Embarking on a higher education journey is a significant investment, and understanding the financial implications is crucial. Northridge University, renowned for its academic excellence and commitment to student success, offers a comprehensive overview of its cost structure to empower prospective students in making informed decisions.

Tuition and Fees: A Breakdown

Northridge University’s tuition and fees vary depending on your program of study, residency status, and other factors. Here’s a detailed breakdown:

Undergraduate Tuition

- California Residents: $8,364 per year

- Out-of-State Residents: $22,704 per year

Graduate Tuition

- Business: $21,312 per year

- Education: $18,960 per year

- Health Sciences: $19,800 per year

University Fees

- Registration Fee: $346 per semester

- Technology Fee: $173 per semester

- Student Health Fee: $113 per semester

Additional Expenses to Consider

Beyond tuition and fees, additional expenses associated with attending Northridge University should be factored into your financial planning. These include:

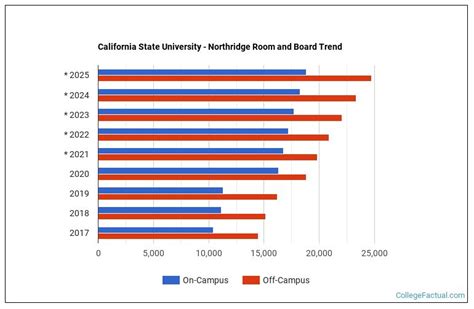

- Housing: On-campus housing options range from $10,000 to $15,000 per academic year. Off-campus housing costs vary depending on location and amenities.

- Dining: Meal plans are available, with costs ranging from $2,000 to $4,000 per academic year. Alternatively, students can cook their own meals or explore various dining options on and off campus.

- Books and Supplies: Textbooks and course materials typically cost between $500 and $1,000 per semester.

- Transportation: Public transportation passes are available for approximately $450 per semester. Students who own vehicles may also incur parking fees.

- Personal Expenses: Clothing, entertainment, and other personal expenses should be allocated accordingly.

Financial Aid: Making Education Accessible

Northridge University is committed to making higher education accessible to deserving students. A variety of financial aid options are available, including:

- Scholarships: Merit-based scholarships are awarded to students with exceptional academic achievement, leadership potential, and financial need.

- Grants: Need-based grants do not require repayment and are awarded based on financial need.

- Loans: Student loans are available to help students cover the cost of tuition, fees, and other expenses.

Common Mistakes to Avoid

- Underestimating the Total Cost: Ensure you thoroughly research all potential expenses and create a realistic budget.

- Ignoring Financial Aid Deadlines: Submit your financial aid applications early to maximize your chances of receiving assistance.

- Borrowing More Than You Can Afford: Carefully consider your financial situation and only borrow what you can reasonably repay.

- Not Exploring Payment Plan Options: Northridge University offers payment plans that can help spread out tuition and fee payments.

- Failing to Budget and Track Expenses: Create a detailed budget and monitor your spending to stay on track financially.

Exploring Your Investment

Investing in higher education is an investment in your future. Northridge University’s cost structure provides a clear understanding of the financial commitment required to pursue your academic goals. By carefully planning, exploring financial aid opportunities, and making informed decisions, you can unlock the doors to a brighter future.

Questions to Ask Yourself

- What is the total cost of my desired program of study, including tuition, fees, and additional expenses?

- Am I eligible for any scholarships or grants based on my academic record and financial need?

- How much student loan debt am I willing and able to take on?

- Are there any payment plan options available to assist with the cost of attendance?

- How can I effectively budget and manage my expenses to ensure financial success during my time at Northridge University?

Tables for Easy Reference

Table 1: Undergraduate Tuition and Fees

| Residency | Annual Tuition |

|---|---|

| California Residents | $8,364 |

| Out-of-State Residents | $22,704 |

Table 2: Graduate Tuition

| Program | Annual Tuition |

|---|---|

| Business | $21,312 |

| Education | $18,960 |

| Health Sciences | $19,800 |

Table 3: University Fees

| Fee | Per Semester |

|---|---|

| Registration Fee | $346 |

| Technology Fee | $173 |

| Student Health Fee | $113 |

Table 4: Estimated Additional Expenses

| Expense | Estimated Cost |

|---|---|

| Housing | $10,000 – $15,000 per year |

| Dining | $2,000 – $4,000 per year |

| Books and Supplies | $500 – $1,000 per semester |

| Transportation | $450 per semester (public transportation pass) |

| Personal Expenses | Varies depending on lifestyle |