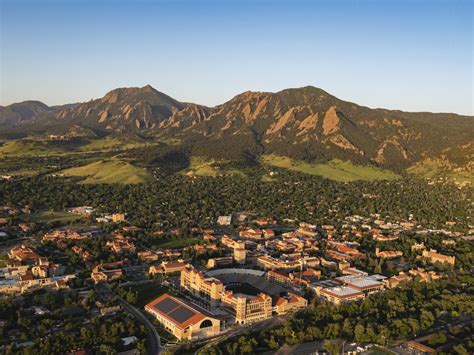

Boulder Colorado Out-of-State Tuition: A Guide for Aspiring Students

Pursuing higher education at the University of Colorado Boulder as an out-of-state student can come with a hefty price tag. But the allure of the university’s prestigious academic programs, vibrant campus life, and stunning mountain backdrop makes it a highly sought-after destination for many students.

Understanding Out-of-State Tuition Fees

For the 2023-2024 academic year, full-time out-of-state undergraduate students at CU Boulder will face tuition and fees totaling $42,512. This is significantly higher than the in-state tuition of $13,216.

The differential in tuition costs reflects the state’s focus on subsidizing higher education for its residents. As an out-of-state student, you will not be eligible for these in-state subsidies, hence the higher tuition.

Exploring Financial Aid Options

While the out-of-state tuition may seem daunting, there are financial aid options available to help mitigate the costs.

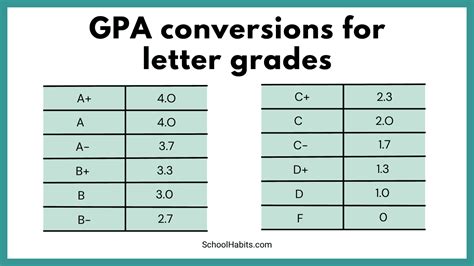

Scholarships: CU Boulder offers merit-based scholarships to out-of-state students with exceptional academic achievements. These awards vary in amount and eligibility criteria.

Grants: Federal and state grants are available to students who demonstrate financial need. The Free Application for Federal Student Aid (FAFSA) is the primary method for determining eligibility for these grants.

Work-Study Programs: The university offers part-time work-study opportunities to help students offset education expenses. These positions are typically on campus and tailored to fit student schedules.

Loans: Student loans are another way to cover tuition costs. Federal student loans have low interest rates and flexible repayment options. Private student loans are also available, but may come with higher interest rates.

Planning Ahead for Expenses

In addition to tuition, out-of-state students should also budget for other essential expenses, such as:

Housing: On-campus housing for out-of-state students ranges from $8,250 to $11,970 per academic year. Off-campus housing options can vary significantly in cost.

Meals: CU Boulder offers meal plans ranging from $2,400 to $3,600 per semester. Students can also purchase groceries and cook their own meals.

Transportation: Boulder has a comprehensive public transportation system. Students can purchase a bus pass for $240 per semester. Those with vehicles will need to factor in parking costs.

Tips for Reducing Out-of-State Tuition Costs

While the out-of-state tuition is fixed by the university, there are strategies you can employ to minimize your overall expenses:

Explore Residency Options: If you plan to stay in Colorado for an extended period, you may consider establishing residency, which would make you eligible for in-state tuition.

Maximize Financial Aid: Diligently complete the FAFSA to qualify for the maximum amount of grants and scholarships.

Seek Scholarships: Research and apply for scholarships that align with your academic interests and achievements.

Negotiate with the University: Contact the Office of Admissions to inquire about the possibility of negotiating a lower tuition rate.

Conclusion

Pursuing a higher education at CU Boulder as an out-of-state student requires careful financial planning. By understanding the costs, exploring financial aid options, and employing cost-saving strategies, aspiring students can make their dream of attending this prestigious university a reality. Remember, the investment in a CU Boulder education extends beyond the tuition fees, as the university offers a transformative experience that will shape your future for years to come.

Understanding the Costs

Pursuing higher education at the University of Colorado Boulder as an out-of-state student entails significant costs. For the 2023-2024 academic year, full-time undergraduate students face tuition and fees totaling $42,512, a stark contrast to the in-state tuition of $13,216.

