Savings bonds are a type of investment that is backed by the government. They are typically purchased at a discount and then redeemed at maturity for their face value. 529 plans are investment accounts that are designed to help families save for college costs. They offer tax-free growth and the ability to withdraw funds tax-free if they are used for qualified education expenses.

Can savings bonds be transferred to 529 plans?

Yes, savings bonds can be transferred to 529 plans. However, there are some important things to keep in mind.

- Not all savings bonds can be transferred. Only Series EE and I savings bonds can be transferred to 529 plans.

- There is a minimum transfer amount. The minimum transfer amount is $500.

- You can only transfer savings bonds that are in your name. If the savings bonds are in the name of a minor, you will need to have them transferred to your name before you can transfer them to a 529 plan.

- There may be fees associated with the transfer. The fees vary depending on the financial institution that you use.

Is it a good idea to transfer savings bonds to a 529 plan?

Whether or not it is a good idea to transfer savings bonds to a 529 plan depends on your individual circumstances. Here are some factors to consider:

- The interest rate on the savings bonds. If the interest rate on the savings bonds is higher than the interest rate on the 529 plan, you may want to keep the savings bonds.

- The fees associated with the transfer. If the fees associated with the transfer are high, it may not be worth it to transfer the savings bonds.

- Your investment goals. If you are saving for college costs, a 529 plan may be a better option than savings bonds. 529 plans offer tax-free growth and the ability to withdraw funds tax-free if they are used for qualified education expenses.

How to transfer savings bonds to a 529 plan

If you decide that you want to transfer savings bonds to a 529 plan, you can do so by following these steps:

- Contact the financial institution where your savings bonds are held.

- Request a transfer form.

- Fill out the transfer form and submit it to the financial institution.

- The financial institution will transfer the savings bonds to the 529 plan.

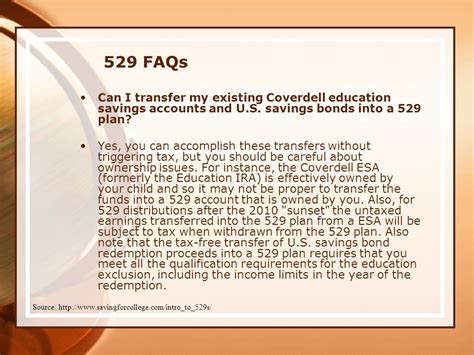

FAQs

- Can I transfer savings bonds to a 529 plan in someone else’s name?

You can only transfer savings bonds that are in your name to a 529 plan. If you want to transfer savings bonds that are in someone else’s name, you will need to have them transferred to your name before you can transfer them to a 529 plan.

- Are there any tax consequences to transferring savings bonds to a 529 plan?

There are no tax consequences to transferring savings bonds to a 529 plan. The bonds will continue to grow tax-free, and you will not have to pay taxes on the earnings when you withdraw them for qualified education expenses.

- What happens if I transfer savings bonds to a 529 plan and then withdraw the funds for non-qualified expenses?

If you transfer savings bonds to a 529 plan and then withdraw the funds for non-qualified expenses, you will have to pay income tax on the earnings. You may also have to pay a 10% penalty.

Conclusion

Savings bonds can be a valuable investment tool for families saving for college costs. If you are considering transferring savings bonds to a 529 plan, be sure to weigh the pros and cons carefully.