based awards that do not require repayment

- Grants: Need-based awards that also do not require repayment

- Loans: Funds borrowed from the government or private lenders that must be repaid with interest

Students are encouraged to explore all available financial aid options to reduce the overall cost of attendance.

Strategies for Reducing Costs

There are several strategies non-resident students can employ to reduce their expenses at Purdue University:

- Apply for Financial Aid: Take advantage of scholarships, grants, and loans to offset the cost of attendance.

- Negotiate Housing: Contact the Purdue University Housing and Residence Life department to inquire about potential discounts or payment plans.

- Cook Meals: Prepare your own meals instead of relying on on-campus dining plans.

- Use Public Transportation: Take advantage of the university’s free bus system to avoid the cost of owning a vehicle.

- Shop Around for Textbooks: Compare prices at multiple bookstores before purchasing textbooks.

Common Mistakes to Avoid

When budgeting for the cost of attendance, non-resident students should avoid these common mistakes:

- Underestimating Expenses: Failing to account for all potential expenses can lead to financial difficulties.

- Not Applying for Financial Aid: Leaving free money on the table by not exploring all available financial aid options.

- Overspending on Housing: Selecting luxurious or spacious housing without considering the additional cost.

- Relying on Credit Cards: Accumulating excessive credit card debt can create long-term financial burdens.

Conclusion

Pursuing higher education as a non-resident student at Purdue University involves significant financial considerations. By understanding the university’s cost of attendance, exploring financial aid options, implementing cost-saving strategies, and avoiding common mistakes, students can effectively manage their expenses and make informed decisions about their educational investment.