Financial Aid Options

To mitigate the financial burden, out-of-state students can explore various financial aid options:

Scholarships

CU Boulder offers merit-based scholarships to academically exceptional out-of-state students, varying in amount and eligibility.

Grants

Federal and state grants are available to students demonstrating financial need, with eligibility determined through the FAFSA.

Work-Study Programs

Part-time work-study positions on campus provide students with opportunities to offset education expenses.

Loans

Federal and private student loans offer financial assistance, but careful consideration of interest rates and repayment options is crucial.

Planning for Additional Expenses

Beyond tuition, out-of-state students should budget for:

Housing

On-campus housing costs range from $8,250 to $11,970 per academic year, while off-campus housing options vary.

Meals

Meal plans range from $2,400 to $3,600 per semester, or students can purchase groceries and cook meals.

Transportation

Students can purchase a bus pass for $240 per semester or consider personal vehicle expenses, including parking.

Cost-Saving Strategies

To minimize out-of-state tuition expenses:

Explore Residency Options

Establish residency in Colorado to qualify for in-state tuition if planning to stay for an extended period.

Maximize Financial Aid

Complete the FAFSA thoroughly to qualify for maximum grants and scholarships.

Seek Scholarships

Research and apply for scholarships that align with your academic interests and accomplishments.

Negotiate with the University

Contact the Office of Admissions to inquire about tuition negotiation possibilities.

Conclusion

Aspiring out-of-state students at CU Boulder should carefully plan for the financial investment required. By understanding the costs, exploring financial aid options, and employing cost-saving strategies, they can make their educational dreams a reality. The transformative experience gained at CU Boulder extends beyond the tuition fees, shaping their futures for years to come.

Boulder Colorado Out-of-State Tuition: A Comprehensive Guide

Understanding the Costs

| Tuition Fees | Out-of-State | In-State |

|---|---|---|

| Undergraduate (Full-Time) | $42,512 | $13,216 |

| Graduate (Full-Time) | $41,544 | $14,440 |

Financial Aid Options

Scholarships:

| Scholarship Type | Eligibility | Amount |

|---|---|---|

| Academic Excellence Scholarship | High academic achievement | $2,500 – $10,000 |

| Diversity Scholarship | Demonstrated commitment to diversity | $1,000 – $5,000 |

| Athletic Scholarship | Exceptional athletic ability | Varies based on sport and performance |

Grants:

| Grant Type | Eligibility | Amount |

|---|---|---|

| Federal Pell Grant | Exceptional financial need | Up to $6,895 |

| Colorado Student Grant | Colorado residency and financial need | Varies based on need and funding availability |

Work-Study Programs:

| Position Type | Eligibility | Earnings |

|---|---|---|

| Research Assistant | Academic qualifications and research experience | $10 – $15 per hour |

| Library Helper | Organizational skills and willingness to assist patrons | $9 – $12 per hour |

Budgeting for Additional Expenses

Housing:

| Housing Option | Cost |

|---|---|

| On-Campus Housing | $8,250 – $11,970 per academic year |

| Off-Campus Housing (Shared Apartment) | $600 – $1,200 per month |

Meals:

| Meal Plan | Cost |

|---|---|

| All-Access Plan | $3,600 per semester |

| Standard Plan | $2,400 per semester |

Transportation:

| Transportation Option | Cost |

|---|---|

| Bus Pass (Semesterly) | $240 |

| Personal Vehicle (Monthly) | $200 – $400 (including gas, insurance, and parking) |

Cost-Saving Strategies

Establish Colorado Residency:

| Residency Requirements | Timeframe |

|---|---|

| Physical Presence | 12 consecutive months |

| Domicile (Intent to Stay) | Evidence of permanent residence, such as a lease or home ownership |

| Financial Independence | Proof of employment or sufficient financial resources |

Maximize Financial Aid:

| Financial Aid Applications | Deadline |

|---|---|

| Free Application for Federal Student Aid (FAFSA) | March 1st (Priority Deadline) |

| Colorado Student Grant Application | March 1st (Priority Deadline) |

Negotiate with the University:

| Negotiation Considerations | Potential Outcome |

|---|---|

| Academic Achievements | Tuition reduction or scholarship increase |

| Financial Hardship | Payment plan or temporary fee reduction |

| Special Circumstances | Case-by-case consideration for tuition adjustments |