Understanding the Financial Landscape

Susquehanna University, a prestigious private institution in Selinsgrove, Pennsylvania, offers students a transformative educational experience. However, understanding the financial implications of attending Susquehanna is crucial before making a college decision. This article delves into the tuition costs, financial aid opportunities, and strategies for managing expenses to help prospective students navigate the financial landscape.

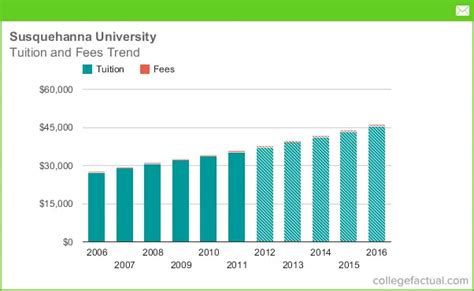

Tuition Overview

Undergraduate Tuition:

| Academic Year | Tuition Rate |

|---|---|

| 2023-2024 | $49,990 |

| 2022-2023 | $46,870 |

| 2021-2022 | $44,150 |

Graduate Tuition

| Program | Tuition Rate |

|---|---|

| MBA | $52,000 |

| MS in Occupational Therapy | $62,800 |

| MS in Physician Assistant Studies | $81,000 |

| Juris Doctor (JD) | $45,500 |

Financial Aid: A Path to Affordability

Susquehanna University recognizes the financial challenges faced by students and families and offers a robust financial aid program to bridge the gap between tuition and financial resources.

- Scholarships: Susquehanna awards merit-based scholarships ranging from $10,000 to $32,000 annually to recognize academic excellence, talent, and community involvement.

- Grants: Students with demonstrated financial need may qualify for federal and state grants, which do not need to be repaid.

- Loans: Stafford and PLUS loans are available to students and parents to help cover educational expenses.

- Work-Study: Students can earn income through on-campus employment to offset living costs or reduce tuition debt.

Strategies for Cost Management

- Explore Scholarships: Dedicate time to researching and applying for scholarships that align with your achievements and aspirations.

- Maximize Grant Eligibility: Document financial need accurately on the Free Application for Federal Student Aid (FAFSA) to qualify for need-based grants.

- Consider a Tuition Payment Plan: Spread tuition payments over several months to make the financial burden more manageable.

- Live a Frugal Lifestyle: Practice cost-consciousness by sharing housing, cooking meals at home, and exploring free or low-cost entertainment options.

- Seek Off-Campus Housing: Consider exploring off-campus housing options, which can be more affordable than on-campus housing.

Common Mistakes to Avoid

- Underestimating the True Cost of Attendance: Tuition is just one component of the total cost of attendance, which also includes fees, textbooks, and living expenses.

- Missing FAFSA Deadlines: Submit the FAFSA as early as possible to maximize grant and loan eligibility.

- Borrowing Excessively: While loans can provide financial assistance, it’s crucial to borrow only what is necessary and understand the long-term repayment obligations.

- Neglecting Financial Literacy: Develop financial literacy skills by creating a budget, monitoring expenses, and seeking professional advice as needed.

- Ignoring Student Discounts: Utilize student discounts on entertainment, transportation, and other services to save money.

Conclusion

Attending Susquehanna University is an investment in your future, and understanding the financial implications is essential for making an informed decision. By leveraging financial aid opportunities and implementing cost management strategies, students can navigate the financial landscape with confidence and unlock the transformative power of a Susquehanna education.