Introduction

In today’s competitive job market, a well-crafted resume is essential for landing your dream role as a Senior Financial Analyst. This guide will provide you with the insights, strategies, and examples you need to create a resume that stands out from the crowd and showcases your skills and experience effectively.

Section 1: Content Essentials

1. Contact Information:

- Include your full name, professional email address, LinkedIn profile URL, and phone number prominently at the top of your resume.

2. Education:

- List your highest degree, including the institution, year of graduation, and GPA (if it’s above 3.5).

- Include any relevant certifications, such as the Chartered Financial Analyst (CFA) or Certified Public Accountant (CPA).

3. Skills:

- Highlight your core financial analysis skills, such as:

- Financial modeling and forecasting

- Data analysis and interpretation

- Investment research and valuation

- Risk management

- Project and portfolio management

4. Experience:

- Describe your relevant professional experience in reverse chronological order.

- Quantify your accomplishments whenever possible, using specific metrics and figures.

- Use action verbs that begin with a strong verb.

- Emphasize your contributions to the financial performance of your organization.

Section 2: Crafting a Powerful Resume

1. Choose the Right Format:

- Use a clean and professional resume format that is easy to read.

- Consider using a chronological format if you have a strong work history.

- A functional resume can be beneficial if you have gaps in employment or are looking to transition careers.

2. Write a Compelling Career Summary:

- Summarize your key skills, experience, and career goals in a concise and engaging paragraph.

- Keep it brief, around 3-4 sentences.

3. Use Keywords:

- Research job descriptions for Senior Financial Analyst roles and include relevant keywords in your resume.

- This will help your resume get noticed by applicant tracking systems (ATS).

4. Proofread Carefully:

- Take your time to proofread your resume for any errors in grammar, spelling, or formatting.

- Ask a friend or professional resume writer to review your resume before submitting it.

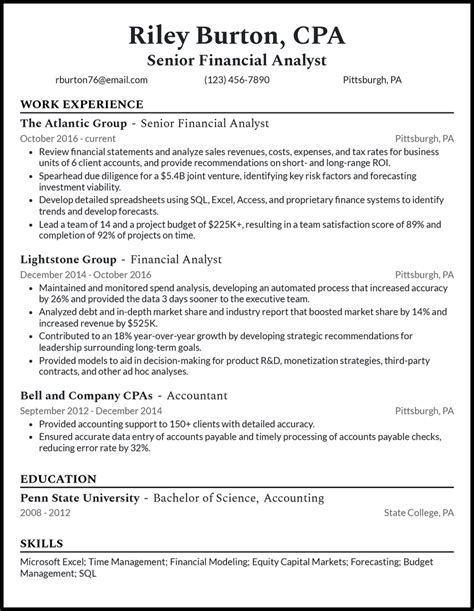

Section 3: Sample Resume

Jane Doe

123 Main Street | Anytown, CA 12345

(555) 123-4567 | [email protected] | LinkedIn.com/in/janedoe

Career Summary

Seasoned Senior Financial Analyst with 10+ years of experience in financial modeling, forecasting, investment research, and portfolio management. Proven track record of driving financial performance and optimizing investment portfolios. Seeking a challenging role where I can leverage my expertise to create value for organizations.

Skills

- Financial Modeling and Forecasting

- Data Analysis and Interpretation

- Investment Research and Valuation

- Risk Management

- Project and Portfolio Management

- Excel, PowerPoint, SQL, Python

Experience

Senior Financial Analyst | ABC Corporation | 2015 – 2022

- Forecasted financial performance and developed financial models for various business units.

- Analyzed and interpreted financial data to identify trends and opportunities.

- Researched and valued investment opportunities, resulting in a 15% increase in portfolio returns.

- Managed a portfolio of $500 million in assets, achieving a 10% annualized return.

Financial Analyst | XYZ Company | 2012 – 2015

- Assisted in the development and analysis of financial plans and budgets.

- Conducted market research and due diligence for potential investments.

- Supported the implementation of new financial software and systems.

Education

MBA in Finance | University of California, Berkeley | 2011

GPA: 3.8

BA in Economics | University of Southern California | 2009

GPA: 3.6

Certifications

- Chartered Financial Analyst (CFA)

- Certified Public Accountant (CPA)

Section 4: Frequently Asked Questions

1. How long should my resume be?

- Keep your resume to around 1-2 pages for entry-level positions and 2-3 pages for more experienced professionals.

2. Should I include a photo on my resume?

- It is not necessary to include a photo on your resume unless specifically requested by the employer.

3. What is the best way to format my resume?

- Choose a font that is easy to read, such as Times New Roman, Arial, or Calibri.

- Use a font size of 11-12 points.

- Set your margins to 1 inch on all sides.

4. How can I make my resume stand out?

- Use strong action verbs and quantify your accomplishments.

- Highlight your relevant skills and experience.

- Tailor your resume to each specific job application.

5. What should I do if I have gaps in my employment history?

- If you have gaps in your employment history, explain them briefly and positively in your resume.

- This could include pursuing further education, taking care of family responsibilities, or starting your own business.

6. How can I get feedback on my resume?

- Ask a friend, family member, or professional resume writer to review your resume and provide feedback.

- You can also use online resume writing services to get feedback from professionals.

7. Should I include my hobbies and interests on my resume?

- Include your hobbies and interests only if they are relevant to the role you are applying for.

- For example, if you are applying for a role in finance, you could include your interest in investing or financial markets.

8. What are some mistakes to avoid when writing my resume?

- Avoid using passive language or clichés.

- Don’t lie or exaggerate your experience.

- Proofread your resume carefully for errors.

Conclusion

Creating a compelling resume for a Senior Financial Analyst role requires careful planning, attention to detail, and a deep understanding of the industry. By following the strategies outlined in this guide, you can effectively showcase your skills, experience, and aspirations, and increase your chances of landing your dream job. Remember to tailor your resume to each specific job application and seek feedback from professionals to ensure that your resume stands out from the crowd.