William Woods University (WWU) is a private liberal arts institution located in Fulton, Missouri. Established in 1870, WWU offers a wide range of undergraduate and graduate programs, including traditional on-campus and online formats. Understanding the financial implications of attending WWU is crucial for prospective students and their families. This article provides a comprehensive overview of William Woods tuition fees, financial aid opportunities, and strategies for minimizing expenses.

Tuition and Fees

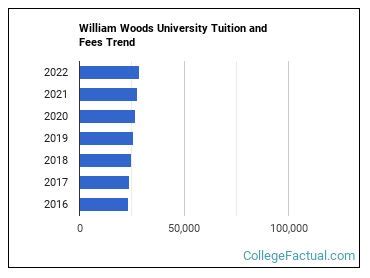

The cost of tuition at William Woods University varies depending on the program and student status. The 2023-2024 tuition rates are as follows:

| Program | Tuition (per credit hour) | Tuition (per semester) |

|---|---|---|

| Undergraduate (traditional) | $620 | $18,600 |

| Undergraduate (online) | $330 | $9,900 |

| Graduate (traditional) | $685 | $20,550 |

| Graduate (online) | $430 | $12,900 |

In addition to tuition, students must also pay various fees, including:

- Activity Fee: $150

- Technology Fee: $100

- Health Insurance Fee: $1,320 (for students not enrolled in a qualifying health insurance plan)

- Student Fee: $400

Financial Aid Options

William Woods University offers a range of financial aid options to assist students and families with the cost of tuition and fees. Approximately 98% of WWU students receive some form of financial assistance.

Scholarships: WWU awards over $12 million in scholarships annually based on merit, academic achievement, and financial need. Scholarships are renewable for up to four years and do not have to be repaid.

Grants: Grants are need-based awards that do not have to be repaid. WWU participates in federal and state grant programs, including the Pell Grant, the Federal Supplemental Educational Opportunity Grant (FSEOG), and the Missouri Access Grant.

Loans: Loans are borrowed funds that must be repaid with interest. WWU offers federal student loans, including the Direct Subsidized Loan, Direct Unsubsidized Loan, and Direct PLUS Loan.

Work-Study: The Federal Work-Study Program provides part-time employment opportunities for students with financial need. Students can earn money to help pay for educational expenses while gaining valuable work experience.

Strategies for Minimizing Expenses

In addition to applying for financial aid, students can explore various strategies to reduce the overall cost of their education at William Woods University.

Consider Online Programs: WWU’s online programs offer a more affordable option than traditional on-campus programs. Online tuition rates are significantly lower, and students can save on expenses such as commuting and on-campus housing.

Transfer Credits: Transferring credits from an accredited institution can help reduce the number of semesters required to complete a degree at WWU. This can save both time and money.

Part-Time Enrollment: Taking classes part-time can extend the length of time it takes to complete a degree but can also reduce the financial burden by spreading out the cost of tuition over a longer period.

Budget Wisely: Creating and sticking to a budget can help students manage their expenses effectively. Students should track their spending, identify areas where they can cut back, and take advantage of discounts and student savings programs.

Seek External Scholarships: Exploring scholarship opportunities outside of WWU can help students supplement their financial aid package. There are numerous scholarships available from local organizations, businesses, and foundations.

Step-by-Step Approach to Financing Your Education

-

Determine Your Financial Need: Calculate your expected family contribution (EFC) using the Free Application for Federal Student Aid (FAFSA). This will determine your eligibility for financial aid.

-

Apply for Financial Aid: Submit the FAFSA to apply for federal and state financial aid. WWU’s priority deadline for financial aid applications is February 1.

-

Explore Scholarship Opportunities: Research and apply for scholarships from both WWU and external sources.

-

Consider Loans as a Last Resort: If necessary, borrow student loans to cover any remaining costs after applying for financial aid and scholarships.

-

Manage Your Expenses Wisely: Create a budget and track your spending to minimize expenses and maximize your financial resources.

Conclusion

William Woods University provides a high-quality education with a strong focus on liberal arts and professional preparation. Understanding the tuition fees and financial aid options available is essential for making informed decisions about your education financing. By exploring scholarship opportunities, considering online programs, and budgeting wisely, students can minimize the financial burden of attending WWU and pave the way for a successful future.