The Finance Department at the University of California, Santa Barbara (UCSB) is renowned for its exceptional curriculum and distinguished faculty, providing students with a comprehensive understanding of the financial industry. With a wide range of courses offered, UCSB’s finance program caters to students with diverse interests, from investment analysis to corporate finance.

Core Courses: Laying the Foundation

The core curriculum for finance majors at UCSB introduces students to the fundamental principles of finance, ensuring a solid grounding for future coursework. Courses include:

- Financial Management: Explores the strategic financial decisions made by corporations, including capital budgeting, investment selection, and dividend policy.

- Investments: Provides an overview of the different asset classes and investment strategies, covering equity, fixed income, and alternative investments.

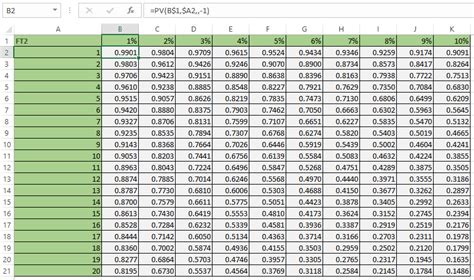

- Financial Modeling: Develops students’ skills in financial modeling, forecasting, and valuation using industry-standard software.

- Corporate Finance: Examines the financing and capital structure of corporations, including debt, equity, and mergers and acquisitions.

- Statistics for Finance: Introduces the statistical tools and methods commonly used in financial analysis, including regression analysis, hypothesis testing, and time series analysis.

Elective Courses: Exploring Specialized Interests

Beyond the core curriculum, UCSB offers a diverse selection of elective courses that allow students to tailor their studies to their specific interests and career aspirations. Some popular electives include:

- Behavioral Finance: Examines the psychological and cognitive biases that influence financial decision-making.

- International Finance: Explores the dynamics of global financial markets, including exchange rates, monetary policy, and cross-border investments.

- Real Estate Finance: Provides an overview of the real estate market, including investment strategies, financing options, and property valuation.

- Financial Derivatives: Introduces students to the world of financial derivatives, such as options, futures, and swaps.

- Private Equity and Venture Capital: Explores the private equity and venture capital industry, including fundraising, investment strategies, and exit options.

Faculty Expertise: Driving Innovation

The Finance Department at UCSB is home to a distinguished faculty of renowned researchers and experienced practitioners who bring real-world insights to the classroom. Faculty members have published extensively in top academic journals and regularly engage with industry leaders, ensuring that students receive the most up-to-date knowledge and industry best practices.

Career Preparation: Equipping Students for Success

UCSB’s finance program is designed to prepare students for a wide range of careers in the financial industry, including:

- Investment banking

- Asset management

- Commercial banking

- Financial planning

- Corporate finance

- Private equity

- Venture capital

The department offers a dedicated career services team that provides students with resume and cover letter writing assistance, networking opportunities, and career counseling. UCSB also has a strong alumni network, providing students with connections to professionals in the field.

Student Clubs and Activities: Enhancing the Experience

To complement the academic curriculum, UCSB offers several student clubs and activities that foster collaboration, networking, and practical experience. These include:

- Finance Club: Hosts guest speakers, organizes industry tours, and provides case study competitions.

- Investment Fund: A student-managed investment fund that provides hands-on experience in portfolio management and investment analysis.

- Excel Modeling Club: Enhances students’ financial modeling skills through workshops and competitions.

- Case Competition Team: Prepares students for case competitions hosted by leading investment banks and consulting firms.

- Student Managed Investment Fund (SMIF): Gives students hands-on experience in managing a real-world investment portfolio.

Admissions: Embracing Excellence

Admissions to the Finance Department at UCSB are highly competitive, with only the top students gaining admission. Applicants are typically expected to have a strong academic record, high standardized test scores, and a demonstrated interest in finance.

Conclusion: A Pathway to Success in Finance

UCSB’s finance program offers an exceptional educational experience for students aspiring to careers in the financial industry. With a comprehensive curriculum, distinguished faculty, a dedicated career services team, and a vibrant student community, UCSB provides the ideal platform for students to develop the knowledge, skills, and network necessary for success in the competitive world of finance.

Table 1: Employment Outlook for Finance Professionals

| Occupation | Median Annual Salary | Projected Job Growth (2019-2029) |

|---|---|---|

| Financial Analyst | $98,710 | 11% |

| Investment Banker | $126,530 | 8% |

| Financial Manager | $134,230 | 15% |

| Financial Advisor | $94,180 | 4% |

| Insurance Agent | $52,880 | 10% |

(Source: Bureau of Labor Statistics)

Table 2: Finance Program Rankings

| Publication | Ranking |

|---|---|

| QS World University Rankings | 31st |

| Financial Times Global MBA Rankings | 34th |

| U.S. News & World Report Best Business Schools | 36th |

Table 3: Scholarships and Financial Aid

| Scholarship | Amount | Eligibility |

|---|---|---|

| Dean’s Scholarship | $25,000 | Top incoming freshmen |

| Regents Scholarship | $15,000 | Top incoming California residents |

| Chancellor’s Scholarship | $10,000 | High-achieving students with financial need |

Table 4: Notable Alumni

| Name | Occupation | Company |

|---|---|---|

| Warren Buffett | CEO | Berkshire Hathaway |

| Jamie Dimon | CEO | JPMorgan Chase |

| Sheryl Sandberg | COO | Meta |

- Attend every class: Regular attendance is crucial for understanding the material and participating in discussions.

- Take good notes: Active listening and note-taking help you retain information and identify key concepts.

- Study regularly: Consistency is key to mastering finance concepts. Review your notes and textbooks daily.

- Participate in class: Ask questions, share your insights, and engage with the professor and classmates.

- Use office hours: Seek clarification on difficult topics and discuss course material with the professor outside of class.

- Form study groups: Collaborating with classmates can enhance understanding and provide different perspectives.

- Practice financial modeling: Develop your modeling skills through exercises and case studies.

- Stay updated on industry news: Read financial publications and attend industry events to keep abreast of market trends.

- Use formulas and functions: Utilize Excel formulas and functions to automate calculations and reduce errors.

- Format your model clearly: Label columns and rows, use consistent formatting, and organize your data logically.

- Test your model: Thoroughly test your model using different scenarios and assumptions to ensure accuracy and reliability.

- Document your model: Include clear documentation to explain the purpose, assumptions, and limitations of your model.

- Learn keyboard shortcuts: Master keyboard shortcuts to navigate Excel quickly and efficiently.

- Use pivot tables and charts: Summarize data and present it visually using pivot tables and charts.

- Leverage conditional formatting: Use conditional formatting to highlight specific data points or trends.

- Consider using the Solver tool: Explore different scenarios and optimize solutions using the Solver tool.

Investment Banker

Pros:

– High earning potential

– Prestigious and challenging work

– Opportunities for professional growth

Cons:

– Long working hours

– Stressful and competitive environment

– Limited opportunities for work-life balance

Asset Manager

Pros:

– Manages large pools of capital

– Potential for performance-based bonuses

– Stable and long-term career options

Cons:

– Market volatility can impact performance

– Can be a highly bureaucratic environment

– Investment returns may be limited by market conditions

Financial Planner

Pros:

– Helps clients achieve financial goals

– Flexible and rewarding work

– Opportunities for self-employment

Cons:

– Lower earning potential compared to other finance careers

– Requires a strong understanding of tax law and investments

– Can be emotionally taxing to work with clients experiencing financial difficulties