Navigating the complexities of financial aid can be daunting, especially for first-time college students. However, understanding the various options available at the University of Hawai’i at Manoa (UHM) can help you secure the financial assistance you need to pursue your academic goals.

What is Financial Aid?

Financial aid is any form of financial assistance provided to students to help cover the costs of higher education. This can include grants, scholarships, loans, and work-study programs.

Types of Financial Aid at UHM

UHM offers a wide range of financial aid options to meet the diverse needs of its students. These include:

- Pell Grants: Federal grants for students with exceptional financial need.

- Federal Supplemental Educational Opportunity Grants (FSEOG): Federal grants for undergraduate students with the greatest financial need.

- Work-Study: A federal program that provides part-time work opportunities for students to earn money while attending school.

- Federal Perkins Loans: Low-interest federal loans for students with exceptional financial need.

- Federal Stafford Loans: Unsubsidized and subsidized federal loans for students with varying levels of financial need.

- PLUS Loans: Federal loans for parents of dependent students and for graduate or professional students.

- Scholarships: Merit- or need-based awards from various sources, including the university, private organizations, and government agencies.

Eligibility for Financial Aid

To be eligible for financial aid at UHM, students must meet the following criteria:

- Be a U.S. citizen or eligible non-citizen.

- Have a high school diploma or GED.

- Be enrolled in an eligible degree program.

- Demonstrate financial need (for most types of aid).

- Maintain satisfactory academic progress.

How to Apply for Financial Aid

The first step is to complete the Free Application for Federal Student Aid (FAFSA). This application gathers information about your family’s income and assets to determine your financial need. The FAFSA also allows you to indicate which schools you want to apply for financial aid from. The UHM school code is 001553.

Once you submit the FAFSA, UHM will send you a financial aid package that outlines the types and amounts of aid you’re eligible for.

Important Deadlines

Financial aid deadlines vary depending on the type of aid. However, it’s advisable to submit the FAFSA by March 1st for full consideration of all types of aid.

Strategies for Maximizing Financial Aid

- Start early: Begin researching and applying for financial aid as soon as possible.

- Explore all options: Consider all available types of aid, including grants, scholarships, loans, and work-study programs.

- Compare costs: Calculate the total cost of attendance at different schools to identify the institution that offers the best financial aid package.

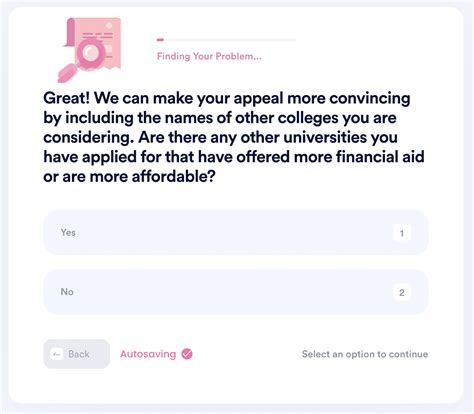

- Appeal decisions: If you’re not satisfied with your financial aid package, contact the UHM Financial Aid office to request an appeal.

- Maintain good grades: Satisfactory academic progress is essential for continued financial aid eligibility.

Common Mistakes to Avoid

- Missing deadlines: Submitting the FAFSA after the deadline can delay or reduce your financial aid eligibility.

- Not completing the FAFSA correctly: Inaccurate or incomplete information can impact your financial aid award.

- Accepting too much debt: Be mindful of your student loan debt and borrow only what you need.

- Ignoring scholarships: Explore and apply for as many scholarships as possible to reduce your out-of-pocket expenses.

- Not reading loan agreements: Understand the terms and conditions of your student loans before signing them.

Why Financial Aid Matters

Financial aid plays a crucial role in making college affordable for many students. It can cover the costs of tuition, fees, books, housing, and other expenses. Without financial aid, many students would be unable to pursue higher education.

Benefits of Financial Aid

- Increases access to higher education: Financial aid helps to level the playing field for students from all socioeconomic backgrounds.

- Reduces student debt: Grants and scholarships can help students avoid or reduce the amount of student loans they have to borrow.

- Improves graduation rates: Financial aid can provide the stability and support that students need to succeed academically and graduate on time.

- Increases economic mobility: A college degree can lead to higher earning potential and improved job opportunities.

Financial Aid Resources at UHM

UHM offers a dedicated Financial Aid office to assist students with the financial aid process. Here are some of the resources available:

- Financial Aid Counseling: One-on-one assistance with financial aid applications, financial literacy, and loan repayment options.

- Financial Aid Workshops: Informative sessions on topics such as completing the FAFSA, understanding different types of aid, and managing student debt.

- Online Financial Aid Tools: Online resources such as the Student Financial Aid Handbook and the Financial Aid Estimator can help you navigate the financial aid process.

Conclusion

UHM offers a comprehensive financial aid program to support students in achieving their academic goals. By understanding the available options, applying for financial aid early, and avoiding common mistakes, you can maximize your financial assistance and reduce the cost of your education. The UHM Financial Aid office is committed to providing personalized guidance and support throughout the financial aid process.

Table 1: Types of Financial Aid at UHM

| Type of Aid | Source | Eligibility |

|---|---|---|

| Pell Grants | Federal Government | Exceptional financial need |

| FSEOG | Federal Government | Greatest financial need |

| Work-Study | Federal Government | Financial need |

| Federal Perkins Loans | Federal Government | Exceptional financial need |

| Federal Stafford Loans | Federal Government | Varying levels of financial need |

| PLUS Loans | Federal Government | Parents of dependent students and graduate students |

| Scholarships | University, private organizations, government agencies | Merit or need-based |

Table 2: Important Financial Aid Deadlines

| Deadline | Type of Aid |

|---|---|

| March 1st | Priority consideration for all types of aid |

| June 30th | Fall semester aid |

| November 15th | Spring semester aid |

Table 3: Strategies for Maximizing Financial Aid

| Strategy | Description |

|---|---|

| Start early | Begin researching and applying for financial aid as soon as possible. |

| Explore all options | Consider all available types of aid, including grants, scholarships, loans, and work-study programs. |

| Compare costs | Calculate the total cost of attendance at different schools to identify the institution that offers the best financial aid package. |

| Appeal decisions | Contact the UHM Financial Aid office to request an appeal if you’re not satisfied with your financial aid package. |

| Maintain good grades | Satisfactory academic progress is essential for continued financial aid eligibility. |

Table 4: Benefits of Financial Aid

| Benefit | Description |

|---|---|

| Increases access to higher education | Financial aid helps to level the playing field for students from all socioeconomic backgrounds. |

| Reduces student debt | Grants and scholarships can help students avoid or reduce the amount of student loans they have to borrow. |

| Improves graduation rates | Financial aid can provide the stability and support that students need to succeed academically and graduate on time. |

| Increases economic mobility | A college degree can lead to higher earning potential and improved job opportunities. |