Introduction

Navigating the world of financial aid can be overwhelming. The SAR (Student Aid Report) plays a critical role in determining your eligibility for federal student aid, but many students struggle to understand this important document. This comprehensive guide will provide you with an in-depth explanation of the SAR, helping you decode its contents and optimize your financial aid applications.

What is the SAR?

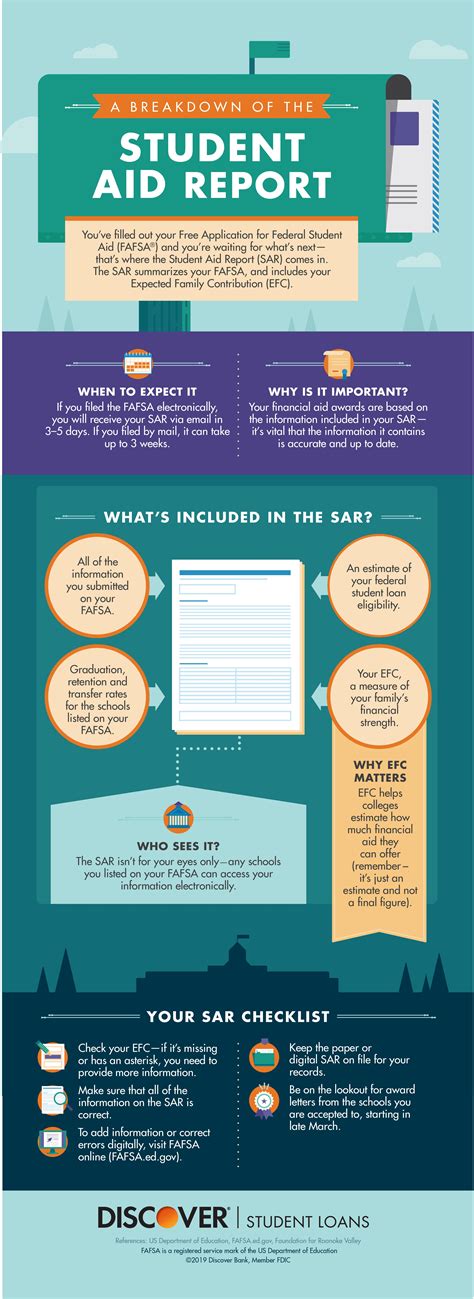

The SAR is an official document generated by the Federal Student Aid (FSA) office. It summarizes the information you provided on the Free Application for Federal Student Aid (FAFSA) and the results of the federal processor’s analysis. The SAR contains crucial data that universities and colleges use to determine your financial aid package.

Understanding the SAR

The SAR is divided into several sections, each containing specific information:

- Student Information: Your name, Social Security number, and address.

- Income and Asset Information: Your taxable income, savings, and investments.

- Dependency Status: Whether you are considered dependent or independent for financial aid purposes.

- Expected Family Contribution (EFC): The amount of money your family is expected to contribute towards your education costs.

- Financial Aid Eligibility: A summary of the federal student loans, grants, and work-study programs you are eligible for.

Importance of the SAR

The SAR is essential for the following reasons:

- It determines your eligibility for federal student aid.

- It provides information that universities and colleges use to calculate your financial aid package.

- It helps you budget for higher education expenses.

- It can identify potential errors in your FAFSA application.

How to Use the SAR

- Review the SAR Carefully: Check for accuracy and any missing information.

- Understand the EFC: The EFC is a key factor in determining your financial aid eligibility. It is calculated using a formula that considers your family’s income, assets, and other factors.

- Compare Your SAR to Your FAFSA: Ensure that the information on your SAR matches what you submitted on your FAFSA.

- Contact the Financial Aid Office: If you have any questions about your SAR, contact the financial aid office at the college or university you are attending.

Effective Strategies for Optimizing Your SAR

- File the FAFSA Early: Federal student aid is awarded on a first-come, first-served basis. Submitting your FAFSA by the deadline increases your chances of receiving maximum financial aid.

- Complete the FAFSA Accurately: Errors on your FAFSA can delay processing and result in incorrect financial aid awards. Use the IRS Data Retrieval Tool to ensure accuracy.

- Consider Dependency Status: Your dependency status can significantly impact your EFC and financial aid eligibility. Explore options for becoming an independent student if possible.

- Maximize Income Exclusions: The EFC formula allows for certain deductions and exclusions from income. Discuss these with a financial aid advisor to maximize your benefits.

How to Step-by-Step Approach to Utilizing the SAR

- Review your SAR carefully to ensure accuracy.

- Calculate your EFC using the formula provided on the SAR.

- Compare your SAR information to your FAFSA application.

- Contact the financial aid office at your college or university with any questions.

- Follow the effective strategies outlined above to optimize your financial aid package.

FAQs about the SAR

- What is the SAR deadline? There is no specific SAR deadline, but it is important to submit your FAFSA by the priority deadline to ensure maximum financial aid eligibility.

- Can I make changes to my SAR? Yes, you can request corrections to your SAR by contacting the FSA office or your college’s financial aid office.

- What if I am not eligible for any federal student aid? There are other financial aid options available, such as state grants and scholarships. Contact your financial aid office for more information.

- Can I use my SAR to apply for private student loans? No, the SAR is not used for private student loan applications. Private lenders use their own criteria to assess creditworthiness and determine loan eligibility.

- How can I prepare for the SAR before submitting my FAFSA? Gather necessary documents such as tax returns and bank statements. Use the IRS Data Retrieval Tool to import income information directly into the FAFSA.

- What is the difference between the EFC and the COA? The EFC is the amount of money your family is expected to contribute towards your education costs. The COA (Cost of Attendance) is the total cost of attending your college or university for an academic year, including tuition, fees, housing, and other expenses.

Conclusion

The SAR is an essential tool in the financial aid process. By understanding its contents and utilizing effective strategies, you can maximize your financial aid eligibility and reduce the burden of college costs. Remember to review your SAR carefully, contact your financial aid office with any questions, and take proactive steps to optimize your financial aid package.