Columbia College is a prestigious institution that offers students an unparalleled educational experience. However, the cost of attendance can be a significant barrier for many students. In this article, we will discuss the various types of financial aid available to Columbia College students and provide tips on how to apply for and maximize your aid package.

What Types of Financial Aid Are Available?

Columbia College offers a variety of need-based and merit-based financial aid programs to help students cover the cost of tuition, fees, room and board, and other expenses.

Need-Based Financial Aid

- Federal Pell Grant: This grant is available to students with exceptional financial need. The maximum Pell Grant award for the 2023-2024 academic year is $6,895.

- Federal Supplemental Educational Opportunity Grant (FSEOG): This grant is available to students with exceptional financial need who are also eligible for the Pell Grant. The maximum FSEOG award for the 2023-2024 academic year is $4,000.

- Columbia College Grant: This grant is available to students with financial need who have not received a Pell Grant or FSEOG. The average Columbia College Grant award for the 2023-2024 academic year is $25,000.

Merit-Based Financial Aid

- Columbia College Presidential Scholarship: This scholarship is awarded to incoming first-year students who have demonstrated exceptional academic achievement and leadership potential. The scholarship covers full tuition, fees, room and board, and other expenses.

- Columbia College Dean’s Scholarship: This scholarship is awarded to incoming first-year students who have demonstrated high academic achievement. The scholarship covers full tuition and fees.

- Columbia College Faculty Scholarship: This scholarship is awarded to continuing students who have demonstrated exceptional academic achievement. The scholarship covers half of tuition and fees.

How to Apply for Financial Aid

In order to apply for financial aid at Columbia College, you must submit both the Free Application for Federal Student Aid (FAFSA) and the Columbia College Financial Aid Application.

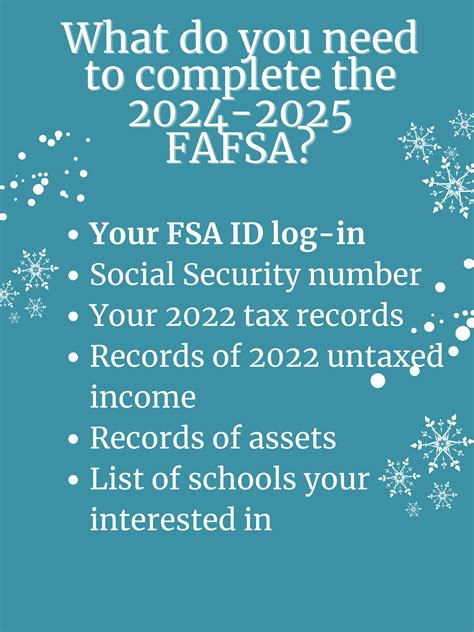

FAFSA

The FAFSA is a federal form that collects information about your family’s income and assets. This information is used to determine your eligibility for need-based financial aid. You can submit the FAFSA online at https://studentaid.gov/h/apply-for-aid/fafsa.

Columbia College Financial Aid Application

The Columbia College Financial Aid Application is a supplementary form that collects information about your academic history and financial need. You can submit the Columbia College Financial Aid Application online at https://www.college.columbia.edu/financial-aid/apply-financial-aid.

Tips for Maximizing Your Financial Aid Package

Once you have submitted your FAFSA and the Columbia College Financial Aid Application, you can take steps to maximize your financial aid package. Here are a few tips:

- File your FAFSA early. The earlier you file your FAFSA, the more likely you are to receive a higher financial aid award.

- Submit all required documentation. The financial aid office will need to verify your income and assets. Be sure to submit all required documentation, such as your tax returns and bank statements.

- Appeal your financial aid award. If you believe that your financial aid award is not sufficient to cover your costs, you can appeal to the financial aid office.

- Explore other sources of funding. In addition to financial aid, you may also be able to find other sources of funding, such as scholarships, grants, and loans.

Why Financial Aid Matters

Financial aid can help you make college more affordable. By reducing your out-of-pocket expenses, financial aid can allow you to focus on your studies and achieve your academic goals.

