Introduction

Palau is a beautiful and independent nation located in the Pacific Ocean. It is known for its pristine beaches, lush rainforests, and vibrant marine life. However, many people are unaware that Palau also has a complex tax system. This article will provide you with information on whether or not you need a Palau ID for tax purposes.

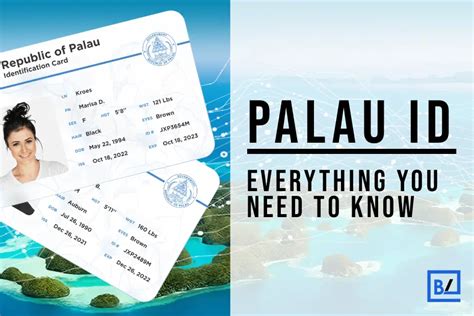

Who Needs a Palau ID?

According to the Palau Revenue Code, all individuals who are engaged in business or employment in Palau must obtain a Palau ID. This includes both citizens and non-citizens. The Palau ID is a unique identification number that is used for tax purposes. It is also used to access government services, such as healthcare and education.

How to Obtain a Palau ID

To obtain a Palau ID, you must file an application with the Palau Revenue Office. The application can be downloaded from the Revenue Office’s website. Once you have completed the application, you must submit it to the Revenue Office along with the following documents:

- A copy of your passport or other government-issued identification

- A copy of your proof of residency

- A fee of $10

The Revenue Office will review your application and issue you a Palau ID number within 30 days.

Using Your Palau ID for Tax Purposes

Once you have obtained a Palau ID, you must use it to file your taxes. You can file your taxes online or by mail. If you file your taxes online, you will need to create an account with the Revenue Office’s website. Once you have created an account, you can file your taxes using the online tax filing system. If you file your taxes by mail, you can download the tax forms from the Revenue Office’s website. Once you have completed the tax forms, you can mail them to the Revenue Office.

Consequences of Not Having a Palau ID

If you are required to obtain a Palau ID but fail to do so, you may be subject to penalties. These penalties can include fines and imprisonment. In addition, you may be unable to access government services, such as healthcare and education.

Conclusion

If you are engaged in business or employment in Palau, you must obtain a Palau ID. The Palau ID is a unique identification number that is used for tax purposes. It is also used to access government services, such as healthcare and education. If you fail to obtain a Palau ID, you may be subject to penalties.

Additional Information

- The Palau Revenue Office website contains a wealth of information on the Palau tax system.

- The Palau Embassy in the United States can also provide you with information on the Palau tax system.

- If you need assistance with your taxes, you can contact a tax professional.

Table 1: Types of Palau IDs

| Type of ID | Issuing Authority | Purpose |

|---|---|---|

| Citizen ID | Palau Immigration Office | Proof of citizenship |

| Non-citizen ID | Palau Immigration Office | Proof of residency |

| Business ID | Palau Revenue Office | Proof of business registration |

| Employment ID | Palau Revenue Office | Proof of employment |

Table 2: Benefits of Having a Palau ID

| Benefit | Description |

|---|---|

| Access to government services | Palau IDs are required to access certain government services, such as healthcare and education. |

| Reduced tax rates | Palau IDs can help you qualify for reduced tax rates on certain types of income. |

| Proof of identity | Palau IDs can be used as proof of identity when conducting business or opening bank accounts. |

| Convenience | Palau IDs are a convenient way to store and carry your personal information. |

Table 3: Penalties for Not Having a Palau ID

| Penalty | Description |

|---|---|

| Fine | Individuals who are required to obtain a Palau ID but fail to do so may be fined up to $1,000. |

| Imprisonment | Individuals who are required to obtain a Palau ID but fail to do so may be imprisoned for up to six months. |

| Denial of government services | Individuals who are required to obtain a Palau ID but fail to do so may be denied access to government services, such as healthcare and education. |

Table 4: How to Obtain a Palau ID

| Step | Description |

|---|---|

| 1. Download the Palau ID application form from the Palau Revenue Office website. | |

| 2. Complete the application form and submit it to the Revenue Office along with the required documents. | |

| 3. Pay the $10 application fee. | |

| 4. The Revenue Office will review your application and issue you a Palau ID number within 30 days. |