The Free Application for Federal Student Aid (FAFSA) is a form that all students who want to receive federal student aid must complete. The FAFSA collects information about your income, assets, and other financial information. This information is used to determine your eligibility for federal student aid, including grants, loans, and work-study programs.

What tax year is used for the FAFSA?

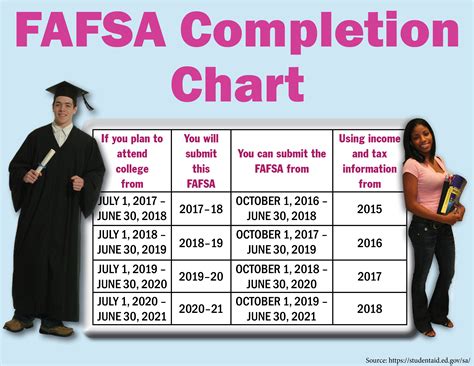

The FAFSA uses the tax year that is two years prior to the academic year for which you are applying for aid. For example, if you are applying for aid for the 2023-2024 academic year, you will need to use your 2021 tax information.

Why is the FAFSA using a prior-prior year tax return?

The primary reason for this is that the FAFSA uses your prior-prior year tax return to estimate your current year income and assets. This information is then compared to the income and asset limits to determine your eligibility for aid. Using the prior-prior year tax return allows the FAFSA to get a more accurate picture of your financial situation. This is because your current year income and assets may not be representative of your financial situation in the year for which you are applying for aid.

What if I haven’t filed my taxes yet?

If you haven’t filed your taxes yet, you can still complete the FAFSA. You will need to estimate your income and assets for the prior-prior year. You can use your pay stubs, bank statements, and other financial documents to help you estimate your income and assets.

What if my financial situation has changed since I filed my taxes?

If your financial situation has changed since you filed your taxes, you can contact the financial aid office at the school you are applying to. They may be able to help you adjust your FAFSA to reflect your current financial situation.

How to Determine Your FAFSA Tax Year

The FAFSA tax year is the tax year that is two years prior to the academic year for which you are applying for aid. To determine your FAFSA tax year, follow these steps:

- Identify the academic year for which you are applying for aid. The academic year begins on July 1 and ends on June 30.

- Subtract two years from the academic year. This will give you the tax year that you need to use for the FAFSA.

For example, if you are applying for aid for the 2023-2024 academic year, your FAFSA tax year will be 2021.

Special Circumstances

There are some special circumstances that may affect your FAFSA tax year. These include:

- You are a dependent student. If you are a dependent student, your FAFSA tax year will be the same as your parents’ FAFSA tax year.

- You are a married student. If you are a married student, your FAFSA tax year will be the same as your spouse’s FAFSA tax year.

- You are a widow(er). If you are a widow(er), your FAFSA tax year will be the same as your deceased spouse’s FAFSA tax year.

Filing Your Taxes

You can file your taxes online, by mail, or through a tax preparer. If you file your taxes online, you can use the IRS Free File program. This program allows you to file your taxes for free using software that is provided by the IRS. You can also file your taxes by mail by completing the paper tax forms. If you need help filing your taxes, you can contact a tax preparer.

Filing Deadline

The deadline to file your taxes is April 15th. However, if you file your taxes electronically, you have until October 15th to file your taxes.

Help with the FAFSA

If you need help completing the FAFSA, you can contact the Federal Student Aid Information Center. The Federal Student Aid Information Center can be reached at 1-800-433-3243.

Additional Resources

FAQs

1. What is the FAFSA?

The FAFSA is the Free Application for Federal Student Aid. It is a form that all students who want to receive federal student aid must complete.

2. What tax year is used for the FAFSA?

The FAFSA uses the tax year that is two years prior to the academic year for which you are applying for aid.

3. Why is the FAFSA using a prior-prior year tax return?

The FAFSA uses your prior-prior year tax return to estimate your current year income and assets. This information is then compared to the income and asset limits to determine your eligibility for aid. Using the prior-prior year tax return allows the FAFSA to get a more accurate picture of your financial situation.

4. What if I haven’t filed my taxes yet?

If you haven’t filed your taxes yet, you can still complete the FAFSA. You will need to estimate your income and assets for the prior-prior year. You can use your pay stubs, bank statements, and other financial documents to help you estimate your income and assets.

5. What if my financial situation has changed since I filed my taxes?

If your financial situation has changed since you filed your taxes, you can contact the financial aid office at the school you are applying to. They may be able to help you adjust your FAFSA to reflect your current financial situation.

6. How do I determine my FAFSA tax year?

To determine your FAFSA tax year, follow these steps:

- Identify the academic year for which you are applying for aid. The academic year begins on July 1 and ends on June 30.

- Subtract two years from the academic year. This will give you the tax year that you need to use for the FAFSA.

7. What is the filing deadline for taxes?

The deadline to file your taxes is April 15th. However, if you file your taxes electronically, you have until October 15th to file your taxes.

8. How long does the FAFSA take to process?

The FAFSA takes about 3 to 5 weeks to process.