The Tax Cuts and Jobs Act (TCJA), signed into law by President Donald Trump in December 2017, significantly reduced the corporate tax rate from 35% to 21%. This change was intended to stimulate economic growth by increasing corporate profits and investment. However, the TCJA also had a number of other effects, including a decrease in tax revenue and an increase in the federal deficit.

Supply-Side Effects of the TCJA

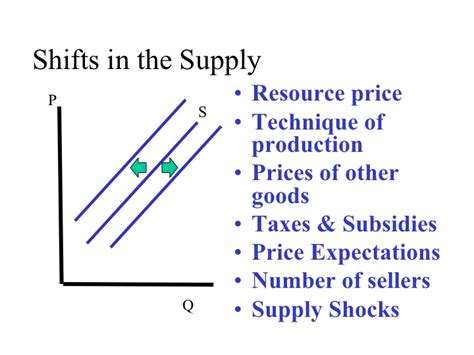

The TCJA had a number of supply-side effects, which are effects that occur on the side of the economy that produces goods and services. These effects include:

-

Increased corporate profits: The TCJA reduced the corporate tax rate, which led to an increase in corporate profits. According to the Congressional Budget Office (CBO), corporate profits increased by 10.9% in 2018, the first full year after the TCJA was enacted.

-

Increased investment: The TCJA also led to an increase in investment. According to the CBO, investment increased by 5.4% in 2018. This increase in investment is likely due to the fact that the TCJA made it more profitable for businesses to invest in new equipment and facilities.

-

Increased economic growth: The TCJA is estimated to have led to a small increase in economic growth. The CBO estimates that the TCJA increased GDP by 0.7% in 2018. This increase in GDP is likely due to the fact that the TCJA increased corporate profits and investment.

Demand-Side Effects of the TCJA

The TCJA also had a number of demand-side effects, which are effects that occur on the side of the economy that consumes goods and services. These effects include:

-

Increased consumer spending: The TCJA increased the after-tax income of consumers, which led to an increase in consumer spending. According to the CBO, consumer spending increased by 2.9% in 2018. This increase in consumer spending is likely due to the fact that consumers had more money to spend after taxes.

-

Increased inflation: The TCJA also led to an increase in inflation. According to the Bureau of Economic Analysis (BEA), inflation increased by 2.4% in 2018. This increase in inflation is likely due to the fact that the TCJA increased consumer spending and demand for goods and services.

Overall Effects of the TCJA

The TCJA had a number of both positive and negative effects on the economy. The positive effects include increased corporate profits, investment, and economic growth. The negative effects include decreased tax revenue, increased federal deficit, and increased inflation.

Overall, the TCJA had a small positive effect on the economy. The CBO estimates that the TCJA increased GDP by 0.7% in 2018. However, the TCJA also increased the federal deficit by $1.9 trillion over the next decade.

Tips for Businesses

Businesses can take a number of steps to take advantage of the TCJA. These steps include:

-

Invest in new equipment and facilities: The TCJA makes it more profitable for businesses to invest in new equipment and facilities. Businesses should take advantage of this by investing in new equipment and facilities that will help them to grow their business.

-

Increase research and development: The TCJA also provides tax breaks for businesses that increase their research and development spending. Businesses should take advantage of this by increasing their research and development spending in order to develop new products and services.

-

Hire new employees: The TCJA also makes it more profitable for businesses to hire new employees. Businesses should take advantage of this by hiring new employees to help them grow their business.

Tips for Consumers

Consumers can also take a number of steps to take advantage of the TCJA. These steps include:

-

Save more money: The TCJA increases the after-tax income of consumers. Consumers should take advantage of this by saving more money. This will help them to build up a nest egg for the future.

-

Invest more money: The TCJA also makes it more profitable for consumers to invest their money. Consumers should take advantage of this by investing their money in stocks, bonds, or mutual funds. This will help them to grow their wealth over time.

-

Spend more money: The TCJA increases the after-tax income of consumers. Consumers should take advantage of this by spending more money on goods and services. This will help to stimulate the economy and create jobs.

Conclusion

The TCJA had a number of both positive and negative effects on the economy. The positive effects include increased corporate profits, investment, and economic growth. The negative effects include decreased tax revenue, increased federal deficit, and increased inflation.

Overall, the TCJA had a small positive effect on the economy. The CBO estimates that the TCJA increased GDP by 0.7% in 2018. However, the TCJA also increased the federal deficit by $1.9 trillion over the next decade.

Businesses and consumers can take a number of steps to take advantage of the TCJA. These steps include investing in new equipment and facilities, increasing research and development, hiring new employees, saving more money, investing more money, and spending more money.