Introduction

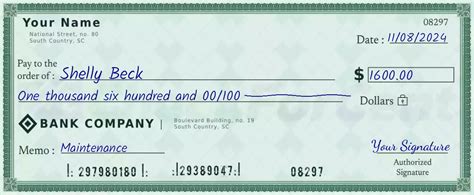

Writing checks efficiently and accurately is a crucial skill for managing finances. Whether it’s for personal expenses, business transactions, or charitable donations, knowing how to write a check correctly ensures that funds are transferred safely and securely. In this comprehensive guide, we delve into the specifics of writing 1600 on a check, providing step-by-step instructions and addressing common challenges.

Understanding Check Writing

A check is a written order to a bank to transfer a specified sum of money from the account holder’s account to the payee. Checks are typically used for situations where cash or electronic payments are not practical or desired. The key components of a check include:

- Payee: The person or organization to whom the payment is made.

- Amount: The numerical and written amount of money to be transferred.

- Date: The date the check is written.

- Signature: The account holder’s authorized signature.

Step-by-Step Guide to Writing 1600 on a Check

1. Fill in the Payee Line:

- Write “Pay to the Order of” followed by the name of the payee.

- Ensure that the name is spelled correctly and matches the recipient’s bank account details.

2. Enter the Amount in Numbers:

- In the box designated for the amount in numbers, write “1600”.

3. Write Out the Amount in Words:

- On the line below the amount in numbers, write out the amount in words: “One Thousand Six Hundred”.

- Use legible handwriting and avoid any smudges or alterations.

4. Write the Date:

- In the space provided, write the current date.

- The date format commonly used is mm/dd/yyyy (month/day/year).

5. Sign the Check:

- Sign your name in the signature line exactly as it appears on your bank account.

- Your signature authorizes the bank to transfer the funds.

6. Double-Check Accuracy:

- Before presenting the check, carefully review all the information to ensure accuracy.

- Check the payee’s name, amount in numbers and words, date, and signature.

Tables

| Feature | Description |

|---|---|

| Numeric Amount Box | Designed to write the amount in numbers. |

| Written Amount Line | Space to write out the amount in words. |

| Signature Line | Area where the account holder signs. |

| Bank Routing Number | Usually printed at the bottom left corner of the check. |

Additional Tips

- Use a high-quality pen: Fine-tipped pens with black or blue ink are recommended for clarity.

- Write legibly: Clear and precise handwriting prevents errors or confusion.

- Protect sensitive information: Keep the check in a safe place and shred it after use.

- Consider using check writing software: Automation tools can enhance efficiency and accuracy.

Overcoming Challenges

- Legibility: Practice writing numbers and words clearly to avoid misinterpretations.

- Incomplete or inaccurate information: Pay attention to all details and double-check for any omissions or errors.

- Forged signatures: Protect your checks from unauthorized access and report any lost or stolen checks immediately.

Call to Action

Mastering the art of writing checks is essential for financial management. By following the steps outlined in this guide and employing the strategies provided, you can write checks accurately and efficiently, ensuring secure and reliable transactions.