Berklee College of Music, one of the world’s most prestigious music schools, offers a transformative educational experience. However, pursuing a Berklee education comes with a substantial financial investment. Understanding the tuition structure, available scholarships, and budgeting strategies is essential for aspiring musicians.

Tuition Structure

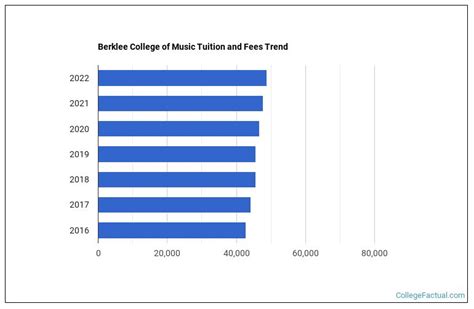

Berklee’s tuition is based on a per-credit system. The cost per credit hour varies depending on the degree program and year of study. For the 2023-2024 academic year, tuition charges are as follows:

| Degree Program | Credit Hours | Tuition per Credit Hour | Total Tuition |

|---|---|---|---|

| Bachelor of Music | 120 | $2,175 | $261,000 |

| Master of Music | 30 | $2,025 | $60,750 |

| Doctor of Musical Arts | 60-90 | $1,875 | $112,500-$168,750 |

| Graduate Certificate | 18 | $1,950 | $35,100 |

Additional costs to consider include:

- Application fee: $150

- Health insurance: $2,500-$3,500

- Housing: $15,000-$25,000

- Transportation: $2,000-$5,000

Scholarships and Financial Aid

Berklee offers a wide range of scholarships and financial aid options to make education more affordable.

- Merit-based scholarships: Awarded based on academic achievement, musical talent, and leadership qualities.

- Need-based scholarships: Determined by financial need as determined by the Free Application for Federal Student Aid (FAFSA).

- External scholarships: Scholarships provided by outside organizations, such as corporations, foundations, and community groups.

- Work-study program: Allows students to earn money while attending Berklee.

- Federal and state student loans: Low-interest loans available to eligible students.

According to the National Center for Education Statistics, 83% of Berklee students receive some form of financial aid. The average scholarship award for undergraduate students is $19,000.

Budgeting Strategies

Planning a budget is crucial for managing the cost of Berklee.

Create a detailed budget: Outline income and expenses, including tuition, fees, housing, transportation, and other expenses.

Explore income sources: Consider part-time jobs, scholarships, grants, and loans.

Reduce expenses: Look for ways to save money on housing, food, and entertainment.

Seek financial advice: Contact Berklee’s Financial Aid Office or an independent financial advisor for guidance.

Monitor spending: Regularly track expenses to identify areas where adjustments can be made.

Common Mistakes to Avoid

- Underestimating the cost: Make sure to factor in all expenses, including tuition, fees, and living costs.

- Relying solely on scholarships: While scholarships can be helpful, do not rely on them exclusively.

- Borrowing too much: Student loans should be used as a last resort.

- Ignoring financial aid deadlines: Apply for scholarships and financial aid early to increase your chances of receiving assistance.

Step-by-Step Approach to Managing Tuition Costs

- Estimate total costs: Factor in tuition, fees, and living expenses.

- Explore financial aid options: Apply for scholarships, grants, and work-study programs.

- Create a detailed budget: Outline income and expenses.

- Reduce expenses: Find ways to save money on housing, food, and entertainment.

- Consider student loans: Use student loans responsibly as a last resort.

- Monitor spending: Regularly track expenses to identify areas for adjustment.

Conclusion

Berklee College of Music tuition is a significant investment, but it is one that can open doors to a fulfilling career in music. By understanding the tuition structure, exploring financial aid options, and implementing effective budgeting strategies, aspiring musicians can make their Berklee dream a reality.