Financial aid is essential for many college students to cover the cost of tuition, fees, and living expenses. But what happens when you need financial aid for longer than the traditional four-year undergraduate program?

Federal Student Aid

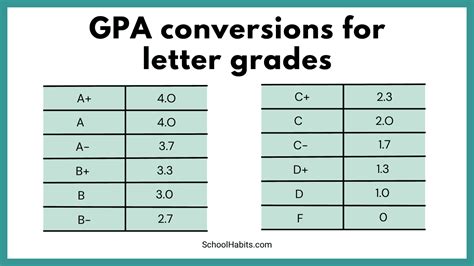

The federal government offers a variety of financial aid programs, including grants, loans, and work-study. The maximum time frame for federal student aid is typically 6 years for an undergraduate program and 8 years for a graduate program. However, there are some exceptions to these limits.

-

Students who have completed a previous degree may be eligible for an additional 2 years of federal student aid to complete a second bachelor’s degree.

-

Students who are enrolled in a teacher preparation program may be eligible for an additional 4 years of federal student aid.

-

Students who are pursuing a doctoral degree may be eligible for an additional 5 years of federal student aid.

State and Institutional Aid

Many states and colleges also offer financial aid programs. The maximum time frame for these programs varies depending on the state or institution. Some states offer financial aid for up to 8 years for an undergraduate program and 10 years for a graduate program.

Private Loans

Private loans are another option for students who need financial aid for longer than the traditional time frame. Private loans are not subject to the same time limits as federal student loans, but they typically have higher interest rates.

Repaying Your Loans

If you borrow student loans, it is important to start repaying them as soon as possible. The longer you wait to repay your loans, the more interest you will owe. There are a number of different repayment plans available, so you should choose one that fits your budget and your financial goals.

Making the Most of Financial Aid

There are a number of things you can do to make the most of financial aid.

-

Apply for financial aid early. The earlier you apply for financial aid, the more likely you are to receive it.

-

File your FAFSA (Free Application for Federal Student Aid). The FAFSA is the first step to applying for federal student aid.

-

Consider all of your options. There are a variety of financial aid programs available, so you should explore all of your options before making a decision.

-

Be careful with private loans. Private loans can be a helpful way to cover the cost of college, but they typically have higher interest rates than federal student loans.

Additional Resources

Step-by-Step Approach to Seeking Max Time Frame Financial Aid

-

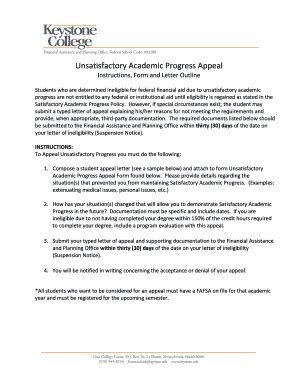

Determine your eligibility. The first step is to determine if you are eligible for max time frame financial aid. This will depend on your circumstances, such as your academic record, financial need, and other factors.

-

Apply for financial aid. Once you have determined that you are eligible, you will need to apply for financial aid. The application process will vary depending on the type of financial aid you are seeking.

-

Gather your documentation. You will need to provide documentation to support your financial aid application. This documentation may include your tax returns, transcripts, and other financial information.

-

Submit your application. Once you have gathered all of your documentation, you will need to submit your financial aid application. The application will be reviewed by the financial aid office, and you will be notified of your award.

-

Manage your financial aid. Once you have received your financial aid award, you will need to manage it carefully. This means monitoring your spending, making sure you are making progress towards your degree, and repaying your loans on time.

Conclusion

Max time frame financial aid can be a helpful way to cover the cost of college. By following the steps outlined in this article, you can increase your chances of obtaining and successfully repaying max time frame financial aid.

Additional Keywords:

- Extended time frame financial aid

- Lifetime financial aid

- Unlimited financial aid

Tables

Table 1: Maximum Time Frame for Federal Student Aid

| Program | Undergraduate | Graduate |

|---|---|---|

| Grants | 6 years | 8 years |

| Loans | 6 years | 8 years |

| Work-study | 6 years | 8 years |

Table 2: Maximum Time Frame for State Financial Aid

| State | Undergraduate | Graduate |

|---|---|---|

| California | 8 years | 10 years |

| New York | 8 years | 10 years |

| Texas | 8 years | 10 years |

Table 3: Maximum Time Frame for Private Student Loans

| Lender | Undergraduate | Graduate |

|---|---|---|

| Sallie Mae | 15 years | 20 years |

| Wells Fargo | 15 years | 20 years |

| Discover | 15 years | 20 years |

Table 4: Repayment Options for Federal Student Loans

| Repayment Plan | Monthly Payment | Loan Term |

|---|---|---|

| Standard Repayment Plan | Fixed monthly payment | 10 years |

| Graduated Repayment Plan | Monthly payments that increase over time | 10 years |

| Extended Repayment Plan | Monthly payments that are lower than the Standard Repayment Plan | 12-25 years |

| Income-Based Repayment Plan | Monthly payments that are based on your income | 20-25 years |

| Pay As You Earn Repayment Plan | Monthly payments that are based on your income | 20-25 years |