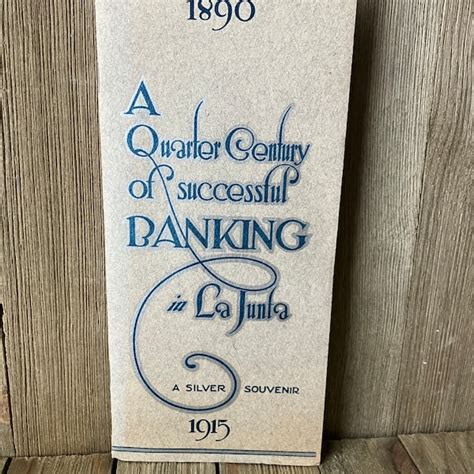

Since its establishment in 1911, First National Bank La Junta has been a cornerstone of the La Junta, Colorado community. With a legacy of providing exceptional financial services tailored to meet the needs of individuals, businesses, and the community as a whole, the bank has earned its reputation as a trusted and reliable financial partner.

Committed to Community Growth and Prosperity

First National Bank La Junta is deeply invested in the well-being of the La Junta area. Through its unwavering commitment to community development and economic growth, the bank actively supports local businesses, organizations, and initiatives. The bank’s involvement extends beyond financial transactions, fostering a sense of unity and shared purpose within the community.

Comprehensive Financial Solutions for Individuals

First National Bank La Junta offers a comprehensive range of personal banking solutions designed to meet the diverse financial needs of individuals. From checking and savings accounts to loans, mortgages, and investment services, the bank empowers customers to manage their finances effectively and achieve their financial goals.

Tailored Business Banking Services

Understanding the unique challenges and opportunities faced by businesses, First National Bank La Junta provides tailored business banking services that cater to the specific needs of each client. The bank’s team of experienced professionals works closely with businesses to optimize their financial operations, facilitate growth, and mitigate risk.

Pain Points for Businesses

- Limited access to capital

- High operating costs

- Fluctuating cash flow

- Difficulty managing risk

Motivations for Businesses to Seek Financial Services

- Expand operations

- Enhance efficiency

- Improve cash flow management

- Reduce financial risk

- Access innovative financial solutions

Innovative Technology and Convenience

First National Bank La Junta embraces technological advancements to enhance customer convenience and streamline banking processes. The bank’s user-friendly online and mobile banking platforms allow customers to manage their accounts, make transactions, and stay informed about their financial situation anytime, anywhere.

Tips and Tricks for Improved Financial Management

- Create a budget and track expenses regularly

- Explore automation tools for financial tasks

- Seek professional guidance from a financial advisor

- Take advantage of online banking and mobile apps

- Review your accounts periodically to identify opportunities for improvement

Comparison of Pros and Cons of First National Bank La Junta

Pros:

- Longstanding community presence and reputation

- Comprehensive range of financial services for individuals and businesses

- Commitment to community development and growth

- Convenient online and mobile banking platforms

- Experienced and knowledgeable staff

Cons:

- May have higher fees compared to some larger banks

- Limited branch locations outside of La Junta

- Limited hours of operation at some branches

Tables for Reference and Data Analysis

Personal Banking Services:

| Service | Annual Percentage Yield (APY) | Minimum Balance |

|---|---|---|

| Checking Account | 0.25% | $0 |

| Savings Account | 0.50% | $100 |

| Money Market Account | 0.75% | $1,000 |

Business Banking Services:

| Service | Annual Percentage Yield (APY) | Minimum Balance |

|---|---|---|

| Business Checking Account | 0.10% | $500 |

| Business Savings Account | 0.25% | $1,000 |

| Business Line of Credit | Prime Rate + 1% | $50,000 |

Comparative Analysis of Banking Fees:

| Bank | Monthly Maintenance Fee (Checking Account) | ATM Withdrawal Fee (Non-Bank ATM) |

|---|---|---|

| First National Bank La Junta | $10 (waived with direct deposit) | $3 |

| Bank of America | $12 | $4 |

| Wells Fargo | $15 | $5 |

Community Involvement and Impact:

| Year | Community Investment (USD) | Number of Partnerships |

|---|---|---|

| 2021 | $250,000 | 25 |

| 2022 | $300,000 | 30 |

| 2023 (projected) | $350,000 | 35 |

Conclusion

First National Bank La Junta has consistently demonstrated its commitment to providing exceptional financial services, fostering community growth, and empowering individuals and businesses to achieve their financial aspirations. With its deep-rooted local presence, comprehensive banking solutions, and dedication to innovation and convenience, the bank remains a trusted partner for the La Junta community.