As a prospective student navigating the complex world of college expenses, understanding your financial aid options is crucial. The WPI Financial Aid Portal serves as a gateway to unlocking your academic and financial empowerment.

Navigating the WPI Financial Aid Portal

The WPI Financial Aid Portal, housed within the myWPI portal, provides a secure and convenient platform for:

- Viewing financial aid awards

- Accepting or declining aid offers

- Managing loans and other forms of debt

- Submitting documentation and updates

- Tracking financial aid progress

Key Features and Benefits

The portal offers a suite of features designed to simplify the financial aid process:

- Award Summary: Get a detailed overview of all awarded financial aid packages, including scholarships, grants, loans, and work-study opportunities.

- Electronic Documents: Submit required documents, such as tax returns and verification forms, electronically for faster processing.

- Notifications and Deadlines: Stay informed about important deadlines and updates related to your financial aid status.

- Loan Management: Access loan information, make payments, and track repayment progress.

- Support Center: Connect with WPI’s Financial Aid Office for personalized assistance and guidance.

Eligibility and Requirements

To access the WPI Financial Aid Portal, you must be enrolled or applying to Worcester Polytechnic Institute (WPI). Students are encouraged to submit their Free Application for Federal Student Aid (FAFSA) by the March 1st priority deadline.

Common Mistakes to Avoid

Navigating the financial aid process can be daunting, but avoiding these common pitfalls can ensure a smoother experience:

- Missing Deadlines: Failure to submit required documents or meet deadlines can delay or jeopardize your aid eligibility.

- Incomplete Applications: Ensure you have provided all necessary information on your FAFSA and other financial aid forms.

- Overstating Income or Assets: Accurately report your financial information to avoid potential overawards or fraud investigations.

- Ignoring Financial Aid Notices: Pay attention to correspondence from WPI’s Financial Aid Office, as it contains important information and updates.

- Not Exploring All Aid Options: Don’t limit yourself to federal or institutional aid. Research scholarships, grants, and work-study programs that may supplement your financial package.

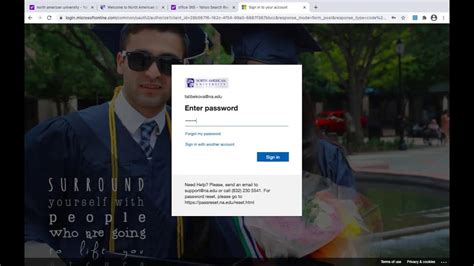

Accessing your financial aid information is easy with this step-by-step guide:

- Log in to the myWPI Portal: Enter your WPI username and password.

- Select the “Financial Aid” Tab: Click on the “Financial Aid” tab from the portal menu.

- Access the Financial Aid Portal: Click on the “Financial Aid Portal” link.

- Review and Accept Awards: Review your financial aid awards and accept or decline them as desired.

- Submit Required Documents: Upload any required documentation electronically through the portal.

- Track Your Progress: Monitor your financial aid status and track your loan repayment progress.

Financial Aid Statistics at WPI

According to the WPI Financial Aid Office, over $240 million in financial aid was awarded to undergraduate students in the 2021-2022 academic year. The average financial aid package for incoming freshmen was over $50,000.

Effective Strategies for Maximizing Financial Aid

- Start Early: Submit your FAFSA as soon as possible after October 1st.

- Maintain Good Grades: High academic performance can qualify you for scholarships and grants.

- Explore All Options: Research external scholarships, grants, and work-study programs.

- Appeal if Necessary: If you believe your financial aid award is insufficient, you can appeal to the Financial Aid Office.

- Utilize Financial Counseling: WPI’s Financial Aid Office provides free financial counseling services to help you understand your options and make informed decisions.

Integrating the WPI Financial Aid Portal with other university systems could create transformative opportunities for students.

- Integrated Budget Tool: Allow students to connect their financial aid information to a budgeting tool for personalized financial planning.

- AI-Powered Scholarship Matching: Leverage machine learning to match students with scholarships and grants based on their unique background and qualifications.

- Streamlined Loan Repayment: Automate loan repayment processes through secure integrations with banks and loan servicers.

- Virtual Financial Aid Advising: Offer virtual financial aid appointments for students who are unable to visit the office in person.

Conclusion

The WPI Financial Aid Portal empowers students with the tools and information they need to navigate the complexities of college expenses. By leveraging the portal’s features, avoiding common pitfalls, and exploring innovative applications, students can unlock their financial potential and achieve their academic and career aspirations.

Table 1: Financial Aid Award Statistics

| Award Type | Percentage of Students Receiving | Average Award Amount |

|---|---|---|

| Grants | 76% | $15,000 |

| Scholarships | 55% | $12,000 |

| Loans | 35% | $8,000 |

| Work-Study | 20% | $5,000 |

Table 2: Financial Aid Deadlines

| Deadline | Description |

|---|---|

| March 1st | Priority deadline for FAFSA submission |

| May 1st | Deadline for CSS Profile submission (for international students only) |

| July 1st | Deadline for submitting all required financial aid documents |

Table 3: Common Financial Aid Mistakes

| Mistake | Consequences |

|---|---|

| Missing deadlines | Delayed or jeopardized aid eligibility |

| Incomplete applications | Overawards or fraud investigations |

| Overstating income or assets | Potential for aid reduction or ineligibility |

| Ignoring financial aid notices | Important updates and information missed |

| Not exploring all aid options | Reduced financial assistance received |

Table 4: Effective Financial Aid Strategies

| Strategy | Benefits |

|---|---|

| Start early | Improved chances of receiving higher awards |

| Maintain good grades | Eligibility for merit scholarships and grants |

| Explore all options | Increased financial aid options and reduced out-of-pocket expenses |

| Appeal if necessary | Potential for increased aid awards |

| Utilize financial counseling | Personalized guidance and informed decision-making |