What is UTMA?

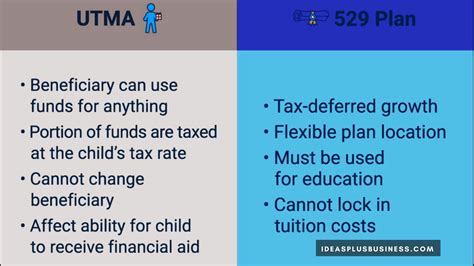

Uniform Transfer to Minors Act (UTMA) is a law that governs the creation and management of custodial accounts for minors. These accounts allow adults to transfer assets to minors, such as stocks, bonds, or cash. UTMA accounts are irrevocable, meaning that once the assets are transferred to the minor, they cannot be withdrawn until the minor reaches the age of majority.

What is 529?

529 plan is a tax-advantaged savings plan designed to encourage saving for future education costs. Contributions to a 529 plan are made on an after-tax basis, but earnings grow tax-free. Withdrawals from a 529 plan are also tax-free if they are used to pay for qualified education expenses, such as tuition, fees, books, and supplies.

Why Convert UTMA to 529?

There are several reasons why you might want to convert a UTMA to a 529 plan.

- Tax advantages: 529 plans offer tax advantages that UTMA accounts do not. Earnings on 529 plans grow tax-free, and withdrawals are tax-free if they are used to pay for qualified education expenses.

- Control: With a 529 plan, you have more control over the assets than you do with a UTMA account. With a UTMA account, the minor becomes the owner of the assets when they reach the age of majority. With a 529 plan, you can retain control of the assets until the minor is ready to use them for education expenses.

- Flexibility: 529 plans offer more flexibility than UTMA accounts. With a 529 plan, you can choose from a variety of investment options, and you can change your investment strategy as the minor’s needs change. With a UTMA account, you are limited to investing in a few specific types of assets.

How to Convert UTMA to 529

Converting a UTMA to a 529 plan is a relatively simple process. You will need to:

- Open a 529 plan with a financial institution.

- Transfer the assets from the UTMA account to the 529 plan.

- Notify the custodian of the UTMA account that you are converting the account to a 529 plan.

Tax Implications of Converting UTMA to 529

There are no tax implications if you convert a UTMA to a 529 plan within the same state. However, if you convert a UTMA to a 529 plan in a different state, you may be subject to state income tax on the earnings in the UTMA account.

Benefits of Converting UTMA to 529

There are several benefits to converting a UTMA to a 529 plan, including:

- Tax advantages: 529 plans offer tax advantages that UTMA accounts do not. Earnings on 529 plans grow tax-free, and withdrawals are tax-free if they are used to pay for qualified education expenses.

- Control: With a 529 plan, you have more control over the assets than you do with a UTMA account. With a UTMA account, the minor becomes the owner of the assets when they reach the age of majority. With a 529 plan, you can retain control of the assets until the minor is ready to use them for education expenses.

- Flexibility: 529 plans offer more flexibility than UTMA accounts. With a 529 plan, you can choose from a variety of investment options, and you can change your investment strategy as the minor’s needs change. With a UTMA account, you are limited to investing in a few specific types of assets.

Disadvantages of Converting UTMA to 529

There are a few disadvantages to converting a UTMA to a 529 plan, including:

- Fees: 529 plans may have fees associated with them, such as annual maintenance fees and investment management fees. UTMA accounts typically do not have any fees associated with them.

- Investment options: 529 plans may have limited investment options compared to UTMA accounts. This is because 529 plans are designed to be used for education expenses, and the investment options are typically tailored to that goal.

- Tax implications: If you convert a UTMA to a 529 plan in a different state, you may be subject to state income tax on the earnings in the UTMA account.

Conclusion

Converting a UTMA to a 529 plan can be a beneficial move for some families. However, it is important to weigh the benefits and disadvantages carefully before making a decision.