Saving for your niece’s future education is a thoughtful and generous gesture. 529 plans are tax-advantaged savings accounts designed specifically for education expenses. While there are some restrictions on who can open a 529 plan, in many cases, you can open one for your niece.

Eligibility Requirements

To open a 529 plan for your niece, you must meet the following eligibility requirements:

- You must be a US citizen or permanent resident. Your niece does not have to be a US citizen or permanent resident.

- You must be at least 18 years old.

- You must have a legal relationship to your niece. This can include being a parent, grandparent, aunt, uncle, or sibling.

Types of 529 Plans

There are two main types of 529 plans:

- State-Sponsored Plans: These plans are offered by individual states and typically offer lower fees and in-state tax benefits.

- Private Plans: These plans are offered by financial institutions and may offer a wider range of investment options.

Tax Benefits

529 plans offer several tax benefits:

- Tax-free growth: Earnings in a 529 plan grow tax-free federally and in most states.

- Tax-free withdrawals: Withdrawals used for qualified education expenses are tax-free federally and in most states.

Contribution Limits

The contribution limits for 529 plans vary by state. For 2023, the federal annual gift tax exclusion is $17,000 per donor. However, some states allow higher contributions.

Opening a 529 Plan

To open a 529 plan for your niece, you will need to:

- Choose a plan: Research different plans and compare fees, investment options, and tax benefits.

- Open an account: Contact the plan provider and complete the necessary paperwork.

- Designate your niece as the beneficiary: Provide your niece’s name, date of birth, and Social Security number.

- Make contributions: You can contribute to the plan on a regular or one-time basis.

Tips and Tricks

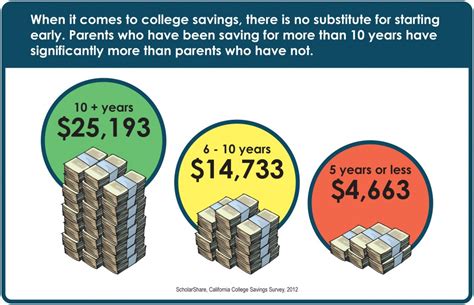

- Consider opening a 529 plan as early as possible to maximize tax-free growth.

- Take advantage of any state tax deductions or credits for 529 plan contributions.

- Explore different investment options to align with your niece’s age and educational goals.

- Encourage your niece to apply for scholarships and grants to supplement her 529 plan savings.

FAQs

- Can I open a 529 plan for a non-relative? No, you must have a legal relationship to the beneficiary.

- What happens if my niece doesn’t use all the funds in her 529 plan? Any unused funds can be rolled over to another 529 plan beneficiary without penalty.

- Can I change the beneficiary of a 529 plan? Yes, you can change the beneficiary as long as the new beneficiary meets the eligibility requirements.

- What are the tax consequences of non-qualified withdrawals from a 529 plan? Non-qualified withdrawals are subject to income tax and a 10% penalty on the earnings portion.

Additional Resources

Conclusion

Opening a 529 plan for your niece can be a valuable way to help her save for her future education. By understanding the eligibility requirements, tax benefits, and different types of plans, you can make an informed decision that meets your niece’s needs.

Tables

Table 1: State Contribution Limits for 529 Plans

| State | Limit |

|---|---|

| California | $422,000 |

| New York | $550,000 |

| Texas | Unlimited |

Table 2: Tax Benefits of 529 Plans

| Tax Type | State | Federal |

|---|---|---|

| Income Tax | Varies by state | Tax-free |

| Capital Gains Tax | Varies by state | Tax-free |

| Gift Tax | Annual exclusion of $17,000 | N/A |

Table 3: Investment Options for 529 Plans

| Type of Investment | Description |

|---|---|

| Age-Based Funds | Automatically adjust investments based on beneficiary’s age |

| Target Date Funds | Invest in a mix of assets that become more conservative as the beneficiary ages |

| Index Funds | Track a specific market index, such as the S&P 500 |

| Individual Stocks | Allow investors to directly invest in specific companies |

Table 4: Non-Qualified Withdrawals from 529 Plans

| Situation | Tax Treatment |

|---|---|

| Used for non-educational expenses | Earnings taxed at ordinary income tax rate, plus 10% penalty |

| Beneficiary receives a scholarship | Earnings subject to income tax, but penalty waived |

| Plan is closed | Earnings subject to income tax, but penalty waived if funds are rolled over to another 529 plan within 60 days |