Overview

Clark Atlanta University (CAU) is a Historically Black College and University (HBCU) located in Atlanta, Georgia. CAU offers undergraduate and graduate programs in a variety of disciplines, including business, education, health sciences, and liberal arts. The university is committed to providing affordable access to higher education for students of all backgrounds.

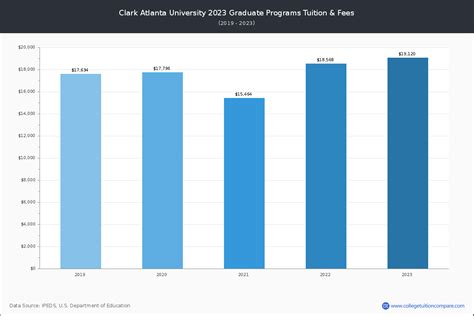

Tuition and Fees for the 2023-2024 Academic Year

The following table outlines the tuition and fees for the 2023-2024 academic year at Clark Atlanta University:

| Category | Tuition | Fees |

|---|---|---|

| Undergraduate In-State | $13,020 | $4,390 |

| Undergraduate Out-of-State | $19,530 | $4,390 |

| Graduate In-State | $12,550 | $4,638 |

| Graduate Out-of-State | $18,915 | $4,638 |

Financial Aid Opportunities

CAU offers a variety of financial aid options to help students pay for their education. These options include:

- Scholarships: CAU offers a number of merit-based and need-based scholarships to students.

- Grants: CAU offers a number of grants to students who demonstrate financial need.

- Loans: CAU offers a variety of student loans to help students pay for their education.

- Work-Study: CAU offers work-study programs that allow students to earn money while they attend school.

Estimated Total Cost of Attendance

The total cost of attendance at CAU varies depending on the student’s residency status, academic program, and other factors. The following table provides an estimate of the total cost of attendance for the 2023-2024 academic year:

| Category | Estimated Cost |

|---|---|

| Undergraduate In-State | $21,780 |

| Undergraduate Out-of-State | $28,300 |

| Graduate In-State | $21,458 |

| Graduate Out-of-State | $27,823 |

Payment Plans

CAU offers a variety of payment plans to help students manage the cost of their education. These plans include:

- Monthly payment plan: This plan allows students to pay their tuition and fees in monthly installments.

- Quarterly payment plan: This plan allows students to pay their tuition and fees in quarterly installments.

- Semester payment plan: This plan allows students to pay their tuition and fees in two installments, one at the beginning of each semester.

Tips for Paying for College

The following tips can help students pay for college:

- Apply for financial aid: Complete the Free Application for Federal Student Aid (FAFSA) to determine your eligibility for financial aid.

- Explore scholarships: Research scholarships that you may be eligible for and apply.

- Get a job: Work part-time while you attend school to help pay for your expenses.

- Borrow responsibly: If you need to borrow money to pay for college, make sure you understand the terms of your loan and only borrow what you need.

- Create a budget: Track your income and expenses to make sure you are staying on track financially.

Why Tuition Matters

The cost of college can be a major concern for students and their families. However, it is important to remember that the investment you make in your education will pay off in the long run. Studies have shown that college graduates earn more money and have better job opportunities than those with only a high school diploma.

How to Lower the Cost of College

There are a number of ways to reduce the cost of college, including:

- Attend a community college: Community colleges offer lower tuition rates than four-year universities.

- Transfer to a four-year university: Once you have completed your associate’s degree at a community college, you can transfer to a four-year university to complete your bachelor’s degree.

- Take advantage of financial aid: Apply for financial aid to help pay for your education.

- Get a part-time job: Work part-time while you attend school to help pay for your expenses.

- Negotiate with your school: Contact your school’s financial aid office to see if you can negotiate a lower tuition rate.

Conclusion

Paying for college can be a challenge, but it is an investment in your future. CAU offers a variety of financial aid options to help students of all backgrounds afford a college education. By exploring the financial aid options available and following the tips outlined in this guide, you can make college more affordable.

Appendices

Table 1: Tuition and Fees for the 2023-2024 Academic Year

| Category | Tuition | Fees |

|---|---|---|

| Undergraduate In-State | $13,020 | $4,390 |

| Undergraduate Out-of-State | $19,530 | $4,390 |

| Graduate In-State | $12,550 | $4,638 |

| Graduate Out-of-State | $18,915 | $4,638 |

Table 2: Estimated Total Cost of Attendance for the 2023-2024 Academic Year

| Category | Estimated Cost |

|---|---|

| Undergraduate In-State | $21,780 |

| Undergraduate Out-of-State | $28,300 |

| Graduate In-State | $21,458 |

| Graduate Out-of-State | $27,823 |

Table 3: Financial Aid Options at CAU

| Type of Aid | Description |

|---|---|

| Scholarships | Merit-based and need-based scholarships awarded to students. |

| Grants | Grants awarded to students who demonstrate financial need. |

| Loans | Loans that students can borrow to help pay for their education. |

| Work-Study | Programs that allow students to earn money while they attend school. |

Table 4: Payment Plans at CAU

| Type of Plan | Description |

|---|---|

| Monthly payment plan | Allows students to pay their tuition and fees in monthly installments. |

| Quarterly payment plan | Allows students to pay their tuition and fees in quarterly installments. |

| Semester payment plan | Allows students to pay their tuition and fees in two installments, one at the beginning of each semester. |

Tips for Paying for College

- Apply for financial aid: Complete the Free Application for Federal Student Aid (FAFSA) to determine your eligibility for financial aid.

- Explore scholarships: Research scholarships that you may be eligible for and apply.

- Get a job: Work part-time while you attend school to help pay for your expenses.

- Borrow responsibly: If you need to borrow money to pay for college, make sure you understand the terms of your loan and only borrow what you need.

- Create a budget: Track your income and expenses to make sure you are staying on track financially.

Why Tuition Matters

The cost of college can be a major concern for students and their families. However, it is important to remember that the investment you make in your education will pay off in the long run. Studies have shown that college graduates earn more money and have better job opportunities than those with only a high school diploma.

How to Lower the Cost of College

There are a number of ways to reduce the cost of college, including:

- Attend a community college: Community colleges offer lower tuition rates than four-year universities.

- Transfer to a four-year university: Once you have completed your associate’s degree at a community college, you can transfer to a four-year university to complete your bachelor’s degree.

- Take advantage of financial aid: Apply for financial aid to help pay for your education.

- Get a part-time job: Work part-time while you attend school to help pay for your expenses.

- Negotiate with your school: Contact your school’s financial aid office to see if you can negotiate a lower tuition rate.