Preparing for the AP Macroeconomics exam requires a solid understanding of key concepts and the ability to apply formulas effectively. This formula sheet provides a comprehensive compilation of essential formulas to help you excel on the exam.

Consumer Behavior and Demand

- Demand Equation: Qd = a – bP + cY + dPE

- Marginal Utility: MU = ΔTU/ΔQ

- Elasticity of Demand: Ed = (%ΔQ/%ΔP) * (P/Q)

- Income Elasticity of Demand: Eyd = (%ΔQ/%ΔY) * (Y/Q)

- Cross Elasticity of Demand: Exy = (%ΔQx/%ΔPy) * (Py/Qx)

Production and Cost

- Production Function: Q = f(K, L)

- Marginal Product of Labor: MPL = ΔQ/ΔL

- Marginal Product of Capital: MPK = ΔQ/ΔK

- Total Cost: TC = FC + VC

- Marginal Cost: MC = ΔTC/ΔQ

- Average Fixed Cost: AFC = FC/Q

- Average Variable Cost: AVC = VC/Q

- Average Total Cost: ATC = TC/Q

Market Structure and Market Equilibrium

- Perfect Competition: P = MC

- Monopoly: MR = MC

- Monopolistic Competition: MC = MR < P

- Oligopoly: P > MC (typically)

- Market Equilibrium: Qs = Qd

Macroeconomic Measurement and Data

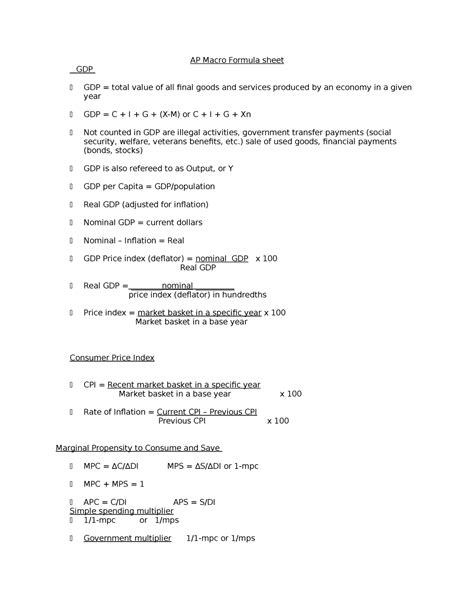

- Real GDP: GDP = Consumption + Investment + Government Spending + (Exports – Imports)

- Nominal GDP: GDP = P * Q

- Consumer Price Index (CPI): CPI = (Current price / Base year price) * 100

- Producer Price Index (PPI): PPI = (Wholesale price / Base year price) * 100

- Unemployment Rate: Unemployment Rate = Number of unemployed / Labor force * 100

Economic Growth and Inflation

- Real GDP Growth: ΔY/Y = (Y1 – Y0) / Y0

- Inflation Rate: Inflation Rate = (CPI1 – CPI0) / CPI0 * 100

- GDP Deflator: GDP Deflator = (Nominal GDP / Real GDP) * 100

- Okun’s Law: ΔUnemployment = – 0.5% * ΔReal GDP Growth

Monetary and Fiscal Policy

- Money Supply: M = Currency + Demand Deposits + Savings Deposits + Time Deposits

- Money Multiplier: Money Multiplier = 1 / Reserve Ratio

- Interest Rate: Interest Rate = (1 / Bond Price) * 100

- Expansionary Monetary Policy: Increase money supply (lower interest rates)

- Contractionary Monetary Policy: Decrease money supply (raise interest rates)

- Expansionary Fiscal Policy: Increase government spending or decrease taxes

- Contractionary Fiscal Policy: Decrease government spending or increase taxes

International Economics

- Balance of Payments: BoP = Current Account + Capital Account + Financial Account

- Current Account Balance: CAB = Exports – Imports

- Exchange Rate: Exchange Rate = Price of foreign currency / Domestic currency

- Purchasing Power Parity (PPP): P1/P2 = E

- Relative Purchasing Power: RPPP = (P1 / E) / P2

Additional Tips and Tricks

- Review these formulas regularly and practice applying them.

- Use flashcards or note-taking techniques to memorize key formulas.

- Seek help from teachers, tutors, or online resources if you struggle with any concepts.

- Remember that understanding the concepts behind the formulas is crucial.

- Don’t be afraid to make mistakes; they are an opportunity for learning.

FAQs

-

What is the most important formula to know for the exam?

– The demand equation (Qd = a – bP + cY + dPE) is critical for understanding consumer behavior. -

How do I calculate the equilibrium price and quantity in a market?

– Set Qs = Qd and solve for P and Q. -

What is the difference between real and nominal GDP?

– Real GDP adjusts for inflation, while nominal GDP does not. -

What is the role of interest rates in monetary policy?

– Interest rates influence borrowing and spending decisions, affecting economic growth and inflation. -

How does the balance of payments affect a country’s economy?

– It provides insights into foreign exchange inflows and outflows and the health of a nation’s external finances. -

What is the importance of the purchasing power parity theory?

– It suggests that exchange rates should adjust to maintain equal purchasing power across countries.

Tables to Assist Your Preparation

Table 1: Demand Elasticity Classifications

| Elasticity Range | Category |

|---|---|

| Ed < 0 | Inelastic |

| 0 < Ed < 1 | Relatively Inelastic |

| Ed = 1 | Unitary Elastic |

| 1 < Ed < Infinity | Relatively Elastic |

| Ed > Infinity | Perfectly Elastic |

Table 2: Market Structures and Pricing Behaviors

| Market Structure | Price Setting |

|---|---|

| Perfect Competition | Price Taker |

| Monopoly | Price Maker |

| Monopolistic Competition | Differentiated Price Setter |

| Oligopoly | Interdependent Price Setter |

Table 3: Monetary and Fiscal Policy Impacts

| Policy | Expansionary | Contractionary |

|---|---|---|

| Monetary | Increase money supply, lower interest rates | Decrease money supply, raise interest rates |

| Fiscal | Increase government spending, decrease taxes | Decrease government spending, increase taxes |

Table 4: International Economic Concepts

| Concept | Definition |

|---|---|

| Balance of Payments | Summary of transactions between a country and foreign entities |

| Exchange Rate | Price of one currency in terms of another |

| Purchasing Power Parity (PPP) | Theory that exchange rates should equalize the cost of goods and services across countries |

| Relative Purchasing Power | Actual purchasing power of a currency compared to another currency |