Introduction

The Illinois CPA exam is a comprehensive evaluation that assesses candidates’ knowledge and skills in accounting principles, auditing, financial reporting, business environment and concepts, and taxation. Passing the exam is a requirement for obtaining a CPA license in Illinois. This guide provides a step-by-step approach to help candidates prepare for and succeed in the exam.

Eligibility and Application

Eligibility Requirements:

– Bachelor’s degree or higher in accounting or a related field

– 150 semester hours of college coursework

– 24 semester hours of accounting coursework

– No convictions of felony or misdemeanor involving dishonesty or fraud

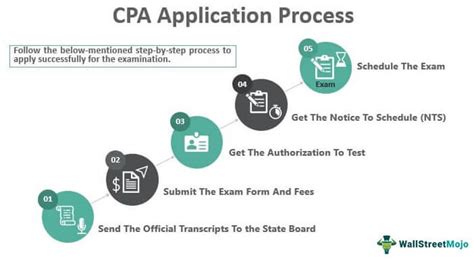

Application Process:

– Register with the Illinois Department of Financial and Professional Regulation (IDFPR)

– Submit an application fee of $100

– Provide official transcripts from all colleges and universities attended

Exam Format and Structure

The Illinois CPA exam consists of four sections:

– Auditing and Attestation (AUD)

– Business Environment and Concepts (BEC)

– Financial Accounting and Reporting (FAR)

– Regulation (REG)

Each section is a four-hour exam with 75 multiple-choice questions (MCQs) and one three-hour exam with 30 to 35 task-based simulations (TBSs). The TBSs assess candidates’ ability to apply accounting principles and concepts to real-world scenarios.

Exam Content

Auditing and Attestation (AUD)

- AUD 100 – Audit Standards, Responsibilities, and Ethics

- AUD 200 – Planning and Performance of an Audit

- AUD 300 – Completing the Audit and Reporting

- AUD 400 – Special Considerations

Business Environment and Concepts (BEC)

- BEC 100 – Economics

- BEC 200 – Management

- BEC 300 – Corporate Governance

- BEC 400 – Information Technology

Financial Accounting and Reporting (FAR)

- FAR 100 – Conceptual Framework and Standard Setting

- FAR 200 – Financial Statement Preparation

- FAR 300 – Specialized Industries

- FAR 400 – Governmental and Not-for-Profit Entities

Regulation (REG)

- REG 100 – Individual Taxation

- REG 200 – Business Taxation

- REG 300 – Federal Taxation of Property Transactions

- REG 400 – Ethics, Professional Responsibilities, and Federal Tax Procedure

Exam Preparation

Study Materials:

- AICPA CPA Exam Blueprints

- Official CPA Exam Study Materials

- Commercial Study Courses

- Online Resources

Study Schedule:

- Plan a study schedule that allows for ample time to cover all exam content

- Aim for consistent study sessions of at least 2-3 hours per session

- Take breaks and revisit topics regularly to retain information

Practice Tests:

- Take practice tests to assess knowledge retention and identify areas for improvement

- Analyze your results and adjust your study plan accordingly

Simulation Practice:

- Practice TBSs with a focus on applying accounting principles to real-world scenarios

- Use the AICPA’s Candidate Practice Simulation (CPS) tool

Exam Day Tips

Before the Exam:

- Arrive at the testing site well-rested and punctually

- Bring required identification and a calculator

- Review your study notes and practice tests

During the Exam:

- Manage your time effectively, allocating approximately 50 minutes per MCQ section and 100 minutes for the TBS section

- Read instructions carefully and allocate time accordingly

- Answer questions to the best of your ability and move on if you get stuck

- Utilize the AICPA’s Testlet Manager to navigate and review questions

Exam Results

Exam results are typically released 6-8 weeks after the test date. Candidates can check their results online through the AICPA’s website.

Additional Resources

AICPA: https://www.aicpa.org/cpa-exam

IDFPR: https://www.idfpr.com/cpa/cpa.asp

CPA Exam Fee: $750 per section

Exam Locations: Prometric testing centers throughout Illinois

Exam Time Limit: 4 hours for MCQ sections, 3 hours for TBS section

Total Hours to Pass: 400 hours of preparation (estimated)

Conclusion

Passing the Illinois CPA exam is a challenging but achievable goal. By following a structured preparation plan, leveraging available resources, and dedicating ample time and effort, candidates can increase their chances of success. The CPA license provides a valuable credential that opens doors to career opportunities and advancement in the accounting profession.