Saving for your child’s education is a crucial part of financial planning. 529 plans offer tax-advantaged savings specifically designed for higher education expenses. But how much should you save in a 529 plan to ensure your child’s financial future?

Determining Your Savings Goal

The amount you need to save in a 529 plan depends on several factors, including:

- Type of institution: The cost of college varies widely between public and private institutions. For example, according to the College Board, the average published tuition and fees for a four-year public college in the 2022-2023 academic year was $10,740 for in-state students and $27,330 for out-of-state students. In contrast, the average published tuition and fees for a four-year private college were $38,070.

- Anticipated expenses: College expenses extend beyond tuition and fees. Students also need to budget for housing, food, transportation, and other living expenses. These costs can vary significantly depending on the location of the institution and the student’s lifestyle.

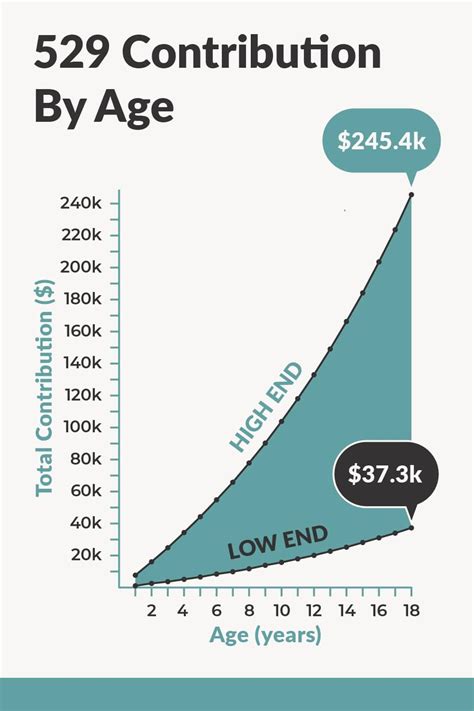

- Time horizon: The length of time you have to save will also impact your savings goal. The sooner you start saving, the more time your money has to grow through compound interest.

- Contribution limits: 529 plans impose annual contribution limits. For 2023, the annual gift tax exclusion for 529 contributions is $16,000 per donor per beneficiary. If you are saving for multiple children, you can contribute up to $32,000 per year.

Common Savings Goals

As a general guideline, financial experts recommend saving approximately 20-25% of your child’s anticipated college expenses in a 529 plan. This assumes that you will have approximately four years to save and that the funds will earn a modest rate of return.

For example, if you anticipate that your child’s college expenses will be $100,000, you should aim to save around $20,000-$25,000 in a 529 plan.

Contributions to Meet Your Goal

To meet your savings goal, it is important to make regular contributions to your 529 plan. You can set up automatic transfers from your checking or savings account on a monthly or quarterly basis.

The amount of your contributions will depend on your individual financial situation and savings timeline. Consider using the following table as a starting point:

| Savings Time Horizon | Annual Savings Goal |

|---|---|

| 10 years | $2,000-$2,500 |

| 15 years | $1,300-$1,600 |

| 20 years | $1,000-$1,200 |

Making the Most of Your 529 Plan

In addition to making regular contributions, there are other strategies you can employ to maximize the growth of your 529 plan:

- Start saving early: The power of compound interest can work wonders for long-term savings. Starting early will give your money more time to grow.

- Take advantage of tax benefits: Withdrawals from 529 plans are tax-free at the federal level as long as the funds are used for qualified education expenses. Some states also offer state income tax deductions or credits for 529 contributions.

- Invest wisely: The investment options offered by 529 plans vary depending on the state. Choose a plan with investment options that align with your risk tolerance and investment timeline.

- Consider a family plan: Family plans allow multiple family members to contribute to a single 529 plan for a single beneficiary. This can be a great way to pool resources and reach your savings goal faster.

Common Mistakes to Avoid

When saving for college in a 529 plan, it is important to avoid the following common mistakes:

- Saving too little: Underfunding your 529 plan can leave you with a shortfall when your child goes to college.

- Spending the money early: Withdrawing money from a 529 plan for non-qualified expenses can result in penalties and taxes.

- Not taking advantage of tax benefits: Failing to maximize tax deductions or credits for 529 contributions can reduce the overall return on your investment.

- Investing too conservatively: While it is important to avoid excessive risk, investing too conservatively may not generate sufficient growth to meet your savings goal.

- Changing investment options too often: Market fluctuations are a normal part of investing. Avoid making frequent changes to your investment options, as this could diminish your returns over time.

Frequently Asked Questions

Q: What are the income limits for 529 plans?

A: There are no income limits for contributing to a 529 plan. However, there may be gift tax implications if you contribute more than the annual gift tax exclusion.

Q: Can I use a 529 plan to pay for K-12 education expenses?

A: Yes, starting in 2024, 529 plans can be used to cover up to $10,000 per year in qualified K-12 education expenses per beneficiary.

Q: What happens if my child does not attend college?

A: If your child does not use the funds in their 529 plan for qualified education expenses, you can withdraw the money, but you will be subject to taxes and penalties on the earnings.

Q: Can I roll over 529 funds into my own retirement account?

A: Yes, but you will be subject to income tax and a 10% penalty on the earnings.

Q: Can I use 529 funds to pay for international education expenses?

A: Yes, 529 plans can be used to pay for qualified education expenses at eligible foreign institutions.

Conclusion

Saving for your child’s education in a 529 plan is an important step in securing their financial future. By determining your savings goal, making regular contributions, and taking advantage of tax benefits, you can help your child achieve their educational aspirations.