Defining Capital Stock

A country’s capital stock refers to the total value of its produced assets used in the production of goods and services. This includes physical capital, such as machinery, buildings, and infrastructure, as well as intangible capital, such as patents, trademarks, and brands.

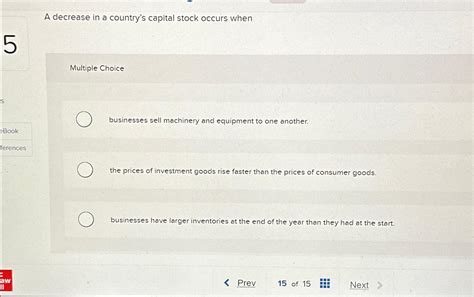

Causes of a Decrease in Capital Stock

Several factors can lead to a decrease in a country’s capital stock:

1. Depreciation and Obsolescence

Over time, physical capital depreciates, reducing its value and productivity. Additionally, technological advancements can render existing capital obsolete, leading to its premature retirement.

2. Disinvestment

Businesses may decide to reduce their capital investments due to factors such as economic downturns, changes in market conditions, or a shift towards less capital-intensive production methods.

3. Natural Disasters

Hurricanes, earthquakes, and other natural disasters can cause widespread destruction of physical capital, significantly reducing a country’s capital stock.

4. Conflict and War

War and armed conflict can result in the destruction or loss of infrastructure, machinery, and other capital assets.

5. Government Policies

Government policies, such as high taxes on capital investment or restrictions on foreign ownership, can discourage businesses from investing in capital, leading to a decline in capital stock.

Consequences of a Decrease in Capital Stock

A decrease in a country’s capital stock can have severe consequences, including:

1. Reduced Productivity

A shortage of capital reduces businesses’ ability to produce goods and services efficiently, leading to lower productivity and economic growth.

2. Lower Living Standards

A decline in productivity results in lower real incomes for businesses and households, leading to a reduction in living standards.

3. Unemployment

Businesses with reduced capital may find it difficult to maintain employment levels, resulting in job losses and increased unemployment.

4. Reduced Innovation

A decrease in capital stock limits a country’s ability to invest in research and development, stifling innovation and economic progress.

5. Foreign Investment Outflows

A decline in capital stock makes a country less attractive to foreign investors, leading to capital outflows and a weakened economy.

Strategies to Mitigate a Decrease in Capital Stock

To address the potential consequences of a decrease in capital stock, countries can implement several strategies:

1. Promote Investment

Governments can encourage investment by providing tax incentives, reducing regulatory barriers, and improving the investment climate.

2. Support Infrastructure Development

Investing in infrastructure, such as transportation, energy, and communication networks, creates a foundation for private sector capital investment.

3. Enhance Education and Skills

Investing in education and workforce training improves the quality of the labor force, making them more productive and capable of using capital effectively.

4. Encourage Innovation

Governments can facilitate research and development by providing funding, tax credits, and other incentives to businesses and researchers.

5. Maintain a Stable Political and Economic Environment

Political stability, low inflation, and sound economic policies create a favorable environment for domestic and foreign investment.

Benefits of Maintaining Capital Stock

Maintaining a healthy capital stock is crucial for any country’s economic well-being:

1. Increased Productivity

A robust capital stock allows businesses to operate more efficiently, boosting productivity and economic growth.

2. Higher Living Standards

Increased productivity leads to higher incomes and improved living standards for citizens.

3. Job Creation

Investments in capital stock create new jobs and support employment growth.

4. Enhanced Innovation

A strong capital stock facilitates research and development, leading to new technologies and innovations.

5. Foreign Investment Attraction

A country with a substantial capital stock becomes more attractive to foreign investors, promoting economic growth and diversification.

Conclusion

A decline in a country’s capital stock poses significant risks to its economic health. By implementing measures to promote investment, enhance human capital, encourage innovation, and maintain a stable environment, governments can mitigate these risks and ensure the sustained growth of their economies. Maintaining a robust capital stock is vital for ensuring productivity, improving living standards, and securing the future prosperity of a nation.

Additional Information

Keywords: Capital stock, economic growth, investment, depreciation, obsolescence, disinvestment, natural disasters, conflict, war, government policies, productivity, living standards, unemployment, innovation, foreign investment.

Tables:

- Table 1: Global Capital Stock by Region

- Table 2: Causes of Capital Stock Decline by Country

- Table 3: Economic Consequences of Capital Stock Decline

- Table 4: Strategies for Mitigating Capital Stock Decline

Tips and Tricks:

- Businesses can extend the lifespan of capital assets through proper maintenance and upgrades.

- Governments can consider leasing or borrowing capital assets instead of purchasing them outright, reducing upfront investment costs.

- International organizations, such as the World Bank, provide grants and loans to developing countries to support capital stock development.

- Public-private partnerships can facilitate large-scale infrastructure projects that would otherwise be difficult for either sector to undertake alone.

Why It Matters:

A robust capital stock is the backbone of a modern economy. It enables businesses to produce goods and services efficiently, creating wealth and improving the quality of life for citizens. A decline in capital stock, on the other hand, has far-reaching consequences, leading to economic stagnation, unemployment, and a reduced standard of living.

Benefits:

Maintaining a healthy capital stock benefits society in numerous ways:

- Increased productivity: A well-maintained capital stock allows businesses to operate more efficiently, reducing costs and increasing output.

- Higher living standards: Increased productivity leads to higher incomes and improved living conditions for citizens.

- Job creation: Investments in capital stock create new jobs in various sectors, such as construction, manufacturing, and technology.

- Enhanced innovation: A strong capital stock facilitates research and development, leading to new technologies and innovations that improve the lives of citizens.

- Foreign investment attraction: A country with a substantial capital stock becomes more attractive to foreign investors, promoting economic growth and diversification.