Special Economic Zones: Definition and Key Concepts

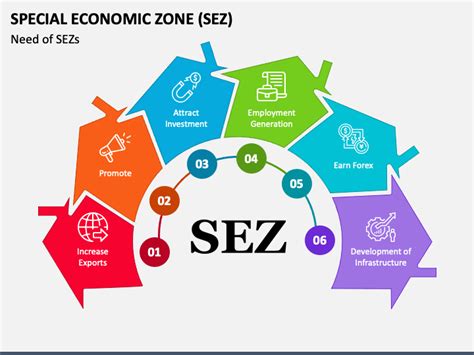

Special Economic Zones (SEZs) are designated areas within a country that offer distinct economic regulations and incentives to businesses and investors. They aim to stimulate economic growth, attract foreign investment, and foster innovation by providing favorable conditions for business operations.

SEZs typically share the following characteristics:

- Reduced taxes and duties: Lower import and export tariffs, tax breaks, and other incentives to attract investment.

- Simplified regulations: Streamlined licensing processes, less bureaucratic hurdles, and expedited customs clearance.

- Improved infrastructure: Investment in transportation, energy, and communication networks to enhance the business environment.

- Investment incentives: Specific schemes and subsidies to attract foreign direct investment (FDI).

- Targeted industries: Focusing on specific sectors such as manufacturing, technology, tourism, or services to promote economic diversification.

SEZs can be classified based on their primary focus:

| Type | Description |

|---|---|

| Export Processing Zones (EPZs) | Dedicated areas for manufacturing and processing goods primarily for export. |

| Industrial Parks | Zones designed to promote specific industries and attract businesses involved in R&D, manufacturing, and distribution. |

| Free Trade Zones (FTZs) | Areas where goods can be imported, stored, and re-exported duty-free, facilitating international trade. |

| Special Economic and Technological Development Zones (SETDZs) | Comprehensive zones that combine industrial parks, universities, research institutions, and other economic activities. |

SEZs offer several potential benefits:

- Economic growth: Attract investment, create jobs, and stimulate economic activity.

- Foreign direct investment (FDI): Provide an attractive destination for international businesses seeking favorable investment conditions.

- Export expansion: Enhance a country’s export capabilities by providing dedicated zones for manufacturing and processing.

- Technological transfer: Facilitate the sharing of knowledge and technology from foreign investors.

- Job creation: Generate employment opportunities in targeted industries.

While SEZs can provide significant benefits, they also have potential drawbacks:

- Environmental concerns: Can lead to pollution and environmental degradation if not managed sustainably.

- Labor exploitation: Possibility of unfair labor practices and exploitation of workers in some SEZs.

- Income inequality: Benefits may not be widely distributed, potentially exacerbating economic disparities.

- Loss of sovereignty: Some critics argue that SEZs may undermine a country’s sovereignty by granting special privileges to foreign investors.

- Displacement of local communities: Development of SEZs can displace local communities, especially in rural areas.

According to the World Bank, there are over 5,000 SEZs worldwide. China has the largest number of SEZs, with over 2,000. Other significant SEZs include the Shenzhen Special Economic Zone in China, the Dubai Airport Free Zone in the United Arab Emirates, and the Singapore Changi Airport Free Trade Zone.

Studies have shown that SEZs can have a positive impact on economic growth and FDI. A World Bank report found that SEZs in developing countries contributed to an average 2.5% increase in national GDP.

SEZs continue to evolve, with newer concepts emerging to address contemporary economic challenges. Some future applications include:

- Sustainable SEZs: Focus on environmental sustainability and social responsibility.

- Digital SEZs: Cater to the growth of digital industries and e-commerce.

- Innovation SEZs: Promote research and development, fostering innovation and technological advancements.

Table 1: Global Distribution of SEZs

| Region | Number of SEZs |

|---|---|

| Asia | 3,015 |

| Africa | 1,652 |

| Latin America and the Caribbean | 628 |

| Europe | 374 |

| North America | 189 |

Table 2: SEZs’ Contribution to National GDP

| Country | Average GDP Increase |

|---|---|

| China | 2.8% |

| India | 1.7% |

| Vietnam | 2.3% |

| Mexico | 2.0% |

| Brazil | 1.5% |

Table 3: Benefits of SEZs

| Benefit | Description |

|---|---|

| Economic growth | Attract investment, create jobs, and stimulate economic activity. |

| Foreign direct investment (FDI) | Provide an attractive destination for international businesses seeking favorable investment conditions. |

| Export expansion | Enhance a country’s export capabilities by providing dedicated zones for manufacturing and processing. |

| Technological transfer | Facilitate the sharing of knowledge and technology from foreign investors. |

| Job creation | Generate employment opportunities in targeted industries. |

Table 4: Drawbacks of SEZs

| Drawback | Description |

|---|---|

| Environmental concerns | Can lead to pollution and environmental degradation if not managed sustainably. |

| Labor exploitation | Possibility of unfair labor practices and exploitation of workers in some SEZs. |

| Income inequality | Benefits may not be widely distributed, potentially exacerbating economic disparities. |

| Loss of sovereignty | Some critics argue that SEZs may undermine a country’s sovereignty by granting special privileges to foreign investors. |

| Displacement of local communities | Development of SEZs can displace local communities, especially in rural areas. |

- Carefully evaluate potential benefits and drawbacks before establishing SEZs.

- Engage with local communities and address their concerns.

- Implement strong environmental regulations and labor standards.

- Create mechanisms for sharing the benefits of SEZs with the broader economy.

- Use SEZs strategically to complement national economic development plans.