Are you an employee or prospective employee of the prestigious University of Michigan (UMich)? Staying informed about your payroll schedule is crucial for effective financial planning. This comprehensive guide will furnish you with an up-to-date UMich payroll calendar, empowering you to manage your finances with confidence.

UMich Payroll Schedule

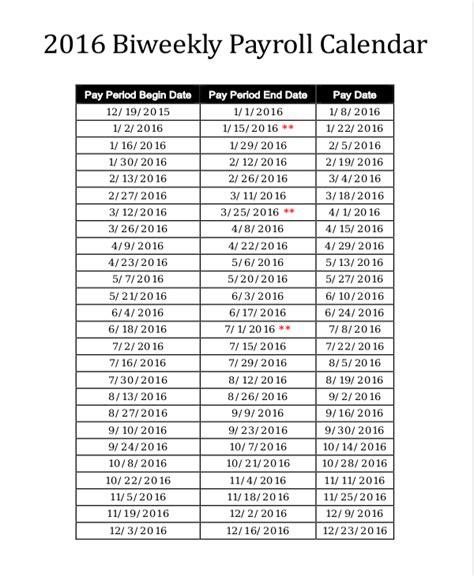

Bi-weekly Payroll Schedule

UMich follows a bi-weekly payroll schedule for most of its employees. This means that employees are paid every other Friday. The payroll processing cut-off time is typically on the Wednesday prior to the payday.

Payroll Calendar 2023

| Pay Date | Reporting Period |

|---|---|

| January 20 | December 25, 2022 – January 7, 2023 |

| February 3 | January 8 – January 21, 2023 |

| February 17 | January 22 – February 4, 2023 |

| March 3 | February 5 – February 18, 2023 |

| March 17 | February 19 – March 4, 2023 |

| March 31 | March 5 – March 18, 2023 |

| April 14 | March 19 – April 1, 2023 |

| April 28 | April 2 – April 15, 2023 |

| May 12 | April 16 – April 29, 2023 |

| May 26 | April 30 – May 13, 2023 |

| June 9 | May 14 – May 27, 2023 |

| June 23 | May 28 – June 10, 2023 |

| July 7 | June 11 – June 24, 2023 |

| July 21 | June 25 – July 8, 2023 |

| August 4 | July 9 – July 22, 2023 |

| August 18 | July 23 – August 5, 2023 |

| September 1 | August 6 – August 19, 2023 |

| September 15 | August 20 – September 2, 2023 |

| September 29 | September 3 – September 16, 2023 |

| October 13 | September 17 – September 30, 2023 |

| October 27 | October 1 – October 14, 2023 |

| November 10 | October 15 – October 28, 2023 |

| November 24 | October 29 – November 11, 2023 |

| December 8 | November 12 – November 25, 2023 |

| December 22 | November 26 – December 9, 2023 |

Payroll Holidays

UMich observes the following holidays, which impact the payroll schedule:

- New Year’s Day

- Martin Luther King Jr. Day

- Memorial Day

- Independence Day

- Labor Day

- Thanksgiving Day

- Christmas Day

Tips and Tricks

- Enroll in direct deposit: Get your paycheck deposited directly into your bank account for convenience and security.

- Adjust your withholding: Review your withholding allowances to ensure you are paying the correct amount of taxes.

- Monitor your pay stubs: Carefully check your pay stubs for accuracy and to identify any deductions or withholdings.

- Utilize employee self-service: Access your payroll information, pay stubs, and other HR-related details through the employee self-service portal.

Common Mistakes to Avoid

- Missing the cut-off time: Submit your timesheets or any other necessary payroll documents by the designated cut-off time to avoid delays in receiving your paycheck.

- Not reporting changes: Inform the payroll department promptly of any changes in your personal information, such as address or banking details.

- Incorrect withholding: Failing to adjust your withholding allowances can result in over or underpayment of taxes.

- Ignoring pay stubs: Neglecting to review your pay stubs can lead to missed deductions or errors going unnoticed.

FAQs

1. When will I receive my first paycheck after starting at UMich?

Your first paycheck will typically be issued on the first payday following the completion of your first pay period.

2. How can I view my pay stubs and other payroll information?

You can access your payroll information through the employee self-service portal.

3. What is the deadline for submitting my timesheet?

The timesheet submission deadline is typically the Wednesday prior to the payday.

4. How do I update my personal information?

Notify the payroll department or HR to update your personal information, such as address or banking details.

5. Who can I contact for payroll-related questions?

The payroll department or HR can assist you with any payroll inquiries.

6. What is the UMich employee self-service portal?

The employee self-service portal is an online platform where employees can access their payroll information, pay stubs, and other HR-related details.

7. What is a withholding allowance?

A withholding allowance is a deduction from your paycheck before taxes are calculated. It reduces the amount of taxes withheld from each paycheck.

8. How do I enroll in direct deposit?

Complete the direct deposit enrollment form and submit it to the payroll department or HR.