How to Apply

To apply for financial aid at Columbia College, you must submit both the FAFSA and the Columbia College Financial Aid Application.

Tips for Success

- File your FAFSA early.

- Submit all required documentation.

- Appeal your financial aid award if you believe it is not sufficient to cover your costs.

- Explore other sources of funding.

How Financial Aid Benefits Students

Financial aid can provide students with a number of benefits, including:

- Reduced out-of-pocket expenses: Financial aid can help reduce your out-of-pocket expenses for college, making it more affordable to attend school.

- Increased access to higher education: Financial aid can make college more accessible to students from all socioeconomic backgrounds.

- Improved academic performance: Financial aid can help students focus on their studies and achieve their academic goals.

- Greater career opportunities: A college education can lead to greater career opportunities and higher earning potential.

Effective Strategies for Getting Financial Aid

- Start early: The sooner you start the financial aid process, the more time you will have to research your options and find the best financial aid package for you.

- Be organized: Keep track of all of your financial aid documents and deadlines.

- Ask for help: If you need help with the financial aid process, don’t be afraid to ask for help from your school’s financial aid office or a financial aid counselor.

Here are some additional tips that you can use to increase your chances of getting financial aid:

- Maintain a good GPA: Your GPA is a major factor in determining your eligibility for financial aid.

- Get involved in extracurricular activities: Extracurricular activities can show that you are a well-rounded student and that you are committed to your education.

- Volunteer your time: Volunteering your time can show that you are a caring and compassionate person.

Understanding Financial Aid Terminology

- Cost of attendance: The cost of attendance is the total amount it will cost to attend college for one year, including tuition and fees, room and board, books and supplies, and other expenses.

- Expected family contribution (EFC): The EFC is the amount of money that your family is expected to contribute to your education.

- Financial aid award: A financial aid award is the amount of money that you receive from the government or from your school to help you pay for college.

- Grant: A grant is a type of financial aid that does not have to be repaid.

- Loan: A loan is a type of financial aid that must be repaid with interest.

- Scholarship: A scholarship is a type of financial aid that is awarded to students who have demonstrated academic achievement or other special talents.

- Work-study: Work-study is a type of financial aid that allows students to work part-time to earn money to help pay for college.

Conclusion

Financial aid can be a valuable resource for students who need help paying for college. By understanding the different types of financial aid available and following the tips in this article, you can increase your chances of getting the financial aid you need to achieve your educational goals.

Tables

Table 1: Need-Based Financial Aid Programs

| Program | Maximum Award |

|---|---|

| Federal Pell Grant | $6,895 |

| Federal Supplemental Educational Opportunity Grant (FSEOG) | $4,000 |

| Columbia College Grant | $25,000 |

Table 2: Merit-Based Financial Aid Programs

| Program | Award |

|---|---|

| Columbia College Presidential Scholarship | Full tuition, fees, room and board, and other expenses |

| Columbia College Dean’s Scholarship | Full tuition and fees |

| Columbia College Faculty Scholarship | Half of tuition and fees |

Table 3: Tips for Maximizing Your Financial Aid Package

| Tip | Description |

|---|---|

| File your FAFSA early | The earlier you file your FAFSA, the more likely you are to receive a higher financial aid award. |

| Submit all required documentation | The financial aid office will need to verify your income and assets. Be sure to submit all required documentation, such as your tax returns and bank statements. |

| Appeal your financial aid award | If you believe that your financial aid award is not sufficient to cover your costs, you can appeal to the financial aid office. |

| Explore other sources of funding | In addition to financial aid, you may also be able to find other sources of funding, such as scholarships, grants, and loans. |

Table 4: Benefits of Financial Aid

| Benefit | Description |

|---|---|

| Reduced out-of-pocket expenses | Financial aid can help reduce your out-of-pocket expenses for college, making it more affordable to attend school. |

| Increased access to higher education | Financial aid can make college more accessible to students from all socioeconomic backgrounds. |

| Improved academic performance | Financial aid can help students focus on their studies and achieve their academic goals. |

| Greater career opportunities | A college education can lead to greater career opportunities and higher earning potential. |