Introduction

Chestnut Hill College, a private Catholic liberal arts college in Philadelphia, Pennsylvania, offers a top-notch education with a vibrant campus life. However, prospective students must consider the financial implications of attending the institution. This article provides an in-depth analysis of Chestnut Hill College cost, including tuition, fees, living expenses, and financial aid options, to help you make informed decisions about your education.

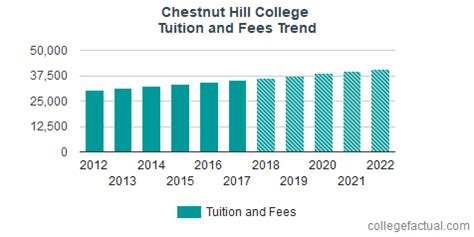

Tuition and Fees

The cost of tuition and fees for the 2023-2024 academic year at Chestnut Hill College are as follows:

| Category | Cost |

|---|---|

| Tuition | $39,530 |

| Student fees | $1,440 |

| Total | $40,970 |

Estimated Living Expenses

In addition to tuition and fees, students should factor in living expenses, which vary depending on lifestyle and personal preferences. The college estimates the following average expenses for the 2023-2024 academic year:

| Category | Cost |

|---|---|

| Room and board (on-campus) | $14,200 |

| Books and supplies | $1,400 |

| Transportation | $1,200 |

| Personal expenses | $2,000 |

| Total | $18,800 |

Total Cost of Attendance

The total cost of attendance for an undergraduate student living on-campus at Chestnut Hill College for the 2023-2024 academic year is approximately:

| Category | Cost |

|---|---|

| Tuition and Fees | $40,970 |

| Living Expenses | $18,800 |

| Total | $59,770 |

Financial Aid Options

Chestnut Hill College offers a range of financial aid options to make education more affordable for students. These include:

- scholarships: Merit-based scholarships based on academic achievement, talent, or special circumstances.

- grants: Need-based grants that do not have to be repaid.

- loans: Loans that must be repaid after graduation.

- work-study: On-campus employment opportunities that allow students to earn money.

Tips and Tricks for Saving Money

Here are some tips to help you save money on your Chestnut Hill College education:

- Apply for scholarships and grants: Explore all available scholarship and grant opportunities.

- Consider living off-campus: Off-campus housing can often be cheaper than on-campus housing.

- Meal plan wisely: Choose a meal plan that fits your dining habits and budget.

- Buy used textbooks: Used textbooks can save you money.

- Use public transportation: Public transportation is often cheaper than owning a car.

Common Mistakes to Avoid

Avoid these common mistakes when planning for the cost of Chestnut Hill College:

- Underestimating living expenses: Living expenses can add up quickly. Be sure to budget for all your expenses.

- Not applying for financial aid: Many students qualify for financial aid. Don’t miss out on this valuable resource.

- Borrowing too much money: Loans must be repaid after graduation. Be careful not to borrow more than you can afford.

- Not planning for the future: Start saving for your education early. The sooner you start, the more time your money has to grow.

Step-by-Step Approach to Financing Your Education

Follow these steps to finance your education at Chestnut Hill College:

- Estimate your costs: Calculate the total cost of attendance using the figures provided in this article.

- Explore financial aid options: Apply for scholarships, grants, and loans.

- Create a budget: Track your income and expenses to ensure you stay within your budget.

- Make a payment plan: Work with Chestnut Hill College to develop a payment plan that meets your needs.

- Start saving: Start saving money for your education as early as possible.

Conclusion

Attending Chestnut Hill College is a significant investment. By understanding the cost of attendance and planning accordingly, you can make your education more affordable. Utilize the financial aid options available and follow the steps outlined in this article to finance your education and achieve your academic goals.