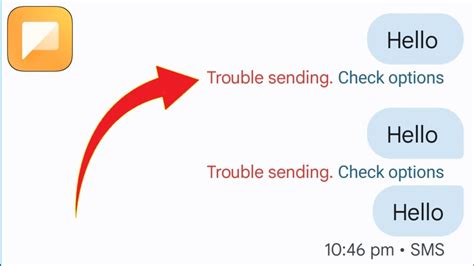

Having trouble sending checks? You’re not alone. In fact, a recent study by the American Bankers Association found that check fraud is on the rise. In 2020, there were over $1 billion in losses due to check fraud.

There are a number of reasons why check fraud is becoming more common. One reason is that checks are relatively easy to forge. Another reason is that checks can be used to make anonymous payments.

If you’re concerned about check fraud, there are a number of things you can do to protect yourself. One option is to use a check writer. A check writer is a device that prints checks with security features that make them more difficult to forge.

Another option is to use a remote deposit capture (RDC) service. With RDC, you can scan your checks and deposit them electronically using your mobile phone or computer. This eliminates the need to mail checks, which reduces the risk of fraud.

If you’re still having trouble sending checks, you may want to consider using a different payment method. There are a number of electronic payment options available, such as ACH transfers, wire transfers, and credit cards. These payment methods are all more secure than checks, and they can be used to make payments to anyone, anywhere in the world.

Why Should You Consider Alternatives to Sending Checks?

There are a number of reasons why you should consider using alternatives to sending checks. Here are a few of the most important benefits:

- Reduced risk of fraud: Checks are relatively easy to forge, which makes them a target for fraudsters. By using a different payment method, you can reduce the risk of becoming a victim of fraud.

- Increased efficiency: Electronic payment methods are more efficient than checks. You can make payments faster and with less hassle.

- Greater convenience: Electronic payment methods are more convenient than checks. You can make payments from anywhere, at any time.

- Lower costs: Electronic payment methods are often less expensive than checks. You can save money on postage, printing, and other expenses.

What Are Some Alternatives to Sending Checks?

There are a number of different electronic payment methods available. Here are a few of the most popular options:

- ACH transfers: ACH transfers are a type of electronic payment that is processed through the Automated Clearing House (ACH) network. ACH transfers are typically used to make payments between businesses and individuals.

- Wire transfers: Wire transfers are a type of electronic payment that is sent directly from one bank account to another. Wire transfers are typically used to make large payments or to make payments to people in other countries.

- Credit cards: Credit cards are a type of electronic payment that allows you to borrow money to make purchases. Credit cards are typically used to make small purchases or to make payments online.

How Can You Choose the Right Alternative to Sending Checks?

When choosing an alternative to sending checks, it’s important to consider your specific needs. Here are a few factors to keep in mind:

- The amount of money you’re sending: Some payment methods have limits on the amount of money that can be sent. If you’re sending a large payment, you’ll need to choose a payment method that can accommodate the amount.

- The speed of the payment: Some payment methods are faster than others. If you need to make a payment quickly, you’ll need to choose a payment method that offers fast processing times.

- The cost of the payment: Some payment methods are more expensive than others. If you’re on a budget, you’ll need to choose a payment method that is affordable.

Conclusion

If you’re having trouble sending checks, there are a number of alternative payment methods available. By using a different payment method, you can reduce the risk of fraud, increase efficiency, and save money.

FAQs

- What is the most secure way to send a check?

The most secure way to send a check is to use a check writer. A check writer is a device that prints checks with security features that make them more difficult to forge.

- What is the fastest way to send a check?

The fastest way to send a check is to use a remote deposit capture (RDC) service. With RDC, you can scan your checks and deposit them electronically using your mobile phone or computer.

- What is the most convenient way to send a check?

The most convenient way to send a check is to use an electronic payment method. You can make payments from anywhere, at any time.

- What is the most affordable way to send a check?

The most affordable way to send a check is to use an ACH transfer. ACH transfers are typically less expensive than wire transfers and credit cards.

- What should I do if I’m having trouble sending a check?

If you’re having trouble sending a check, you should contact your bank or credit union. They can help you resolve the issue and recommend alternative payment methods.

- What are the benefits of using electronic payment methods?

The benefits of using electronic payment methods include:

- Reduced risk of fraud

- Increased efficiency

- Greater convenience

- Lower costs

- What are the different types of electronic payment methods?

The different types of electronic payment methods include:

- ACH transfers

- Wire transfers

- Credit cards

- Debit cards

- Mobile payments

- How can I choose the right electronic payment method?

When choosing an electronic payment method, you should consider the following factors:

- The amount of money you’re sending

- The speed of the payment

- The cost of the payment